Economic Chapter 3: Production theory and market structure

Economic Chapter 3: Production theory and market structure

Production

This refers to the process of creating utility in goods and services in order to satisfy human wants. It seeks to analyze the input-output relationships and to answer the following questions.

1) How will output respond if all inputs are simultaneously increased or decreased in the same proportion?

2) Supposing that there is more than one process of producing a commodity, how will the output’ change in response to changes in the factor proportions?

3) What is the most efficient production technique that minimizes costs?

4) How can the least cost combination of inputs be achieved to maximize profits by minimizing costs?

Types of Production

- Direct (subsistence) production; the production of commodities for one’s own consumption (home use) e.g. Planting maize for food at home without surplus left for sale, a doctor treating his own child.

- Indirect (market) production; the production of goods and services for exchange e.g. a farmer growing cotton for sale, producing pancakes for sale.

Stages (Levels) of production

- Primary Production. This refers to the extraction of raw materials from their natural existence.

It involves application of factors of production on the raw materials in order to produce primary products. Primary production includes items like fishing, mining, lumbering, farming etc.

- Secondary Production. This involves the transformation of raw materials into final commodities which are ready for use. It includes activities like manufacturing, processing etc.

- Tertiary Production. This is the production of services. These services may be direct or indirect. The provision of these services is necessary because they help to bridge the gap between the producer and the consumer.

Specialization and division of labour

Specialization is a method of production whereby an entity focuses on the production of a limited scope of goods to gain a greater degree of efficiency and leaves out other activities to be done by other people or country or region.

Forms of specialization

- Specialization by craft. This was the earliest from of specialization where certain families specialized in different activities basing on their location like fishing, hunting, farming, etc.

- Specialization by process. This is where different people specialize in different stages in the production process.

- Regional specialization. This is where a certain region specializes in carrying out an activity which it can do best.

- International specialization. This is where a country specializes in production of a commodity which it can do best and exchanges it with other countries which cannot produce the commodity e.g. Developing countries like Uganda specializing in Agricultural products and developed countries in industrial products.

Division of labour

This is the allocation of tasks (activities) among workers in the production process such that each worker is given a task which he/she can perform best.

Advantages (merits) of specialization and division of labour

- It increases the efficiency of labour. This is as a result of performing the same task over time.

- It is time saving. This is because there is no need of moving from one job to another.

- It helps to improve on the quality of the product. Workers become perfect in carrying out particular tasks.

- It helps to speed up the training process. This is because a worker is trained to carry out a particular task in the production process.

- It enables workers to exploit their natural talents by concentrating on particular tasks which they can do better:

- International specialization promotes international trade. This is because different countries utilize their resources to produce a commodity in which they can do best and exchange it with other countries.

- It increases the level of output. This is because specialization increases the scale of production and reduces the production costs as a result of economies of scale.

- Specialization increases economic interdependence between countries. This is because different countries can be able to get what they do not have from other countries through the process of exchange.

- Specialization promotes technological development through innovations and inventions as a result of continuous use of machines. This leads to efficiency in production.

Demerits (Disadvantages) of Specialization and Division of labour

- It leads to boredom. This is because performing the same task all the time becomes monotonous which results into loss of efficiency and work dissatisfaction.

- It is difficult to assess the individual contribution of the worker to the final product under division of labour. This is because many workers contribute in the making of the total final product.

- It leads to loss of craftsmanship. This is because when the job is divided into a series of tasks, one’s skill in making a complete product is lost.

- Specialization leads to unemployment. This is because when a worker is laid off from a certain firm, it becomes very difficult for the worker to get another job in another firm which requires different skills.

- 5. It leads to unnecessary delays in case of breakdown in one department of the firm during the production

- It leads to over production especially when markets are limited. This leads to wastage of resources due to excess output which is not sold.

- International specialization promotes over dependence of one country on other countries. This leads to shortage of certain commodities in case there are some misunderstandings among countries.

- It increases occupational labour immobility. This is because workers concentrate on performing one task and with time may not be able to carry out other tasks.

- 9. It leads to loss of responsibility among workers which undermines team work. This is because each worker is concerned about his/her own tasks.

Factors (agents) of production

Factors of production are resources (inputs) required in the production of goods and services.

They include, Land, Labour, Capital and Entrepreneurship

Factor price refers to the monetary reward (payment) given to the factor of production for its contribution to the production process. Examples of factor prices include; Rent, Wages, Interest and Profits

Classification of Factors of production

Physical factors of production; are tangible factors of production; e.g. land, capital, buildings, machines, furniture, tools and equipment etc.

Non-physical factors of production; are intangible factors of production for example

Skilled labour (services), entrepreneurship etc.

Specific factors of production; are factors of production which are only used for a specific purpose and cannot be put ‘to any other use.

These are factors of production which cannot be used for any other purpose other than for which they were designed for example harvesters, railway lines, highly skilled labour, type writer etc.

Non-specific factors of production; are factors of production which can be used to serve various purposes for example a buildings, liquid capital, land, computers etc.

Note. Specificity of a factor of production is the extent (degree) to which a factor of production is designed to serve a particular purpose.

Mobility of factors of production

Factor mobility is the ease with which a factor of production can be moved from one geographical area to another or from one occupation to another.

Types of mobility of factors of production

- Geographical mobility of a factor of production; is the ease with which a factor of production can be moved from one geographical area to another. For example a doctor moving from Nairobi to Kampala, an Entrepreneur moving from Mable to Gulu.

- Occupational mobility of a factor of production. This refers to the ease with which a factor of production can be transferred from one occupation to another. For example office practice teacher becoming a secretary, an accounts teacher becoming an accountant etc.

LAND

Land refers to all natural resources used in the production process. It includes soil, minerals, forests, water bodies, air etc. The reward for land is rent.

Characteristics of land

- Its supply is fixed.

- Land is a gift of nature.

- It is geographically immobile that is, it cannot be transferred from one place to another.

- It is occupationally mobile that is, it can be used for various purposes.

- Land is not homogenous for example some land is fertile and another is infertile.

Importance of land

- It is used for agricultural activities for example hunting, farming and fishing.

- Land acts as a ground for waste disposal for example sewage disposal

- Land is used for construction of industries, roads, building, etc.

- It is a source of raw materials for example fish, water, minerals, timber etc.

- It is a source of fuel for example coal and oil from the ground, charcoal form forests etc.

- It is a source of government revenue since it can be taxed.

- Land also provides beautiful scenery for tourism which is a source of foreign exchange.

Capital

Capital refers to any man made resource which is used in the production process for example machinery, buildings, money, clothes etc. Capital is used to produce other goods. In the factor market, capital is rewarded by interest.

Types of capital

- Real capital is the physical assets used in the production of goods and services for example machines, buildings, roads etc. It is also called fixed capital.

- Liquid (money/financial} capital is capital which is in cash form. It is used as a means of payment for capital goods.

- Floating (circulating/operating/working) capital is capital used in the day to day running of the business activities for example buying raw materials.

- Human capital is the productive qualities found in human beings for example skills and knowledge. Such qualities are attained through training and education.

- Overhead capital is the social and economic infrastructure or assets which facilitate in the production process for example roads, banks, insurance etc.

- Public (social) capital is capital owned by the government on behalf of its citizens for example government hospitals, schools, roads etc.

- Private capital is the type of capital owned by private individuals. It includes private cars, schools, businesses etc.

Productivity of capital and marginal efficiency of capital

Capital productivity is the measure of how well physical capital is used in providing goods and services in a given time

Marginal productivity of capital is the additional output that results from adding one unit of capital—typically cash

Marginal efficiency of capital (MEC) refers to the expected (anticipated) monetary returns on an extra (additional) unit of capital employed in the production process.

Determinants of Marginal efficiency of capital (MEC)

- Anticipated level of output is an expected increase in the level of output by the firm leads to an increase in MEC but an expected decline in the level of output by the firm leads to a reduction in MEC.

- Level of taxation; the higher the amount of taxes imposed on capital, the lower the MEC and the lower the tax rate, the higher the MEC.

- Quantity and quality of other co-operate factors; the availability and high quality of corporate factors increases the MEC but lack and poor quality of such factors decreases the MEC.

- 4. Available excess capacity; availability of excess capacity increases the MEG but existence of full capacity reduces the MEC

- Rate of interest on capital; the higher the rate of interest, the lower the MEC and the lower the interest rate, the higher the MEC.

- The rate of depreciation of capital; the higher the rate of depreciation, the lower the MEC and the lower the rate of depreciation the higher the MEC. ,

- Market size; the bigger the market size, the higher the MEC and the lower the market size, the lower the MEC.

- The general price levels (inflation); the high level of inflation in the economy reduces the MEC but low level of inflation in the economy increases the MEC

Capital Accumulation (Capital Formation)

This is the process through which the stock of capital increases overtime for purposes of future investments. Capital accumulation can be in form of increased savings, resource utilization, construction etc. In the process of capital formation, society has to forego some of its present consumption and direct it to increasing the stock of capital goods in order to improve on the production of consumer goods in future.

Determinants of (factors influencing) capital accumulation

- The level of savings; the higher the level of savings, the higher the level of capital accumulation on the other hand, the low rate of savings reduces the rate of capital accumulation.

- Level of technology; use of better methods of production like modem machinery increases the productivity of factors of production hence, capital accumulation. On the other hand, use of poor production techniques reduces the productivity of factors of production hence low capital accumulation.

- Government policy; favorable government policies like subsidization, tax holidays encourage investments and this increases the production of commodities hence capital accumulation. On the other hand unfavorable government policy like high taxes discourage investment hence law rate of capital accumulation.

- Level of development of social and economic infrastructure; for example banks, hospitals, micro finance institutions, roads schools, etc. Availability of such infrastructure which is well developed facilitates the production and investments hence capital accumulation. On the other hand, the presence of under developed and poor infrastructure discourages production and investment hence low rate of capital accumulation.

- Political stability; a politically stable country encourages both local and foreign investors hence capital accumulation but a politically unstable country discourages investors hence-low rate of capital accumulation.

- Level of education; high level of education in form of skills and knowledge increases the productivity of labour hence capital accumulation. On the other hand, low level of education limits labour productivity hence low capital accumulation.

- Level of liquidity preference; this refers to the desire by individuals to hold their wealth in cash or near cash form other than investing it in alternative assets. The higher the level of liquidity preference, the lower the rate of capital accumulation and the lower the level of liquidity preference the higher the rate of capital accumulation.

- Degree of availability of market; availability of both foreign and domestic markets encourages production and investments hence capital accumulation, But presence of inadequate markets limits the scale of production hence low capital accumulation. “

- Level of economic stability; if the economy is stable, inform of stable commodity prices and interest rates, this encourages investment hence increased capital accumulation. On the other hand instability in form of inflation discourages investments hence low capital accumulation.

- Level of interest rate; high interest rate charged on loans discourage potential borrowers or investors hence low capital accumulation and low interest rate charged on loans encourage investors hence increased capital accumulation.

- Level of population growth rate; high population growth rates increase the dependence burden which reduces the level of savings. This limits the level of investment hence low capital accumulation. But a low population growth rate reduces the dependence burden hence high level of capital accumulation.

- Degree of availability of entrepreneurs; the presence of individuals who have the capacity to generate new investments and who are innovative leads to capital accumulation and absence of entrepreneurs leads to low capital accumulation.

Importance (role) of capital accumulation in economic environment

- It leads to technological development in form of inventions and innovations. This leads to the production of goods and services in large quantities and of high quality hence economic growth and development.

- It increases the standards of living. This is due to increased incomes of individuals and production of a variety and better quality goods and services which are consumed at lower prices.

- It facilitates resource exploitation. This increases production and investments in the industrial, agricultural and service sectors hence economic growth and development.

- It helps to create employment opportunities in the economy. This is due to increased investments and production activities in the economy.

- It facilitates the construction social overheads in form of roads, railways etc. This increases mobility of factors of production

- It helps to reduce on the level of inflation in the economy. The increased production of goods and services helps to meet the high aggregate demand for goods and services. In addition, capital accumulation reduces the supply rigidities associated with the production of goods especially in the agricultural sector. This increases supply in the long run hence economic stability.

- It helps to solve the balance of payment problems. This is as a result of increased production of high quality goods and services for export which helps the government to earn more foreign exchange. In addition, capital accumulation leads to establishment of import substituting industries and this reduces on the importation of high valued manufactured goods. Therefore, the gap between export earnings and import expenditure is reduced hence favourable balance of payments.

- It brings about market expansion through establishment of social and economic infrastructure. This facilitates trade and economic development.

- It increases the national income of the country. This is as a result of increased production and economic activities resulting from capital accumulation.

- It helps to relieve the country from the burden of the foreign debt. This is because capital accumulation increases resource exploitation and mobilization which increases the country’s capacity to be self-sufficient and reliant.

Labour

Labour refers to all human effort both mental and physical which is used in the production process.

The types of labor

The types of labor in economics are skilled, unskilled, semi-skilled, and professional. Together, these four types of labor make up the active labor force.

Marginal product of labour refers to the additional output resulting from employing an extra unit of labour.

Average product of labour refers to output per unit of labour employed

Mobility of Labour

Mobility of Labour refers to the ease with which labour can be moved from one place of work to another or from one occupation to another.

Types of labour mobility

Geographical mobility of labour is the ease with which labour can be moved from one place of work to another. For example a worker transferring from Kampala to work in Mukono.

Occupational mobility of labour is the ease with which labour can be moved from one occupation to another. For example, a medical doctor becoming a biology teacher.

Immobility of Labour

Labour immobility is the inability (or difficulty) of labour to move from one place to another or from one occupation to another.

Types of labour mobility

Geographical immobility of labour refers to the inability of labour to move from one place of work to another.

Occupational immobility of labour refers to the inability (difficulty) of labour to move from one occupation to another.

Types of occupational mobility of labour

Horizontal mobility of labour refers to the change of occupation where no change occurs in the status of the worker. For example a biology teacher becoming a chemistry teacher, a minister of finance becoming a minister for internal affairs.

Vertical mobility of labour refers to the change of occupation which results into a change in the status of the worker. For example when a classroom teacher becomes a headmaster, a nurse becoming a doctor.

Factors affecting/Determinants of labour mobility

- The length of the training period. The longer the length of the training period, the lower the mobility of labour and the shorter the training period, the higher the mobility of labour.

- The level of skills required for a particular job. Jobs which require highly specialized skills reduce the mobility of labour but in cases where no special skills are required, the mobility of labour increases

- The degree of job security. The more the security on the job in terms of permanent employment the lower the mobility of labour. But temporary employment in form of contracts increases labour mobility.

- The level of advertisement of the job. In cases where the degree of knowledge about the existence of jobs by workers is high, mobility of labour increases. But in cases where labour lacks information about the prevailing jobs, mobility of labour reduces.

- The influence of trade unions and other professional associations. In occupations where there are restrictions on entry into certain professions for example lawyers, mobility of labour reduces and in occupations where there are no restrictions, mobility of labor increases.

- Level of education. The higher the level of education, the higher the mobility of labour and the lower the level of education, the lower the mobility of labour.

- Nature of the job. Risky jobs with high occupational hazards. For example mining, body guards, sugar cane cutting etc. discourage workers hence labour immobility, but jobs which are less risky with fewer occupational hazards tend to attract workers hence increasing labour mobility.

- The degree of specialization. The higher the level of specialization, the lower the mobility of labour and the lower the degree of specialization, the higher the mobility of labour.

- Age of the worker. Old people tend to be immobile because they have more family responsibilities and cultural attachments but young individuals tend to be mobile because of less family and cultural attachments.

- Degree of political instability. In areas which are politically stable, labour tends to be mobile as compared to areas which are politically unstable. This is because labour tends to fear to go and work in insecure places for fear of loss of life.

- Racial, tribal and religious prejudices. In occupations where there is discrimination based on such prejudices, labour tends to be immobile. But in cases where there are no such discriminations, labour tends to be mobile.

The Entrepreneurship

An entrepreneur is a person or group of persons who under take the task of organizing the other factors of production in order to make production process possible. He or she is a co-coordinator, risk-taker, innovator and decision maker of the business enterprise. In the factor market, an entrepreneur rewarded with profits.

Functions of the entrepreneur

- The entrepreneur is responsible for starting the business

- The entrepreneur employs other factors of production such as land, capital and labour

- The entrepreneur makes arrangements for rewarding the other factors of production

- The entrepreneur makes decisions concerning the business activities and allocation of resources

- The entrepreneur undertakes the necessary innovation for the proper running of the business

- The entrepreneur takes responsibility of the profits and losses made by the business

Factors that influence the supply of Entrepreneurs

- The level of education and training. There higher the level of education and training, the greater the supply of entrepreneurs and the lower the level of education and training, the lower the supply of entrepreneurs

- Personal abilities of the individuals. In societies with a large number of individuals who are more innovative and hardworking, there is high supply of entrepreneurs while in societies with many people who are less innovative leads to low supply of entrepreneurs.

- The level of economic activities. The higher the level of economic activities, the higher the supply, of entrepreneurs and the lower the level of economic activities, the lower the supply of entrepreneurs.

- The market size of commodities. The bigger the market size, the higher the supply of entrepreneurs and the smaller the market size, the lower the supply of entrepreneurs.

- The government policy in relation to investment. Conducive government policies towards investment encourage the supply of entrepreneurs while poor investment policies discourage the supply of entrepreneurs.

- The degree of political stability. The higher the degree of political stability in the country, the higher the supply of entrepreneurs and the lower the degree of political stability, the lower the supply of entrepreneurs. .

Forms of business organizations

A business organization is the control of economic resources aimed at producing and distributing commodities to the final consumers. Business organizations are categorized according to ownership into two broad categories. The privately owned business organizations include sole proprietorship, partnerships and joint stock Companies which can be private or public Limited Companies. The Public or state owned business organizations include public co-operations and parastatals

Sole proprietorship

This is where the business is owned and managed by one person. The owner may be assisted by family members. The major source of capital is personal savings and borrowing.

Merits (advantages) of a sole proprietor

- It is easy to set up the business. This is because it does not require many bureaucratic procedures of registration and documentation as for the case of other business organizations like partnerships.

- It does not require a lot of capital to set up the business. This promotes entrepreneurial abilities in the economy.

- There is quick decision making. This is because the business is owned and controlled by one person

- The benefits (profits) are enjoyed by the owner of the business alone unlike other business organizations where profits are shared among the business shareholders.

- It is easy to develop personal contact with the customer. This ensures that the customers’ needs are satisfied.

- The business owner has self-interest and motivation in business as opposed to the other forms of business organizations like the public enterprises.

- It is easy to supervise and manage the activities of the business unlike other business organizations.

- A sole business owner enjoys the secrecy of his business unlike other forms of business organizations like joint stock companies.

Demerits (disadvantages) of a sole proprietor

- The business owner has unlimited liability. That is, in case of the collapse of the business, the debt arising out of business operations can of large be recovered by selling the personal property of the business owner in addition to the property of the business.

- It is difficult to expand business and enjoy economies scale in the long run. This is due to limited capital contributed by the business owner.

- It is difficult to undertake speculation and division of labour due to small size of the business.

- There is uncertainty in the continuity of the business in case of the death of the business owner. This is because the business activities are undertaken by one individual. .

- The sole proprietor is overworked and this leads to inefficiency. The sole proprietor manages the business alone and does not get enough time to rest. .

- It is difficult to undertake research by the sole proprietor. This is due to limited capital contributed by the sole proprietor. .

- It is difficult to access credit facilities like loans from financial institutions. This is due to lack of collateral security and lack of trust in one man’s business by financial institutions.

Partnerships

Partnerships is a business type where members come together pool (contribute) financial resources in order to carry out business jointly with the aim of making profits.

The minimum number of members in partnership is two (2) and the maximum number is twenty (20). Each member in partnership is called a partner:

The sharing of capital and profits and general running of the business is spelt out in a document called a partnership deed. It is presented to the registrar of companies before business commences.

Types of partners

- Active partner. This is one who contributes capital and takes part in the active management of the business. He also shares profits and losses jointly with other members of the partnership.

- Dormant partner. This is one who does not take part in the active management of the business but contributes the capital and shares losses and profits of the business.

- Quasi partner. This is a partner who offers his name to be used as the name of the partnership. He does not contribute capital to the business and does not take part in the active management of the business. He is not responsible for any debts and losses incurred by the business.

Merits (advantages) of partnerships

- Losses and other risks are shared among the members. Partnerships involve a number of members and therefore the risks per unit member are greatly reduced.

- Partnership creates room for specialization within its members. This is because different members have different skins regarding production, management, marketing etc. within the organization.

- There is continuity in business in case of death or sickness of one partner unlike under sole proprietorship.

- It is to expand the scope of discovery and innovation under the partnership, This is because members can easily share the skills and knowledge concerning business operations. This leads to improvement in the performance of the business.

- It is easy to form a partnership as compared to the joint stock company. This is because it requires less documents or formalities as in the case of joint-stock Companies.

- It is possible to enjoy economies of large scale, this is because it is easy to rise capital and expand on the operations of the business.

- It is easy to raise enough capital to start and expand the business under partnership. This widens the capital base as compared to the sole proprietor.

Demerits (disadvantages) of partnerships

- Partnerships have unlimited liability. That is, in case of debts arising out of the business operations, personal property of the partners in addition to partnership property can be sold in order to recover the debt.

- The mistake made by an individual affects all the members within the partnership. This is due to collective responsibility in the business operations.

- There are delays in business decision making and implementations. This is because all members have to be consulted before any action is undertaken.

- A partnership can be dissolved in case of death of one partner. This affects the continuity of the business.

- Partnerships suffer from dis economies of scale due to large-scale operations of the business. This is in form of mismanagement of funds.

- The membership of partnership is limited up to 20 members. This limits the capacity of the partnership to mobilize and raise more funds in order to expand the business.

Joint-Stock Companies (Limited Liability Companies)

These are business organizations with several members (shareholders) who come together and contribute capital to start business with the aim of making profits.

Types of joint – stock companies

Public limited companies

These consist of not less than seven (7) members and there is no maximum number. The shares are freely transferable to the public. That is, members who wish to sell their shares the public are free to do so.

Private limited companies

These consist of a minimum of twenty (20) members and a maximum of fifty (50) members. The shares are not freely transferable to the public. That is, a member who wishes to sell his shares has to first consult all the other members within the company before he floats them to the public.

Formation of joint stock companies

The formation of joint-stock companies involves legal documents and these include:

- Memorandum of association (MOA). This clearly lays down the name of the company with the word limited at the end, the location of the business, amount of capital to be contributed by each shareholder, purpose of the business and the signatures of all the shareholders.

- Articles of association (AOA). This is the document which lays down the rules and regulations governing company. It spells out the rights and powers of each shareholder, the procedures of calling and conducting general meetings, powers of the executive and rules regarding the election of the executive members.

- Certificate of incorporation (COl). This is issued by the registrar of companies after paying the registration fee by the promoters of the company. It gives the company a legal entity and authorizes it to begin floating the shares to the public so as to raise capital.

- Prospectus. This document invites the general public to come and buy shares from the company. This is done after registration of the company to raise the required capital start business.

- Certificate of trading (C0T). This is the document which empowers the company to start business operations. It is issued by the registrar of companies after the company has raised the minimum share capital required.

A share and a stock

A shareholder is an individual who owns and contributes capital to the company with the aim of making profits.

A share is a unit of capital contributed by each shareholder when starting the company with the aim of making profits.

A stock is a combination of shares contributed by shareholders to the company.

Types of shares

- Ordinary shares; are shares which do not carry a fixed rate of return (dividend). These shares receive only dividends after all preference shares have paid

- Cumulative preference shares; are shares which are entitled to dividends irrespective of whether the company has made profits of incurred losses in a given period

- Preference shares; are shares that carry a fixed rate of return (dividend). However, if no profits are made in the given period, no dividends are paid

Dividends, Retained profits and Debentures

- A dividend is a profit earned on the shares by the shareholders of the company.

- Retained profits are profits made by the company which are not shared among the shareholders but they are left to expand on the business.

- A debenture is a document that gives evidence that an individual or company has borrowed a certain sum of money from the person or institution named on it.

Types of debentures

- Naked debentures; this is a debenture where no collateral security is required in order to access the loan by the borrower from the lender. In case of failure to pay the loan, the lender (debentures holder) has no powers to take over or sell the borrowers property to recover his/her Money.

- Mortgage debenture. This is a debenture where the collateral security is required by the lender before the borrower is given a loan. In case of failure to pay the loan by the borrower, the debenture holder has the powers and rights to sell the borrower’s property and recover his/her money.

Collateral security refers to the physical/tangible asset presented by the borrower before accessing the loan from the lender, For example land title, tangible house hold properties, motor vehicle registration card etc.

Advantages of joint – stock companies

- It is easy to raise enough capital from the sale of shares. This increases the scale of operation of the business hence economic of scale.

- Shareholders have a limited liability. That is, in case the business collapses the shareholders only lose their share capital to recover the business debts.

- There is continued existence of the company even if a shareholder dies or becomes insane.

- It is easy to access loans from financial institutions. This is because such companies are highly trusted by the financial institutions and they have enough collateral security

- In case of losses and other business risks, they are shared among the many shareholders. This minimizes the burden of the loss per share holder.

- Shareholders are free to sell their shares to the public for the case of public limited companies,

- The joint stock companies help individuals with limited entrepreneurial abilities to participate in business as shareholders. This promotes economic activities in the economy.

- Joint stock companies are capable of employing necessary expatriates in various fields. This increases efficiency in business operations.

- Joint stock companies are capable of offering employment opportunities to many individuals. This is due to their large scale operation. This improves on the standards of living of individuals.

- Joint stock companies generate a lot of tax revenue to the government in form of corporate and profit taxes. Such tax revenue can be used to construct both social and economic infrastructure.

Disadvantages of joint -stock companies

- Shareholders do not exercise full control over their business. This is because; under joint stock companies management differs from shareholders.

- Shares are not equally owned. Those with more shares tend to dominate decision making in line with their personal interests or benefits.

- It is difficult to start a joint stock company. This is because there is a need to present several documents to the registrar of companies before the company is incorporated.

- There is bureaucracy in decision making. This is because there is need to consult the various shareholders before the action is taken.

- There no secrecy in the running of the business. For example books of accounts are published in the newspapers especially for public limited companies.

- High taxes are paid by shareholders. This is because taxes are paid on both company profits and dividends.

- Rivals of the public company can easily buy off the majority shares there by crippling the activities of the company.

- There is little personal contact between the shareholders of the company and the customers. This undermines customer care services. ,.

- There is lack of flexibility in business operations. This is because the company can only engage in activities which are stipulated in the constitution.

- There is a risk of suffering from diseconomies of scale. This is as a result of large scale operation joint stock companies for example lack of sufficient markets, raw materials etc. .

Sources of business finance

- From personal savings of individuals

- Borrowing from relatives and friends

- Borrowing from financial institutions like banks and micro finance institutions

- Borrowing from non-bank financial intermediaries like the housing finance companies, insurance companies etc.

- Retained profits that is, profits which are not shared by the shareholders of the company. They are left in the company to expand the business. .

- Through the sale of shares to the public as the case of joint stock companies.

- Using debentures by companies in order to raise capital from the public.

- Loans from international financial lending institutions for example I.M.F and World Bank.

- Through gambling and national lotteries.

- Through donations and grants.

- Through the sale of government securities to the public for example treasury bills and bonds in case of public enterprises.

Some definitions

Money market is a market where short term financial assets are traded for example treasury bills.

Money markets include markets for such instruments as bank accounts, including term certificates of deposit; interbank loans (loans between banks); money market mutual funds; commercial paper; Treasury bills; and securities lending and repurchase agreements (repos).

Capital markets. This is a market where medium and long term financial assets are traded for example bonds, shares etc.

Stock exchange market is an organized market for the sale and purchase of securities such as shares, stocks, and bonds.

Features of money markets in developing countries

- They are mainly urban based

- They mainly charge high interest rates

- They mainly operate on a small scale

- There are still few participants in the market

- They deal in a limited variety of financial assets

- They mainly deal in short term financial assets

Subsistence production versus market production

Subsistence (direct) production

Subsistence /direct) production is the production of goods and services by and individual for use

Features (characteristics) of subsistence production

- There is high degree of dependency on family labour in the production activities;

- There is use of simple (rudimentary) tools for example pangas, hand hoes etc. in the production process

- There is low labour productivity because of using poor production techniques.

- There is lack of specialization in production.

- Barter trade is the predominant system of exchange. That is exchange of commodities for commodities

- There is limited use of scientific production methods. For example, there is no application of fertilizers, mulching, etc.

- There is absence of profit motive. Individuals simply produce for basic survival.

- There is a high degree of conservatism. Production is greatly influenced by social attitudes and cultural beliefs.

- Land is the basic factor of production characterized by diminishing returns.

Problems (disadvantages/demerits) of subsistence production

- Poor standards of living due to production of poor quality output.

- Narrow tax base because of limited production activities. This leads to low government tax revenue.

- Poor infrastructure in form of poor roads, hospitals, communication services etc.

- Technological backwardness due to lack of inventiveness as a result of conservatism.

- Limited and poor quality output hence low levels of economic growth and development.

- It discourages hard work and expansion of production due to absence of profit motive.

- It limits the level of employment opportunities due to limited production activities.

- It leads to low levels of foreign exchange earnings due to lack of trade activities.

- It discourages the monetization of the economy due to use of barter system of exchange.

- It promotes conservatism and cultural backwardness which leads to cultural dualism.

- There is a high degree risks resulting from natural disasters due to over dependency on nature which adversely affects output.

Market (money/indirect/commercial) production

This refers to the production of goods and services for exchange in the market.

Features (characteristics) of market production

- There is use of money as a medium of exchange.

- There is existence of profit motive.

- There is use of modem techniques of production.

- There is production of high quality output.

- There is use of hired labour in the production process.

- There is use of capital intensive technology of production.

Advantages (merits) of market production

- It encourages the production of high quality output hence better standards of living.

- It widens the tax base thereby increasing government revenue through taxation.

- It promotes the development of social and economic infrastructure in form of roads, marketing facilities, banks, telecommunication services etc. This leads to rural transformation.

- It stimulates capital accumulation as a result of increased savings and production activities.

- It increases foreign exchange earnings of the country as a result of increased production for export.

- It promotes the optimal exploitation and utilization of resources. This is as a result of increased production of goods and services for the export market.

- The presence of profit motive encourages hard work and large scale production. This promotes economic growth and development.

- It promotes technological progress as a result of increased innovations and inventions.

- It reduces on the dependency of the economy on other foreign economies for trade, manpower, technology etc.

- It increases the supply of industrial raw materials for agro based industries. This promotes the creation of forward and backward linkages between the agricultural and industrial sectors.

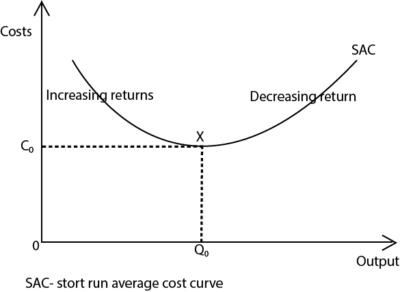

Input-output relationships (planning periods)

The input-out relationship explains how output is related to factors inputs. This relationship depends on the planning periods which include:

- Very short run period. This is the planning period where all factors of productions are fixed that is, it is impossible to increase on the factor of production with the aim of increasing output. Supply on market can only be increased by drawing stock from stores.

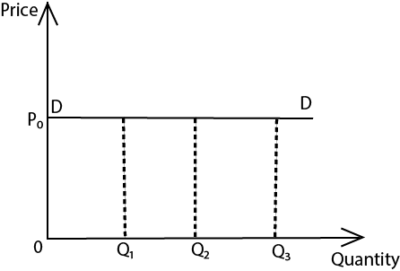

- Short run period. This is the planning period in which other factors of production are fixed and others are variable (change) for example land tends to be fixed in the short run while capital and labour on variable. In the short run the supply of land is fixed (perfectly) in elastic) while the supply of capital and labour is elastic therefore output is increased by increasing on the variable factors only and the law of diminishing returns applies.

- Long run (secular) period. This is a planning period where all factors of production are viable a part from Technology that is, it is possible to increase on output by varying both the variable and what has been the fixed factors in the short run.

- Very long term period. This is where all factors of production are variable including technology. In this planning period technological progress takes place and produces can increases output in the shortest time possible.

Note:

- Variable factors (Inputs)of production, are factor inputs whose supply is elastic in the short run. That is, if their demand increases their supply also increases for example labour.

- Fixed factors of production are factor inputs whose supply remains constant in the short run for example land.

Short run production Period

The production function is a mathematical relationship between factor inputs and output. The production function in the short run assumes the following;

- At least one variable factor of production.

- It assumes constant technology. .

- It assumes that all factors of production are perfectly divisible that is, they can be combined in all proportions.

Determinants of the production function

- The amount of factor input used like capital, labour, land, etc.

- The size of the production unit (the firm)

- The level of prices for factor input

- The proportion in which the factors of production are combined.

The production function can be expressed in the following ways:

(a) As a mathematical statement/Equation. In this case, output is expressed as a function of factor inputs. For example:

(i) Q= f(K,L) where capital is fixed

(ii) Q = aK + bL

(iii) Q = AKαLβ (Cobb Douglas production function)

Where Q = level of production, K = capital and L = labour

(b) In mathematical (tabular form)

| Input (labour) | Output (units) |

| 10 | 100 |

| 20 | 200 |

| 30 | 300 |

| 50 | 250 |

(c) Graphical form

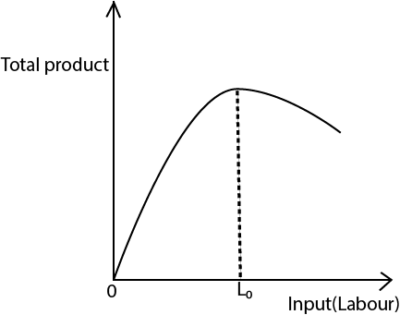

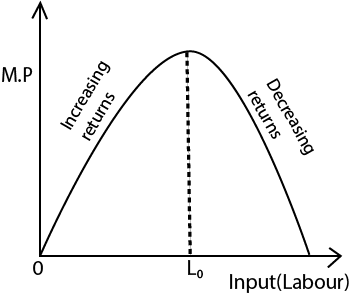

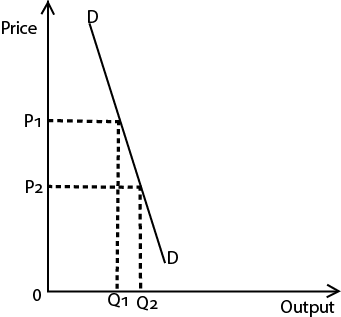

By keeping other factors constant (fixed) and one factor variable (labour) the relationship between output and labour can be explained graphically as shown above. Output increases with increase in labour up to a certain point beyond which output decreases as labour increases.

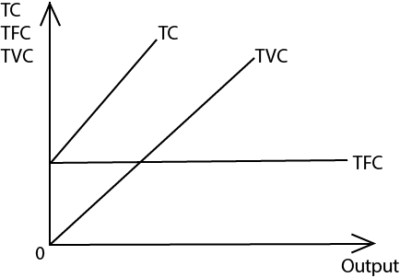

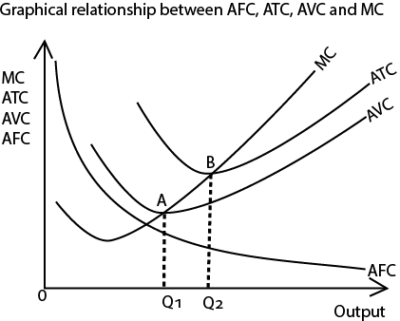

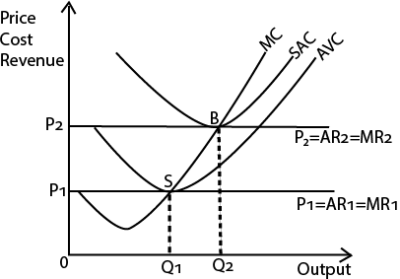

Variation of output in the Short run

By using the input-output relationship in the short run where we have one variable input (labour) and the fixed factor (land), a change in output can be analyzed in the following ways;

- Total product. This refers to the total amount of output produced using both variable and fixed factors of production in a given time.

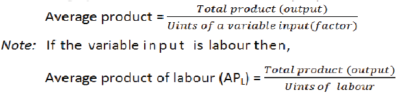

- Average product. This refers to output per unit of the variable input.

- Marginal product. It refers to the additional output resulting from the use or employment of an extra unit of variable factor input

A hypothetical example to show the mathematical relationship between T.P, A.P and M.P

| Fixed factor

(Land) in acres |

Variable factor

(labour) |

T.P(Q) | A.P | M.P |

| 5 | 1 | 5 | – | – |

| 5 | 2 | 15 | 7.5 | 10 |

| 5 | 3 | 45 | 15 | .30 |

| 5 | 4 | 73 | 18.5 | 28 |

| 5 | 5 | 86 | 17.2 | 13- |

| 5 | 6 | 91 | 15.2 | 5 |

| 5 | 7 | 91 | 13 | 0· |

| 5 | 8 | 88 | 11 | -3 |

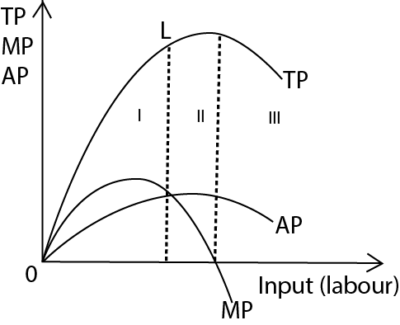

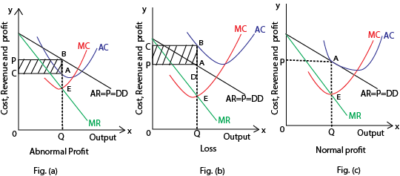

Graphical illustration of the relationship between Average product, Marginal product and Total product

From the graph the following is observed;

- T.P begins by increasing, reaches maximum point B and then falls

- Marginal product begins by increasing reaches a maximum and then decreases up to the negatives.

- Average product begins by increasing, reaches a maximum and then falls.

- When total product (TP) is increasing at an increasing rate (up to point L), Marginal product (M.P) is also increasing. When TP is at maximum M.P is zero, when T.P is falling M.P is negative. Therefore M.P is the measure of the rate of change of total product.

- When average product (A.P) is increasing; M.P is higher than AP and when average product (A.P) is falling M.P is lower than A.P and when A.P is at maximum when MP = A.P.

- L is called a point of inflexion. It refers to the point below which MP is increasing and beyond which M.P is declining. OR. It is a point below which total product is increasing at an increasing rate and beyond which total product is increasing at a declining rate.

From the graph the short run input-output relationship can be explained in three stages of

Production:-

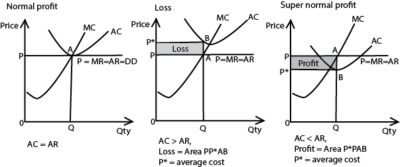

Stage I: The stage of increasing returns.

This stage starts from zero output up to the point where AP is at maximum. In this stage TP, MP and AP are generally increasing. TP is increasing at an increasing rate. The ratio of the fixed factor to the variable factor is high. That is, the fixed factor is still underutilized by the variable factor. MP is greater than AP. Any rational producer (farm) cannot operate in this stage because an increase in the labour inputs (variable factor) can still lead to increase in output.

Stage II: The stage of diminishing returns.

This is also referred to as the optimal or economic region of production. In this region, MP and AP are declining but MP is still positive. There is efficient utilization of the fixed factor by the variable factor and therefore production should take place in this region. In other words, a rational producer whose aim is to maximize profits should operate in this region. MP is less than AP

Stage III: The Stage of negative returns.

It is also called the intensive stage. In this stage, TP, AP and MP are declining and MP is negative. This implies, employment of an extra unit of a variable factor would instead lead to a decline in the total output. This is due to over utilization of the fixed factor by the variable factor. It is irrational to operate in this stage since the employment of an extra unit of variable factor leads to less output generated.

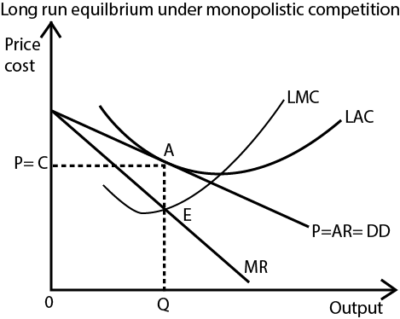

The law of diminishing returns (The law of variable factor proportions)

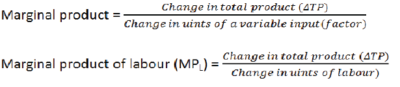

The law states that as more and more units of a variable factor (labour) are added to fixed factor (land), marginal product first increases reaches the maximum beyond which it diminishes.

Illustration

From the graph marginal product increases up to the maximum point beyond which it begins to diminish

Assumptions of the law of diminishing returns

- It assumes a short run period

- It assumes existence of a variable factor

- It assumes existence of a fixed factor

- It assumes constant technology

- All units of a variable factor are homogeneous

- Assumes that all factors of production are divisible and they are easy to change in proportions in which they are combined:

- It assumes that factors of production are equally efficient in the production process. That is, they have the same skills, level of education etc.

- It assumes constant factor prices.

Applications (importance) of the law of Diminishing returns

- It makes it possible for the producers to determine the optimum level of a variable factor which can be combined with fixed factor to yield maximum output.

- It’s used as a basis for the formulation of the law of diminishing marginal utility under the theory of demand. .

- The law forms the basis of Malthusian population theory which explains the relationship between population growth and food supply.

- It forms the basis of the marginal productivity theory of wages. That is a wage given to workers should be equal to the value of his/her marginal product.

- The law helps the producer to determine the profit maximizing level of output that is profits are maximized were marginal product is at maximum.

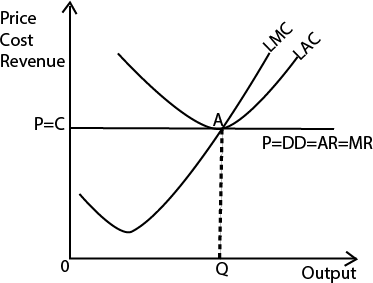

Variation of output in the long run

In the long run, all factors of production are variable apart from technology. Therefore, it is possible for the firm to vary (change) all the factor inputs in a given scale/proportion in order to produce a given level of output. The production relationships in the long run can be analyzed using the law of returns to scale in terms of increasing, constant and decreasing returns to scale.

Returns to scale refer to the change in output when all factor inputs are changed in a given proportion. It shows the relationship between the proportionate change in the factor inputs and corresponding changes in the quantity of output produced in the long runs

The law of returns to scale can be analyzed in three stages:

Stage I: Increasing returns to scale. This is where, when factor inputs double, output (returns) more than doubles. Taking capital and labour as variable factor inputs, increasing returns to scale can be illustrated as shown below.

| Capital | Labour | Output (kg) |

| 2 | 10 | 100 |

| 4 | 20 | 300 |

| 8 | 40 | 700 |

Stage II: Constant returns to scale: This is where when factor inputs are doubled, output also doubles. That is inputs and output increase in the same proportion. This stage indicates the optimum size of the firm. It is illustrated as shown below:

| Capital | Labour | Output (kg) |

| 2 | 10 | 100 |

| 4 | 20 | 200 |

| 8 | 40 | 400 |

Stage Ill: Decreasing (diminishing) returns to scale. This is where an increase in factor inputs exceeds the increase in output in terms of scale. That is, when factor inputs are doubled output less than doubles.

| Capital | Labour | Output (kg) |

| 2 | 10 | 100 |

| 4 | 20 | 250 |

| 8 | 40 | 250 |

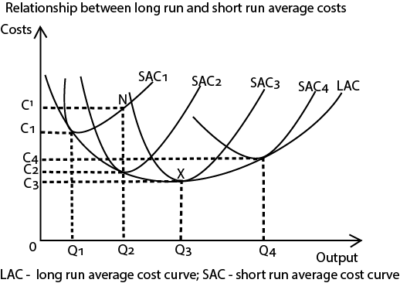

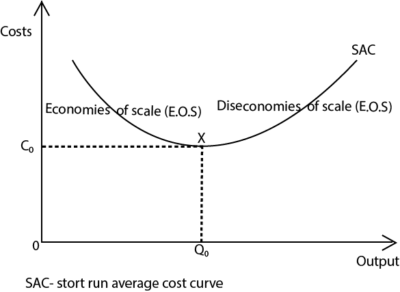

Economies and diseconomies of scale

Economies of scale (E.O.S) are cost advantages gained by companies when production becomes efficient. Companies can achieve economies of scale by increasing production and lowering costs

Note:

- Real economies of scale; are advantages(benefits/gains) enjoyed by the firm as a result of using reduced physical quantities of inputs used in the production of a given level of output. For example the number of units of inputs may change from 100kgsto 70 kg to produce the same level of output.

- Pecuniary (Financial) economies of scale; are advantages (benefits or gains) enjoyed by the firm inform of paying lower prices for factor inputs used in the production process. This normally occurs when the firm buys factor inputs in large quantities.

Note: Economies of scale can be internal or external.

- Internal economies of scale; are advantages (benefits) enjoyed by the firm inform of reduced average costs resulting from the firm’s own expansion.

- External economies of scale; are advantages (benefits) enjoyed by the firm in form of reduced average costs due to the expansion of the industry as a whole.

Examples of internal Economies of scale

- Technical internal E.O.S. These arise from the use of better methods (techniques) of production which results into lower average costs of production For example, a large firm can manage to purchase specialized machines like tractors which increase output at reduced average costs.

- Managerial (Administrative) internal E.O.S. Large firms can acquire highly qualified personal in various fields for example, accountants, marketing managers, production managers, etc. These can help to do the work efficiently which lead to increased output at reduced average cost.

- Marketing internal E.O.S. These are advantages enjoyed by the firm through buying and selling in large quantities e.g. when raw materials are purchased in bulk, the cost per unit are reduced also when goods are sold in bulk more revenue is realized by the firm hence reduced average cost.

- Financial internal E.O.S. A large firm is able to secure a loan from financial institutions like commercial banks. This is because it has enough collateral securities and it is highly trusted by financial institutes.

- Transport internal E.O.S. These result from a large firm transporting raw materials or commodities in bulk (large quantities) which reduces the cost per unit of transportation. For example the unit cost of transporting 600tones per trip is different from the unit cost of transporting 100 tones per the same trip.

- Storage internal E.O.S. A large firm enjoys by storing raw materials or commodities in bulk as compared to small firms, That is, large firms incur lower: costs per unit as a result of storing in large quantities.

- Research internal E.O.S. Large firms are able to carry out research as a way of improving on the quality and quantity of their output unlike small firms.

- Risks bearing internal E.O.S. Large firms are able to diversify their output by producing a wider range of products and selling in different markets. In addition they are also able to insure their business activities against certain risks so to avoid losses.

- Social (welfare) internal E.O.S. Large firms can afford to provide their workers with facilities like medical, transport, accommodation, higher wages, etc. all of which motivate their workers and make them feel contented. This increases efficiency hence reduced average costs.

Examples of external economies of scale

- Transport external E.O.S. Firms in one industry can share transport facilities and other social infrastructure which results into reduced average costs of transportation to each firm.

- Information external E.O.S. Firms in one area can share information collected from various sources e.g., information concerning market prices, new commodities on market, exchange rates and information concerning other business opportunities. Such collective information can help to reduce the average costs to each firm in the industry.

- Technical external E.O.S. Firms in one area can share specialized machinery and technical personnel, for example they can share maintenance facilities like workshops, garages etc. This implies sharing costs hence reduced average costs for each firm.

- Financial external economies of scale. Firms in one area can attract financial institutions like banks, building societies advertising agencies, insurance companies, etc. This makes it possible for individual firms to acquire loans at lower interest rates and to carry out other activities at reduced charges hence reduced average costs to each firm.

- Marketing external economies of scale. Firms under one industry can sell commodities and buy raw materials collectively in order to reduce on the costs and even enjoy huge discounts when buying. In addition firms may form marketing co-operatives which can assist in the selling of their products as an industry.

- Specialization external E.O.S. Firms under one industry can enjoy reduced average costs when they specialize in different in the production process e.g. within the same industry, some firms may provide raw materials used by other firms through the backward and forward linkages making each firm to operate at lower average costs

- Welfare external economies of scale. Firms under one industry can be able to establish certain social infrastructures like hospitals, schools, recreational centers, etc. which can improve on the welfare of their workers.

Diseconomies of scale

These are disadvantages accruing to the firm of in form of increased average costs resulting from over expansion of the scale of production of the firm or industry.

Note. Diseconomies of scale can be internal or external.

- Internal diseconomies of scale. These are disadvantages accruing to the firm in form of increased average costs resulting from over expansion of the scale of production of the firm.

- External diseconomies of scale. These are disadvantages accruing to the firmin form of increased average costs resulting from over expansion of the industry.

Examples of Internal Diseconomies of scale

- 1. Managerial internal D.O.S. As the firm over expands beyond its optimum level, supervision of workers, decision making and coordination becomes difficult and this results into increased average costs of management.

- Financial internal D.O.S. Due to over expansion of the firm, it becomes very difficult to get enough money to finance all the production activities. This may force the firm to borrow at very high interest rates hence increasing the average costs of production.

- Marketing internal D.O.S. As the firm over expands it may get problems in form of limited markets for its products. In addition, prices if inputs may rise due to their increased demand and this results into increased average costs of production.

- Technical internal D.O.S. As the firm over expands the rate of depreciation of the machines increases. This forces the firm to incur high costs of repair and maintenance hence increased average costs of production

- Transport internal D. O.S. As the firm expands the transport facilities may be over utilized due to transporting heavy and bulky products. This results into break down of infrastructure and vehicles, forcing the firm to incur higher costs of repair.

- Storage internal D.O.S. This occurs when the firm has limited storage facilities yet the output is increasing. This forces the firm to incur high storage costs hence diseconomies of scale.

- Social internal D.O.S. These can be in form of congestion which results into easy spread of diseases, increased theft etc.

Examples of external Diseconomies of scale

- Congestion. This occurs when a number of firms compete for the available space for expansion.

- Pollution. When many firms concentrate in one area, there is too much wastes and fumes from these firms or factories which pollute the environment. This increases the average costs of fighting pollution or removing the wastes of each firm,

- High competition. The firms begin to compete for the facilities like ware houses, markets, raw materials etc. This increases the prices hence higher average costs of production for each firm,

Revision Questions

Section A questions

1 (a) Define the term “production”

(b) Mention any three agents of production in your country.

2 (a) What is meant by factor price

(b) Mention any three factor prices in an economy

3 Give any four determinants of demand for factors of production.

4 (a) What is meant by factor specificity?

(b) Explain the relationship between specificity and mobility of a factor of production

5 (a) Distinguish between horizontal and vertical factor mobility

(b) Give two examples of vertical mobility of labour.

6 (a) Distinguish between specialization and division of labour

(b) Give two advantages of specialization in an economy.

7 (a) What is meant by factor mobility?

(b) State three causes of factor immobility in your country

8 Mention four factors which limit occupational mobility of labour in your country

9 (a) Define Marginal efficiency of capital

(b) Give any three determinants of Marginal efficiency of capital.

10 Make a difference between private Limited companies and public Limited companies.

11 Distinguish between the following terms

(a) Unlimited liability and limited liability

(b) A share and a stock

(c) A money market and a capital market

12 Mention four features stock exchange markets in developing countries

13 (a) State the law of diminishing returns

(b) Mention any three usefulness of the law of diminishing returns

14 (a) State the law of variable factor proportions.

(b) Mention any three assumptions underlying the law above.

15 (a) Define marginal efficiency of a factor of production

(b) Mention three determinants of marginal efficiency of a factor

16 Outline four sources of business finance in your country.

17 (a) Differentiate between interest and profit

(b) Calculate the compound interest earned on the principle sum of 100.000/= lent for a period of three years at an interest rate of 10% per annum.

18 (a) What is meant by subsistence production

(b) Mention three features of subsistence (direct) production.

19 (a) What is meant by market (indirect) production

(b) Give three merits of market production.

20 (a) Distinguish between Pecuniary and real economies of scale

(b) Give two examples of pecuniary economies of scale

Section B questions

- (a) With examples, distinguish between Horizontal and Vertical mobility of labour.

(b) Explain the determinants of labour mobility in your country.

- (a) Explain the role of capital accumulation in economic development

(b) Discuss the factors that influence capital accumulation in your country

3 (a) What is meant by the term capital accumulation and capital depreciation

(b) Suggest measures that should be taken to increase the rate of capital accumulation in your country.

4 (a) Explain the barriers to occupational labour mobility.

(b) Suggest policies that can be adopted to improve labour mobility in your country.

5 (a) Distinguish between economies of scale and diseconomies of scale.

(b) Discuss the various economies of scale enjoyed by firms in your country

6 (a) Distinguish between external economies of scale and internal economies of scale

(b) Account for the survival of small firms despite the presence of economies of large scale production.

Concept of the firm

- A firm is a production unit under one management which organizes resources to produce goods and services.

- An industry is a collection of firms dealing in related products for example foot wear industry plastic industry, textile industry etc.

Types of industries

- Rooted Industries. These are industries located near the source of raw materials e.g. Cement industries located near lime stone rocks, sugar industries located near, sugar cane plantations

- Footloose Industries. There are industries which can be located anywhere without considering the source of raw materials or market.

- Tied Industries. These are industries located near the market for their finished products e.g. furniture industries, bakeries, carpentry workshops soda industry, etc.

Objectives of the firm

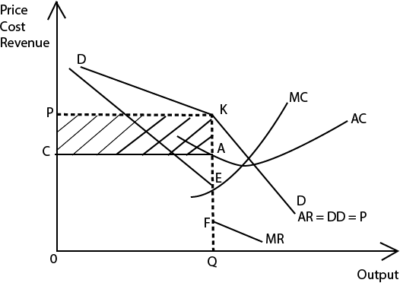

- Profit maximization. This is a major objective of the firm. The firm tries to minimize the costs and maximize the revenue the revenue in order to maximize Profits are maximized at a point where marginal cost equals to marginal revenue.

- Sales revenue maximization. The firm may aim at increasing sales through reduced prices, advertisement and other incentives given to customers with the aim of maximizing the sales revenue.

- Good image. Some firms do not aim at profit making but to serve the community and maintain their reputation especially parastatals. This can be achieved by fixing low average prices, providing quality products and services that are appropriate to community needs.

- Market expansion. Firms aim at getting a bigger market share as compared to their competitors through market research, supplying good quality products, advertisement etc.

- Long run survival. The firm may operate in such way to exist for a long time. This can be achieved through proper management and making proper decisions.

- Entry limitation. Some firms are interested in preventing other firms from entering the industry. This is achieved by setting lower prices that make entry of new firms in the-industry un attractive. This is referred to as limiting pricing policy.

- Employee welfare maximization. Some firms aim at maximizing the welfare of their workers increasing the wage and non-wage benefits,

Survival of small scale firms alongside large firms

As firms increase their scale of operation, they enjoy economies of large scale. Therefore every firm must strive hard in order to reap such benefits. However some firms continue to operate on a small scale because of the following factors.

- Limited capital. Small firms may be limited by capital for their expansion and this makes them to remain small for a long time.

- Limited Market Size. Some firms may remain small due to a small market size which necessitates the production of low output. Therefore the firm remains small to avoid loss resulting from over production.

- Using bi-products from large firms. Small scale firms may survive When they are using raw materials supplied by large firms. This makes them to remain in a small state despite the benefits of large production.

- Providing personalized services. Small scale firms which provide personal services and pay individual attention to their customers like doctors, tailors may not need to operate on a large scale if they are to provide standardized services to their customers.

- Need for personal contact. The owners of small scale firms can easily develop personal contacts with their customers. This may help the firms to keep on operating unlike large firms where the owners may not develop personal contacts with their customers e.g. salons.

- Simplicity in management. Small scale firms are easy to manage that is there is easy communication and co-ordination within the small firm unlike large firms.

- Beginner firm. When the firm has just started, it operates on a small scale because time is required for it to expand and enjoy the economies of large scale.

- Fear of diseconomies of scale. Unlike large scale firms, small firms do not face internal diseconomies of scale and therefore, this forces them to small for a long time.

- Production of very expensive products. Firms engaged in the production goods of ostentation may remain small because of the nature of their expensive products and the need to show class among their customers. Examples are firms dealing in sports cars, expensive jewelry etc.

- Flexibility in production. Small scale firms can easily change the line of production without wasting much resources for example when the market demand changes, a small firm does not lose so much as compared to a large firm,

- Production of bulky and fragile products. Small scale firms dealing in bulky and fragile products may feel secure to remain small to avoid risks of over expansion e.g. Firms dealing in glass making, brick making, eggs etc.

- Fear of paying taxes to the government. Small firms can easily avoid and evade paying taxes and this makes them to operate on a small scale.

Merging (Integration) of firms

This is where two or more firms join together to form one business unit with the aim of enjoying economies of large scale.

Reasons (Aims/Objectives) for merging/integration

- To expand the market in form of increased sales resulting from large production.

- To ensure efficient management, that is, different firms can combine different management skills which enable them to operate more effectively and efficiently.

- To reduce on the risks involved in business operations. This is because under mergers risk bearing economies of scale can be enjoyed through diversification in production.

- To monopolize business activities. When a number of firms combine to form one large firm, they can outcompete other small firms hence enjoying the monopoly power.

- To increase employment opportunities. A number of business activities are created due to large scale of production hence more employment opportunities.

- To increase resource utilization. A combined big firm can be able to raise more capital in order to increase on the utilization of resources and produce more goods and services, in case small firms have been operating at excess capacity.

- To ensure reliable supply of raw materials. For example when one firm is using bi-products of another firm as its source of raw materials.

- To increase on the profits of each firm within the merger due to the large scale of operation of the merger.

- To ensure increased quality and quantity of output. For example, through joint research, firms can be able to improve on the quality of their products.

- To promote specialization in production. Each firm under the merger can specialize in producing a given product. This increases the efficiency and output of each firm.

Types of Mergers

(a) Horizontal Mergers. This is where two or more firms in the same industry and at the same stage of production join together so as to enjoy economies of large scale. For example Toyota Company merging with Nissan Company.

(b) Vertical mergers. This is where two or more firms in the same industry and at different stages of Production, join together (amalgamate). For example sugar firm merging with sugar cane producing firm, textile firm merging with cotton producing firm etc.

There are two types vertical mergers;

(i) Forward Vertical Mergers. This is the form of vertical integration where a firm at a lower stage of production merges with the firm at higher stage of production like a secondary school merging with a university, sugarcane firm initiating the process of merging with a sugar firm etc.

(ii) Backward Vertical Mergers. This is the form of vertical integration where a firm at higher stage of production absorbs a firm at a lower stage of production. For example the sugar firm absorbs a sugar cane plantation, a steel manufacturing industry absorbing an iron supplying company etc.

Note

- Backward linkages. This is a situation where the existing large firm or industry leads to establishment of another industry by providing inputs (raw materials). For example a sugar industry having a backward linkage to a firm that grows sugar cane, a secondary school has backward linkage to a primary school

- Forward linkages. This is a situation where an existing firm or industry leads to the establishment of another firm to create market for its products. A sugar factory has a forward linkage to supermarket or restaurant, a secondary school has a forward linkage to a university.

(c) Lateral integration/merger is the expansion of a corporation to include other previously competitive enterprises within the same sector of goods or service production. For example one candy maker takes over another candy maker.

(d) Conglomerate (Diversifying) mergers. This is a merger between firms that are involved in totally unrelated business activities., For example a brewery industry merging with a textile industry, a sugar industry merging with a furniture industry. A conglomerate merger provides the merging companies with the advantage of diversification of business operations and target markets.

Factors which make it difficult for firms to Merge

- Fear of complexity in management in form of bureaucracy

- Fear of losing independence enjoyed by individual firms

- Differences in aims and objectives of individual firms

- Government policy which may be aimed at discouraging merging of firms

- Fear of losing employment due to merging for example the managers

- Fear of paying high taxes by one single big firm

- Fear of losing personal contact with the clients of the firm.

- Fear of under taking high risks associated with large scale operation

- Fear of not achieving the optimum level of production due to a large scale of production

- Fear of diseconomies of large scale. For example marketing and technical diseconomies of scale

- Market potential may favor competition which forces firms to remain independent.

Advantages of merging of firms

- It helps to expand the market in form of increased sales resulting from large firms.

- It increases employment opportunities as a result of large scale production.

- It increases utilization of resources hence increased output.

- It helps to minimize unnecessary competition among firms producing related products in form of duplication of commodities.

- It ensures reliable supply of raw materials.

- It improves efficiency in management. This is because people of different expertise and experience are combined together under the merger.

- It reduces the cost of advertising for individual firms.

- It enables firms to carry out research jointly at a reduced cost.