The Classical Quantity theory of Money Demand

The classical quantity theory of money demand states that, keeping the level of transactions and velocity of money constant, the general price level of goods and services is determined by the stock of money circulating in the economy.

This theory is illustrated by Irving fisher’s equation of exchange which states that MV = PT

where;

M is the stock of money (money in circulation)

V is the velocity of money (that is, the number of times money changes hands)

P is the general price level

T is the level of transactions

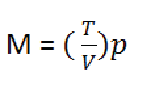

From the equation above, assuming V and T constant, the stock of money (M) is directly proportional to the general price level. That is an increase money supply keeping the level of transactions and velocity of money constant increases the general price level of goods and services in the economy. That is

The theory is based on the following assumptions;

- Price is only affected by changes in money supply

- There is full employment of resources in the economy

- All money earned is spent on the consumption of goods and services

- Money is only demanded for transaction motive.

- Absence of barter trade

- The volume of transactions is constant

- The velocity of money in circulation is constant

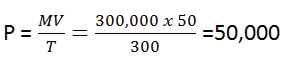

Example

Given that in the economy, M = shs.300,000, V = 50, T = 300. Calculate the general price level.

Solution

MV=PT

Criticisms (Limitations) of the classical Quantity theory of money demand

The quantity theory of money is criticized on the following grounds;

- The theory only emphasizes the transaction motive of holding money and it ignores the precautionary and speculative motives of money demand.

- It is just a truism and not a theory. It merely shows that the four variables M, V, P and T are related.

- The theory ignores commodities that are transacted through barter trade as a system of exchange.

- The theory only explains the changes in the value of money but not how the value of money is determined.

- The assumption that the velocity of money (V) and the level of transactions (T) are constant is unrealistic. This is because they are affected by the expenditure behavior and hoarding habits of individuals.

- It assumes a general price level which is unrealistic. This is because there may be a series of price levels of commodities in the economy.

- The four variables M, V, P and T are not independent of one another as the theory assumes. This is because a change in one induces a change in other variables.

- If the country has many unemployed resources, the increase in money supply leads to an increase in output of goods and services which makes the price to fall or not to change at all.

- An increase in money supply may result into higher savings if the marginal propensity to save is high. This reduces the velocity of circulation and prices may fall.

- The theory ignores haggling as a method of price discrimination in the market. That is haggling between buyers and a seller to reach an agreeable price is not taken into account.

- It does not take into account other causes of price increases (inflation) like cost push, break down of infrastructure etc.

- It ignores influence of interest rate. The theory cannot be complete without mentioning interest as the major determinant of money demand in the economy.

- The theory ignores government control of prices in the market as a way of ensuring price stability.

- The theory does not take into account the demand for money. It only looks at money supply.

Thanks a lot for the work you have provided to us its very useful and understandable thank you very much