Chapter 2 Economic: Market analysis

Market concept

A market is a place where buyers and sellers can meet to facilitate the exchange or transaction of goods and services. Markets can be physical like a retail outlet, or virtual like an e-retailer

Price theory

Price theory is the study of prices in the market.

Price is the sum or amount of money or its equivalent for which anything is bought, sold, or offered for sale at a given time.

OR.

Price is the amount of money which must be given up in order to obtain a commodity in a given, market at a given time . . ,

Types of Markets

- Competitive (Perfect) market. This is a market where buyers and sellers have no ability to influence the price in the Prices are determined by the market forces of demand and supply.

Characteristics/Features of competitive market

- Large numbers of buyers and sellers in the market.

- Identical/homogenous products sold by all firms,

- the freedom of entry into and exit out of the industry or perfect resource mobility

- Perfect knowledge of prices and technology.

- No price control.

- Perfect mobility of factors of production, the factors of production are completely mobile leading to factor-price equalization throughout the market.

- Cheap and Efficient Transport and Communication

- the consumer has plenty of choice when buying goods or services

- Imperfect market. This is a market where the buyers or sellers have ability to influence the price set in the market by either controlling supply or

- Goods market: This is a market where goods are

- Commodity market: This is a market where goods and services are

- Factor market. This is a market where factors of production are For example land, labour, capital, entrepreneurship

Note. Factor price is the monetary reward to factors of production for their contribution in the production process. For example wages, interest, profit and rent.

- The spot market is where financial instruments, such as commodities, currencies, and securities, are traded for immediate delivery

- Future (Forward) market. This is a market where commodities are traded for future

Methods of Price determination in the Market

- Haggling (Bargaining). This is where the buyer negotiates with the seller for the suitable price of the During bargaining, the seller keeps on reducing the price and the buyer keeps on increasing until the agreed price is reached.

- Auctioning (Bidding). An auction is a sale in which buyers compete for an asset by placing bids. The highest bidder takes the commodity. This is method is common in fundraising especially in churches and other functions.

- Fixing by treaties (Agreements). This is where buyers and sellers come to an agreement to fix the price of the commodity. The price remains fixed for a given time but the agreement can be renewed and prices can be changed.

- Government determination (legislation). This is where the government fixes the price of the commodity. The government can either fix the maximum or minimum price.

- Price leadership. This is where a large and low cost firm in the industry fixes the price of a commodity which has to be followed by other small firms. This firm normally has a large share of the market.

- Price fixing by cartels. A cartel is an organization of firms producing and selling similar products. These firms come together and fix one price at which they have to sell the commodity to the consumers for example OPEC.

- Interaction of the forces of demand and supply. This is where the price in the market is determined by the forces of demand and supply at a point where quantity demanded equals to quantity supplied.

- Resale price maintenance. This is where the producer (manufacturer) fixes the price of a commodity at which the seller (retailers) has to sell to the final consumers. The price is usually written the commodity container. For example Newspapers, soft drinks. etc.

Advantages (merits) of resale price maintenance

- It is time saving since it does not involve bargaining

- It reduces unnecessary competition among sellers.

- It helps to control consumer exploitation in form of increasing prices by sellers/retailers.

- It helps to maintain price stability.

- It helps to reduce on the duplication of the products by other producers.

The theory of demand

Demand. This refers to the a consumer’s desire to purchase goods or services and willingness to pay for them at a particular prices

Quantity demanded. This is the volume of goods and services that consumers are willing and able to buy at a given price in a given time.

Determinants of quantity demanded

- The price of the commodity .The higher the price, the lower the quantity demanded and the lower the price, the higher the quantity demanded of the commodity.

- The nature of tastes and preferences. Favorable tastes and preferences by the consumer increase the quantity demanded of the commodity but unfavorable tastes and preferences decrease the quantity demanded.

- The price of related commodities. An increase in the price of the substitute increases the demand for the commodity in question but a reduction in the price of the substitute reduces the demand for the commodity in

- Price of complements. An increase in the price of the complement leads to a fall in the demand of the commodity in question and a fall in the price of the complement leads to an increase in demand for the commodity in question.

- Government policy. An increase in taxes on the commodity by the government leads to a decline in quantity demanded of the commodity but subsidization to consumers by the government encourages the consumption of the commodity and therefore quantity demanded Increases.

- Population size and structure. A population comprised of a big percentage of middle and high income earners increases the quantity demanded of the commodity but a population with a big percentage of low income earners leads to a fall in quantity demanded of the commodity.

- The nature of income distribution. Even distribution of income among the consumers increases the quantity demanded of the commodity but uneven distribution of income reduces the demand for the commodity.

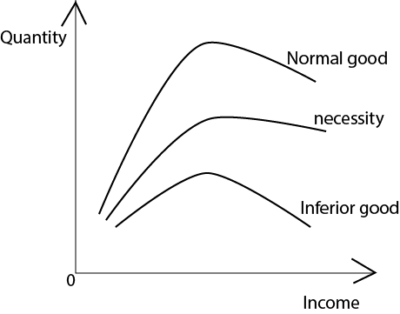

- The level of the consumers’ income. This depends on the nature of the commodity, that is, normal good, a necessity or an inferior good.

- For a normal good, an increase in the consumers’ income increases the quantity demanded of a commodity and the decrease in the consumers’ income leads to decrease in the quantity demanded.

- For the necessity, an increase or decrease in the consumers’ income does not affect quantity demanded of the commodity.

- For the inferior good, an increase in consumers’ income leads to the decrease in quantity demanded and a decrease in consumers’ income increases the quantity The three situations are illustrated using the angle curve

- Future price speculation. An expected future increase in the price of a commodity increases its current demand but an expected future reduction in the price reduces the quantity demand for the commodity with the hope of consuming more in future at a lower price.

- Seasonal factors. In certain seasons of the year, the demand for some commodities increases or decreases e.g. in the rainy season, there is high demand for rain coats and their demand decreases in the dry season.

- Religion and culture The demand for pork is low in places where there are many Moslems as compared to places where there are many Christians especially

- Sex of the consumer. Some commodities are demanded by a particular sex e.g. the demand for shirts is likely to be high in places where there are many males as compared to females. Also, the demand for sweets is likely to be high in a girls’ school as compared to a boys’

- Marital status. For example, the demand for wedding rings is high in a society where there are many married couples as compared to that dominated by singles.

- Level of education. For example, the demand for scholastic materials is high in places where there are many people going to school as compared to places where there are few students.

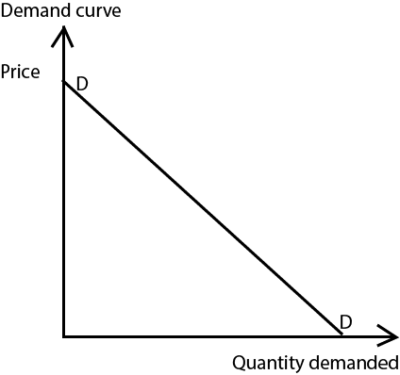

Demand curve

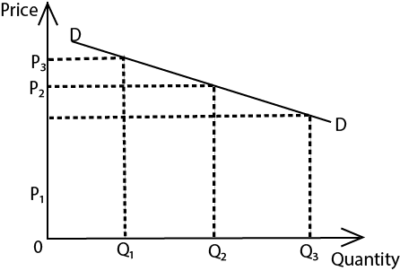

The demand curve is a graphical representation of the relationship between the price of a good or service and the quantity demanded for a given period of time.

The graph shows that increase in price leads to reduction in quantity demanded and vice versa

Reasons why demand curve slopes down from left to right

- The law of diminishing marginal utility. As a person consumes more units of a commodity, the extra satisfaction derived from extra units of the same commodity diminishes. Therefore a consumer will only be willing to purchase more of the units at a lower price explaining a downward sloping curve.

- Substitution effect. As price of a commodity falls consumer purchase more units of the commodity and less of its substitutes. However, as its price rises, consumers purchase less of it and buy more of its substitutes. Thus at higher prices, less of a commodity is purchased and more is purchased at lower prices.

- Real income effect. As price of a commodity falls, the real income of the consumer increase and therefore he is able to buy more of a commodity at a lower price. But as the price rises, the real income of the consumer falls and is only able to buy less.

- Presence of low income earner. Ordinary people or low income earners buy more of a commodity when the price falls because that is when they can afford to purchase it. Increase in price of a commodity lowers demand. The rich do not affect the demand curve as they are well capable of buying more commodities even at high prices

- Commodities with different uses. As prices of these commodities increase consumer reduce the quantity demanded by only purchasing what is essential e.g. lighting n case of high price for electricity. However when prices reduce consumer demand for more to use for luxurious purpose.

- New buyers. Due to the fall in the price of a commodity new buyers get attracted towards it and buy it. Thus, this increases the demand for the commodity.

- Tendency To Satisfy Unsatisfied Wants. There is always a human tendency to satisfy unsatisfied wants. Each and every person has some unsatisfied wants. When the prices of goods, such as apples, falls, the consumer will buy more of that commodity as he wants to satisfy his unsatisfied wants. As a consequence of this habit of humans, the demand curve slopes downward to the right.

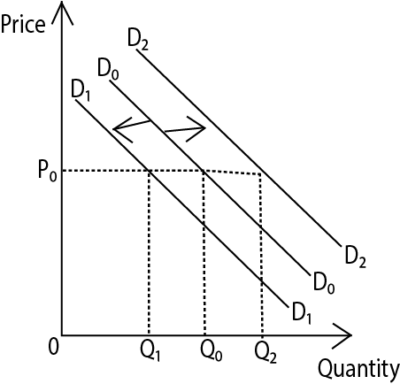

Change in demand

This refers to increase or decrease in amount of the commodity bought due to changes in other factors affecting demand keeping price of the commodity constant. It involves a shift in demand curve either to the left or to the right

A shift in the demand curve to the right (from D0D0 to D2D2) is called an increase in demand. It refers to the outward shift in the demand curve caused by the favorable factors which affect demand at constant price of the commodity. Such factors include;

- Increase in the price of the substitute

- A fall in the price of the complement

- A favorable change in the tastes and preferences of the consumer

- Expected increase in the future price of the commodity

- An increase in the size of the population

- Favorable season of the commodity

- Favorable government policy like subsidization of consumers

- Increased even distribution of income

- Increase in the disposable income of the consumer

- Increase in advertisement of the commodity

- Increase in the amount of credit facilities offered by the government to consumers.

A shift in the demand curve to the left (from D0D0 to D1D1) is called a decrease in demand. It refers to an inward shift in the demand curve caused by the unfavorable factors which affect demand at constant price of the commodity. Such factors include;

- Decrease in the consumer’s disposable income

- Decrease in the price of the close substitute.

- An increase in the price of the complement.

- Unfavorable change in tastes and preferences of the consumer

- Expected fall in the future price of the commodity

- A decrease in the size of the population.

- Unfavorable season of the commodity

- Unfavorable government policy like increased taxation of consumers.

- Increase in income inequalities.

- Reduction in the advertisement of the commodity

- Withdrawal of credit facilities offered by the government to consumers

Types of demand

- Competitive demand. This is the demand for commodities which serve the same purpose. (Demand for substitutes). For example the demand for tea and coffee, brands of detergents, etc.

- Complimentary (Joint) demand. This is the demand for commodities which are used together. (Demand for complements). An increase in the demand for one commodity leads to an increase in demand for another commodity. For example demand for car and petrol, camera and films, guns and bullets, etc.

- Composite demand. This refers to the demand for the commodity which is used for several (various) purposes e.g. the demand for water, electricity. “, .

- Independent (unrelated) demand. This refers to the demand for commodities which are not related such that the demand for one commodity does not directly affect the demand of another commodity. For example demand for a car and a pen, clothes and sugar.

- Derived demand. It refers to the demand for a commodity not for its own .sake, but for its own purposes (uses). For example the demand for factors of production.

Aggregate demand

Aggregate demand refers to the total demand of finished goods and service produced in an economy by both households and firms

Aggregate demand curve

A demand curve is the locus of points showing total demand of finished goods and service produced in an economy by both households and firms in a period of time. It draws on assumption that the higher the price, the lower the quantity demanded other factors remaining constant.

Aggregate demand curve is the horizontal summation of all individual household demand curves.

Note that different reasons account for down slopping of a demand curve (one product) and aggregate demand curves (many products)

Reasons cause the aggregate demand curve to be downward sloping.

- The first is the wealth effect. The aggregate demand curve is drawn under the assumption that the government holds the supply of money One can think of the supply of money as representing the economy’s wealth at any moment in time. As the price level rises, the wealth of the economy, as measured by the supply of money, declines in value because the purchasing power of money falls. As buyers become poorer, they reduce their purchases of all goods and services. On the other hand, as the price level falls, the purchasing power of money rises. Buyers become wealthier and are able to purchase more goods and services than before. The wealth effect, therefore, provides one reason for the inverse relationship between the price level and real GDP that is reflected in the downward‐sloping demand curve.

- A second reason is the interest rate effect. As the price level rises, households and firms require more money to handle their transactions. However, the supply of money is fixed. The increased demand for a fixed supply of money causes the price of money, the interest rate, to rise. As the interest rate rises, spending that is sensitive to rate of interest will decline. Hence, the interest rate effect provides another reason for the inverse relationship between the price level and the demand for real GDP.

- The third and final reason is the net exports effect. As the domestic price level rises, foreign‐made goods become relatively cheaper so that the demand for imports However, the rise in the domestic price level also means that domestic‐made goods are relatively more expensive to foreign buyers so that the demand for exports When exports decrease and imports increase, net exports(exports ‐ imports) decrease. Because net exports are a component of real GDP, the demand for real GDP declines as net exports decline.

The factors which affect the level of aggregate demand

- The general price levels in the country: when the general price level s of goods and services are high, aggregate demand lowers and when the general price level is low aggregate demand increases.

- The general level of incomes: when the incomes of households and firms in a country are high, the demand for goods and services are high and vice versa.

- The amount of money supply in an economy: the high supply of money in the country increases the purchasing power of the households and firm raising the aggregate demand.

- The level of aggregate money demand in a country. High level of aggregate money demand reduces the purchasing power of consumers reducing aggregate demand and the vice versa.

- The supply of consumer goods and service. A limited supply of good and services force prices to increase and reduces the aggregate demand and vice versa.

- The distribution mechanism of good and services: When the distribution of goods and services is poor, the level of aggregate demand will be low and vice versa.

- The size of the population: high population increase purchasing power and aggregate demand and vice versa.

- The tastes and preferences. If the tastes and preferences are positive for particular goods and service, the purchasing power increases leading to increase in aggregate demand.

- The political climate in the country. A stable conducive political climate increase the purchasing power leading to increase in aggregate demand

- Economic climate. Stable economic climate such as stable prices increase purchasing power and therefore increase aggregate demand.

- Levels of development of the commercial sector. A well-developed commercial sector implies high levels of income leads to an increase in aggregate demand.

- Government polity on taxation and subsidization. When the tax rates in the country are high, this reduces the income of consumers leading to low purchasing power thus reducing aggregate demand.

- The expectation of inflation/speculation:– If the consumer expects high inflation in the future then the demand rises in the present such that the aggregate demand curve shifts rightward.

- Level of Advertising. The higher the level of advertising the higher the aggregate demand

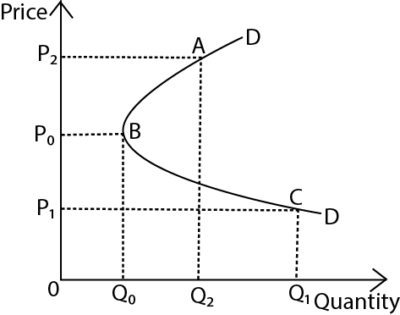

Abnormal (Regressive/exceptional) demand curves

These are demand curves which violate(disobey)the law of demand which state that “the higher the price, the lower the quantity demanded and the lower the price, the higher the quantity demanded keeping other factors constant”. The demand curves normally slope from left to right.

Causes of the Abnormal demand curve

- Demand for goods (Articles) of ostentation. This refers to the demand for expensive luxurious commodities .For example very expensive In this case, a further price increase leads to an increase in the demand of the commodity. This is because consumers want to be unique and they tend to show their economic status by demanding for very expensive items so as to impress the public.

.

AB is the abnormal part of the demand curve. Further increase in the price from 0P0 to 0P2 leads to an increase in quantity demanded from 0Q0 to 0Q2.

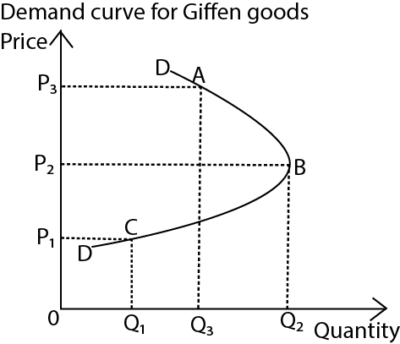

- Giffen good paradox. Giffen goods are inferior goods which take a large percentage of the consumer’s income such that as their prices increase, their quantity demanded also increase andas their prices fall, quantity demand also decreases g. staple food stuffs.

.

ABC is the demand curve. CB is the abnormal part. An increase in the price form 0P1 to 0P2 leads to an increase in quantity demanded from OQ1 to 0O2.

- Future price expectation. When the consumers expect a future price increase, they buy more units of the commodity in the current period even if the prices are slowly On the other hand, when they expect a future price fall, they buy less units of the commodity even if the prices are falling slowly hence violating the law of demand.

- Ignorance effect of the consumers. Some consumers may buy more units of the commodity at high prices due to their ignorance about the existing market This is normally due to persuasive advertisement sellers hence violating the law of demand.

- Depression effect. A depression is an economic situation where all economic activities are at low levels g. low prices, low incomes, low investment levels etc. In such situations when the price of the commodity reduces, quantity demanded remains low due to the low purchasing power of consumers as a result of low incomes. This violates the law of demand.

- Addiction (Habit) to the consumption of the commodity. This violates the law of demand in such a way that increasing the price of the commodity may not reduce the quantity demanded of that commodity to a consumer who is addicted to consuming that commodity, e.g. smokers

- High degree of necessity of the commodity. When the commodity is of high degree of necessity, its demand remains constant even if its price increases or reduces, for example the demand for salt.

- Judging quality by price. Some consumers tend to judge quality by price. Hence they tend to buy more of a commodity whose price is high, thinking that it is of high, quality. This is common in developing countries.

- Special seasons (occasions). For example, during Christmas seasons, wedding occasions In such seasons, the demand for certain commodities increases with an increase in their prices due to high need for them. For example the demand for fruits increases during Idd season.

The supply theory

Supply is the total amount of a given product or service a supplier offers to consumers in a given period and at a given price level.

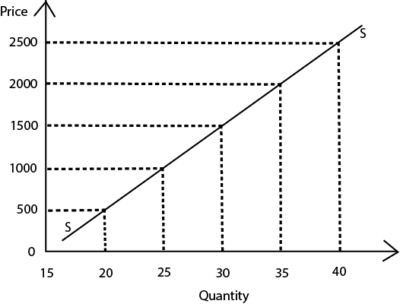

Supply Schedule refers to the numerical representation showing the quantity supplied of the commodity at various prices in a given time. OR. It is the table showing quantities of the commodity supplied in. the market at various prices in a given time.

Hypothetical example to illustrate the supply schedule

| Price | 500 | 1000 | 1500 | 2000 | 2500 |

| Quantity | 20 | 25 | 30 | 35 | 40 |

- From the supply schedule above, as the price increases, quantity supplied also

- From the supply schedule we derive the supply curve by plotting price against quantity supplied.

Supply Curve.

This refers to the graphical representation of quantity supplied of a commodity at various prices in a given time. OR. It is a locus of points showing quantity supplied of a commodity at various prices in a given time.

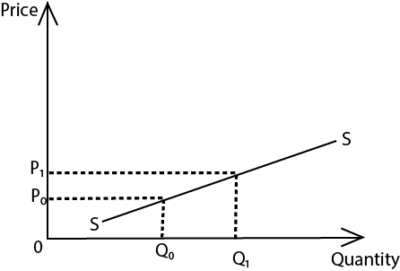

From the graph, the supply curve is positively slopping that is, it slopes upwards from left to right.

The law of supply

The law of supply states that “the higher the price, the higher the quantity of commodity supplied and the lower the price the lower the quantity supplied keeping other factors constant”.

Factors affecting quantity supplied of the commodity

- The price of the commodity. The higher the price, the higher the quantity supplied and the lower the price of the commodity the lower the quantity supplied.

- The number of producers of the commodity. The higher the number of producers of the same commodity the greater the quantity supplied, and the smaller the number of suppliers, the lower the quantity supplied:

- Level of costs of production. A reduction in the factor prices reduces the cost of production and this leads to an increase in supply but an increase in the costs of production discourages producers and this leads to a fall in the quantity supplied.

- Degree of availability of factor inputs. An increase in the supply of factor inputs in form of raw materials increases quantity supplied of the commodity but a reduction in the supply of factor inputs reduces the quantity supplied of the product.

- Degree of freedom of entry of firms in production. Free entry of firms increases the supply of the commodity while restricted entry of firms reduces the supply of goods.

- Level of technology used in production. Use of better and improved technology increases quantity supplied but in case the technology used is inefficient, the quantity supplied reduces e.g. a tractor versus a hand hoe.

- Nature of the working conditions. Favorable working conditions in form of higher wages, transport and food allowances etc. motivate workers to work hard and this increases quantity supplied of the product. But unfavorable working conditions encourage workers to become inefficient and therefore quantity supplied of the product decreases.

- The length of the gestation period. This is the time taken for a commodity to be ready on market. The longer gestation period, the lower the quantity supplied and the shorter the gestation period, the higher the quantity supplied.

- Goal of the firm. A firm that aims at profit maximization may put less quantity on market and charge a high price hence reducing the quantity supplied of the commodity but for the firm aiming at sales maximization, quantity supplied of the product increases.

- Government policy, increasing taxes by the government on the producers of a certain commodity increases the cost of production and this reduces quantity supplied of the product. But subsidization of producers by the government in form of reduced prices for factor inputs increases the quantity supplied of the commodity.

- The nature of the Climate. Favorable climate increases the supply of the commodity especially for the agricultural products but unfavorable climate reduces the supply of agricultural commodities.

- Degree of political stability of the country. A politically stable country encourages investments and production of goods and services hence increasing the supply of commodities. But a politically unstable country discourages the production of goods and services hence a fall in the supply of commodities.

- The size of the market, the bigger the market size, the higher the supply of the commodity and the smaller the market size, the lower the supply of the commodity.

- Future price expectations. An expected future increase in the price of the commodity by the producers reduces the current supply of the commodity. This is because they expect to sell at a higher price and earn more profits in future. But an expected future fall in the price increases the current supply of the commodity. This is because the producers want to avoid making losses by selling at lower prices in future

Change in quantity supplied

This refers to the increase or decrease in the quantity supplied of a commodity due to change in its price keeping other factors constant. It involves the movement along the supply curve.

- The movement downwards the supply curve is called a contraction (decrease in quantity supplied). It is brought about by the fall in price of a commodity keeping other factors constant.

- An upward movement along the supply curve is called an expansion (increase in quantity supplied). It is brought about by increase in the price of the commodity keeping other factors constant

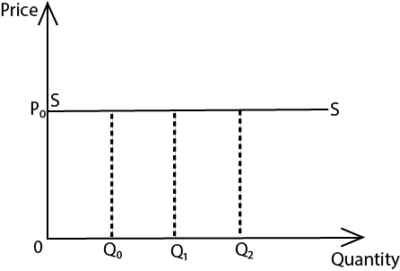

Change in supply

Change in supply refers to an increase or decrease in supply due to changes in other factors affecting supply of the commodity at a constant price. OR. It refers to a shift in the supply curve brought about by the changes in other factors affecting supply at constant price of a commodity.

- A shift in the supply curve from S0 to S1 is called a decrease in supply, It refers to the shift in the supply curve to the left caused by the unfavorable factors which affect supply at a constant

- A shift in the supply curve from S0 to S2 is called a increase in supply, It refers to the shift in the supply curve to the left caused by the favorable factors which affect supply at a constant

Types of Supply

- Competitive supply. This is where the supply of one commodity leads to a reduction in the supply of another commodity. For example increasing the supply of beef at the expense of milk.

- Complementary (Joint) supply. This refers to the situation where the commodities are supplied together. That is, the supply of one commodity automatically leads to the supply of another e.g. beef and hides, mutton and wool.

Regressive (Abnormal/Exceptional) supply curve

A regressive supply curve is one which violates (disobeys) the law of supply which states that “the higher the price, the higher the quantity supplied and the lower the price, the lower the quantity supplied keeping other factors constant”. It does not slope upwards from left to right.

Examples of regressive supply curves

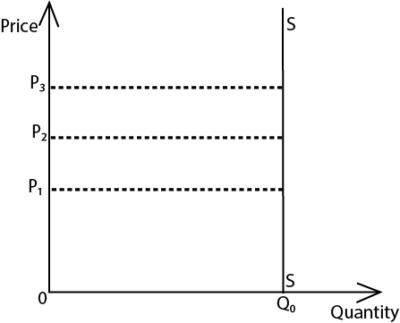

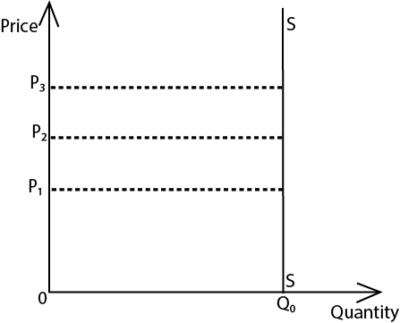

- Fixed supply curve of land in short run

From the graph above, an increase in price from OP1 to OP2 does not lead to an increase in the quantity of land supplied; that is; despite the increase in price, the quantity supplied remains constant at OQ0

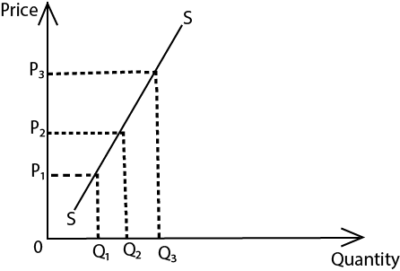

- Supply curve for labour

From the graph, ABC is the backward bending labour supply curve, When the wage increases from OP1 to OP2 labour supply increases from OQ1 to 0Q2, After point B, the wage increase from OP2 to OP3 leads to a reduction labour supply from OQ2 to OQ3

This regressive labour supply curve is due to the following factors;

- Presence of target workers. These are workers who work only to fulfill their targets or objectives after which they abandon work or decide to work for fewer hours. This violates the law of supply.

- High preference for leisure. As workers earn more wages, they prefer leisure to work and therefore they end up working for fewer hours.

- Decline in the real wage of workers due to high levels of inflation .This forces workers to work for fewer hours.

- Use of progressive taxation by the government. That is where the tax rate increases as the income of the tax payer These discourage hard work for high wage earners and are forced to work for fewer hours so as to earn a lower wage and pay fewer taxes.

- Speculative supply. When prices are expected to increase in future, sellers or producers put less on market even if prices are slightly increasing. This is because they are expecting to get a lot of profits in future at very high prices. ‘

- Supply of perishable goods. For perishables, more is supplied (put on the market) immediately after harvest. Therefore even if prices are low or decreasing, more is supplied hence violating the law of supply.

- Existence of Catastrophic periods. In such periods, supply may not increase even if prices are increasing due to scarcity of commodities.

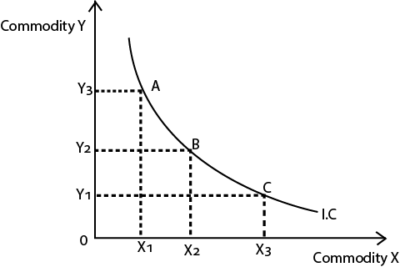

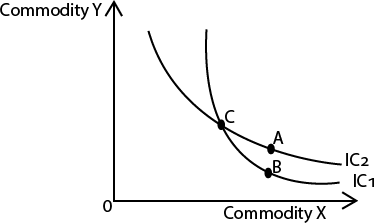

Market equilibrium

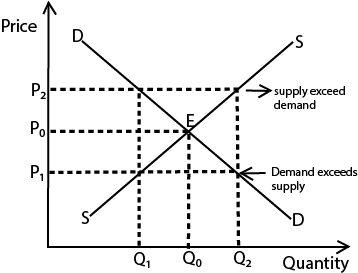

In a competitive market, the market is in equilibrium when quantity demanded equals quantity supplied. This is graphically illustrated as shown below

- At high price OP2 supply exceeds demand and therefore a surplus of Q0Q2 is When supply is in excess, the producers decrease the price in order to sell the surplus (excess) and in the process equilibrium is restored in the market at point E.

- At lower price OP1, quantity demanded exceeds quantity supplied therefore a shortage Q1Q0 is created which forces the producer (seller) to increase the price until the equilibrium point is attained at point E.

Note

- Market price refers to the prevailing (ruling) price in the market at a given time. Market price is any price determined by the buyers and sellers in the market irrespective of whether quantity demanded is equal to quantity supplied at a given.

- Equilibrium price refers to the market price where quantity demanded is equal to quantity supplied.

- Normal (natural) price refers to the long run equilibrium price established in the market after a long period of price fluctuations.

- Reserve price refers to the minimum price set by the seller below which he is not willing to sell his commodity.

- Reserve wage refers to the minimum wage set by a worker below he is not willing to work/offer services.

Factors affecting/Determinants of Reserve price

- Degree of durability of the commodity. The higher the degree of durability of the commodity, the higher the reserve price and the more perishable the commodity is the lower the reserve price.

- Cost of production. The higher the costs of production, the higher the reserve price and the lower the cost of production, the reserve price.

- Degree of liquidity preference. Liquidity preference refers to the extent to which individuals prefer to hold their wealth in cash or near cash form instead of investing it in alternative assets. The higher the level of liquidity preference, the lower the reserve price and the lower the level of liquidity preference, the higher the reserve price.

- Future price expectations. When the seller expects the price to increase in future, he fixes a high reserve price but when the seller expects the price to fall in future, he fixes a lower reserve price.

- Degree of necessity of the commodity. The higher the degree of necessity, the lower the reserve price and the lower the degree of necessity, the higher the reserve price.

- Quality of the commodity. The higher the quality of the commodity, the higher the reserve price and the lower the quality of the commodity, the lower the reserve price.

- Level of storage expenses. The higher the storage expenses, the lower reserve price and the lower the storage expenses, the higher the reserve price.

Importance (uses) of prices in the economy

- Price acts as a signal for shortages and surpluses which help firms to determines what to produce and how to produce it

- Determines the value of goods and services.

- High prices act as incentives to increased supply of goods and services and economic growth

- Guides producers on what techniques to use i.e. technology to use

- Helps consumer in making consumption plan

- Determines peoples income distribution, the price mechanism is a system of real flows from producers to consumers and from consumers to producers

- Ensures efficient utilization of resources; the factors of production (land, labour, capital) will be used for their most valuable purposes.

- High prices is an incentive for improvement on quality of the product

- Prices help to redistribute resources from goods with little demand to goods and services which people value more.

- Income distribution in the economy is determined by price mechanism. High incomes or revenues go to those expensive goods.

- Distribution of goods and services; the price mechanism determines the products are for. Goods and services are normally produced for those to can pay high prices

- Where to produce commodities from is determined by price mechanism. Production units tend to be located in places where there is demand for the products

- Price mechanisms determines when to produce; goods are produced when their demand is higher to ensure profit maximization

- . They help in the automatic adjustment of demand and supply for example when prices increase, quantity demanded reduces and supply increases.

The theory of elasticity

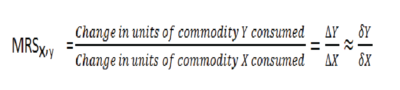

Elasticity is the measure of degree of responsiveness of dependent variable due to changes (variations) in the independent variable(s).

In the theory of demand and supply, quantity supplied and quantity demanded are said to be dependent variables while their determinants like price of the commodity are said to be independent variables.

There are two broad categories of elasticity. These include: .

1) Elasticity of demand

2) Elasticity of supply

Elasticity of demand

This is the measure of degree of responsiveness of quantity demanded due to changes in the factors which influence quantity demanded.

Types of Elasticity of demand

(a) Price elasticity of demand

(b) Point elasticity of demand

(c) Arc elasticity of demand

(d) Cross elasticity of demand

(e) Income elasticity of demand

Price elasticity of demand

This is the measure of the degree of responsiveness of quantity demanded due to changes in the price of the commodity.

![]()

The negative is multiplied in the formula because of the negative relationship between quantity demanded and the price of the commodity.

Examples 1

A change in price form 10/= to 15/= lead to a reduction in quantity from 24 to 20. Calculate price elasticity of demand

Example 2

A 20% change in price of a commodity led to a fall in quantity demanded of the commodity from 40 to 20 units. Calculate price elasticity of demand.

Interpreting price elasticity of demand

(a) Perfectly inelastic demand (EP= 0). This is when price elasticity of demand equals to zero. Here the quantity demanded does not respond to changes in price at all.

From the graph a change in price from OP1 to OP2 to OP2 leaves quantity demanded unchanged at 0Q0.

(b) Inelastic demand (0 < Ep<1)

In this case, the price elasticity of demand is greater than zero but less than one. A big proportionate change in price leads to a smaller percentage change in quantity demanded.

(c) Unitary elasticity of demand

In this case, the price elasticity of demand equals to one. The percentage change in quantity demanded equals to the percentage change in price. It is illustrated by a rectangular hyperbola.

(c) Elasticity of demand (1 < Ep < ꝏ)

In this case, the price elasticity of demand is greater than one but less than infinity or is between one and infinity. A big percentage change in quantity demanded is due to a small percentage change in price

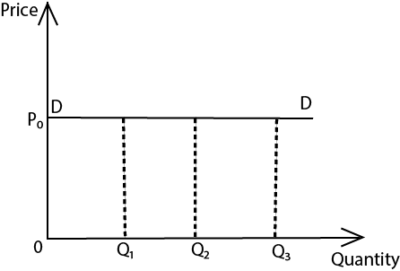

(e) Perfectly elastic demand (Ep = ꝏ)

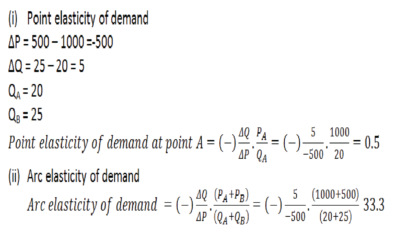

Point elasticity of demand

This measures the elasticity of demand at a particular point on the demand curve. It is given by the formula

![]()

Arc elasticity of demand

This is a measure of elasticity of demand between two points on the demand curve. It is given by the formula

![]()

Given two points A and B along the same demand curve

Example 3

Given the graph below

Calculate

This is the measure of the degree of responsiveness of quantity demanded of commodity (Y) due to the changes in the price of a related commodity (X). It is given by the ration of the percentage change in the quantity demanded of commodity (Y) to the percentage change in price of related commodity (X).

![]()

Interpretation of cross elasticity of demand

- If XED > 0 (positive): it implies that the commodities are substitute. An increase in the price of one of the commodity leads to an increase in to an increase in the quantity demanded of the other commodity. For example blue band and butter.

- If XED < 0 (negative): it means that the commodities are compliments. Increase in the price of one commodity leads to a decrease in the quantity demanded of the other commodity. For example a car and petrol.

- If XED = 0: it implies that the commodities are nonrelated. A change in price of one commodity has no effect on the quantity demanded of the other commodity.

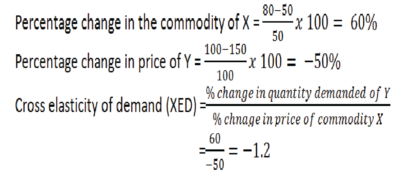

Example 4

An increase in the quantity demanded of commodity X from 50 units to 80 units was due to the fall in price of commodity Y from 100/= to 150/=.

(i) Calculate the cross elasticity of demand of commodity X and Y.

(ii) State the nature of commodities X and Y

The two commodities are complements

(iii) Suggest two examples of X and Y

Camera and film; car and petrol, shoes and shoe polish

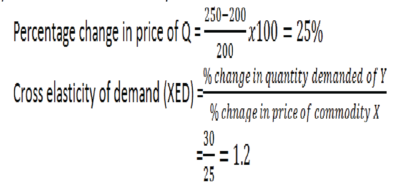

Example 5

A 30% increase in the quantity of commodity P is due to an increase in price of commodity Q from 200/= to 250/=

(i) Calculate the cross elasticity of demand of commodities P and Q

(ii) State the nature of commodities P and Q

The two commodities P and Q are substitute

(iii) Give two examples of commodities P and Q

Kakira Sugar and Kinyara sugar, Samona baby jelly and Sleeping baby jelly, Omo and Nomi, Colgate tooth paste and Closeup tooth paste.

Income elasticity of demand

Income elasticity of demand is the degree of responsiveness of demand of a commodity due to a change in Consumer’s income.

It is obtained as a ratio of the percentage change in the quantity demanded of a commodity to the percentage change in the customer’s income

Interpretation of Income elasticity of demand

- If YED > 0 (positive): the commodity is a normal good. The demand for normal good increase as the consumer’s income increase.

- If YED < 0 (negative): the commodity is an inferior good. The demand for an inferior good reduces as the consumer’s income increases.

- If YED = 0: the commodity is a pure necessity. The increase in consumer’s income has no effect on the quantity demanded for a pure necessity such as salt.

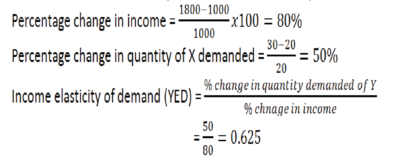

Example 6

An increase in the consumer’s income from 1000/= to 1800/= led to an increase in the quantity demanded of commodity X from 20 to 30.

(i) Calculate the income elasticity of demand for commodity X.

(ii) What is the nature of commodity X

Commodity X is normal good

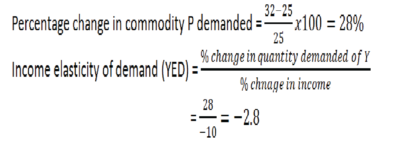

Example 7

A 10% decrease in consumers income led to an increase in quantity demanded of commodity P from 25 to 32.

(i) Calculate the income elasticity of demand of commodity P

(ii) State the nature of commodity P

P is an inferior good

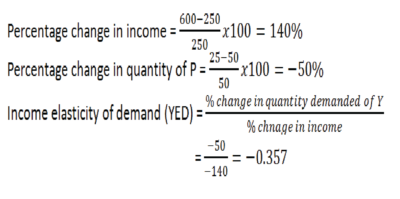

Example 8

| Income | Quantity demanded of commodity P |

| 250 | 50 |

| 600 | 25 |

(i) Calculate the income elasticity of demand of commodity P

(ii) What is the nature of commodity P

P is an inferior good

Determinants of price elasticity of demand

- Level of consumers’ income. The higher the level of consumers’ income, the lower the elasticity of demand (inelastic) and the lower the level of income, the higher the elasticity of demand (elastic).

- Degree of necessity of the commodity. The higher the degree of necessity of the commodity likes salt, the lower the elasticity of demand (inelastic) while the lower the degree of necessity of the commodity the higher the elasticity of demand (elastic).

- Degree of availability of substitutes. The demand for a commodity with many substitutes tends to be elastic while the demand for a commodity with few or no substitutes tends to be inelastic.

- The cost of the commodity. The demand for the commodity that takes a small proportion of the consumers’ income tends to be inelastic. For example elasticity of demand for a match box. On the other hand, the demand for a commodity that takes a large proportion of consumers’ income tends to be elastic.

- Habit (addiction) in the consumption of the commodity. The demand for the commodity for which the consumer is addicted to tends to be inelastic for example a consumer who is addicted to the consumption of cigarettes. On the other hand, the demand for the commodity for which the consumer is not addicted to tends to be elastic

- Number of uses of the commodity. The demand for the commodity that has many uses “tends to be elastic. For example, if the unit price of electricity increases, consumers use less of it for only vital purposes for lighting: On the other hand, the demand for the commodity that has few uses tends to be inelastic.

- Degree of durability of the commodity. The demand for a durable commodity tends to be inelastic. This is because even if the price of such a commodity falls, the consumer may not demand more of that commodity because he already has that commodity. On the other hand, the demand for a perishable commodity tends to be elastic.

- Level of advertisement for the commodity. The demand for a commodity that is highly advertised tends to be inelastic but the demand for the commodity that is not highly advertised tends to be elastic.

- Future price expectations. The demand for the commodity whose price is expected to decrease in future makes its current demand to be elastic but the demand for the commodity whose price is expected to increase in future makes its current demand to be inelastic.

- The demand for a commodity whose use can be postponed. The demand for the commodity whose use can be postponed to a future date tends to be elastic but the demand for the commodity whose use cannot be postponed tends to be inelastic.

- Time period. In the short run, the demand for the commodity may be elastic because the consumers are not yet used to the new product on the market while in the long run the demand for such a commodity may be inelastic after the consumers getting used to the product.

- Level of consumers’ ignorance. Consumers may buy commodities at a high price when they do not know where such commodities or their substitutes are sold. Consumers may also mistake the increase in the price to be a result of increase in the quality of products which may not be the case. Consumers’ ignorance therefore leads to low elasticity of demand of commodities.

- Degree of convenience in obtaining the commodity. The higher the level of convenience, the lower the elasticity of demand and the lower the level of convenience, the higher the elasticity of demand.

Practical application of price elasticity of demand to consumer

- It helps in determining incidence of tax. For goods whose demand is elastic, the burden is borne by the producer and for those whose demand is inelastic; the burden is borne by the consumer.

- It is used to determine the expenditure of the consumers. Consumers spend more on commodities whose demand is inelastic such as soap and spend lend less on commodities whose demand is elastic

- Protection and subsidization. The government has a duty to protect its citizens from over exploitation by giving subsidies to essential commodities such as drugs and maintenance of roads.

Practical application of price elasticity of demand to Producers

- It helps a producer in determining prices for his commodities. If a commodity has elastic demand, the producer will reduce the price and charge high price for a commodity that has inelastic demand

- It helps the producer in determining wages of his workers. Workers whose demand is inelastic are paid more than those whose demand is elastic

- It helps monopolists in price discrimination. A monopolist will charge high price for same for commodity where prices are inelastic and less price are elastic price.

- It helps a producer to determine advertisement costs. If a commodity has inelastic demand, the producer tends to spend less on advertisement and spends more on advertisement of commodities that have elastic demand because of stiff competition.

- In the Determination of Output Level: For making production profitable, it is essential that the quantity of goods and services should be produced corresponding to the demand for that product. Since the changes in demand is due to the change in price, the knowledge of elasticity of demand is necessary for determining the output level

- In Demand Forecasting: The elasticity of demand is the basis of demand forecasting. The knowledge of income elasticity is essential for demand forecasting of producible goods in future. Long- term production planning and management depend more on the income elasticity because management can know the effect of changing income levels on the demand for his product.

- Making decisions on what to produce. A businessman chooses the optimum product- mix on the basis of price elasticity of demand for various products. The products having more elastic demand are preferred by the businessmen. The sale of such products can be increased with a little reduction in their prices.

- Shifting of tax burden:e. if the demand is inelastic the larger part of the indirect tax can be shifted upon buyers by increasing price. On the other hand if the demand is elastic the burden of tax will be more on the producer

- Wage discrimination; worker who have elastic demand such as causal workers are paid less than workers with inelastic demand such as doctors.

Practical application of price elasticity of demand to government

- Helps government to regulate prices. I.e. In order to protect the interest of consumers’ government fixes the maximum price of the commodity with inelastic demands and those for export.

- Can be used by government to determine taxes on commodities. Government can impose higher taxes on goods with inelastic demand whereas low rates of taxes imposed on commodities with elastic demand

- It helps government in currency devaluation. The government can devalue it currency if her imports and exports have elastic demand and supply such that as the prices of imports increase, quantity of imports reduce and as prices of exports reduce the volume of export increase.

- The concept of elasticity of demand enables the Government to decide as to which industry should be declared as public utility and consequently owned and controlled by the state. The products like electricity, gas, water, transportation, etc. have inelastic demand to avoid high prices to the nationals.

- Protection and subsidization. It helps the government in giving subsidies to producers. The producers whose products have elastic demand seek more protection and assistance from the government because they are unable to face strong competition whereas produce whose products have inelastic demand will get fewer subsidies from government.

- Wage policy. This helps the government when establishing wages of its workers. Workers with inelastic demand such as Doctors are paid more than those that have elastic demand are paid less e.g. office messengers, cleaners, drivers

- Gain in international Trade: The ‘terms of trade’ can be determined by measuring elasticity of demand in two countries for each other’s goods. In international trade, a country earns more profits by importing the commodities, which have high elastic demand and exporting the ones, which have relatively less elasticity.

- It applicable under the tariff policy. A tariff is a tax imposed on exports and imports of the country. Tariffs are imposed on imports with the aim of discouraging their importation and local consumption. Such a policy is only successful when the price elasticity of demand for imports is elastic.

- This measurement can be useful in predicting consumer behavior as well as forecasting major events, such as an economic recession or recovery.

- To address Paradox of poverty amidst plenty. Government can stabilize the prices of agricultural goods by following a policy of price support program in the event of increased production.

- To regulate consumption of harmful goods by high taxation.

- To reduce inflation. Government can levy taxes on products with inelastic demand to withdraw money from circulation

Elasticity of supply

Elasticity of supply refers to the degree of responsiveness of quantity supplied due to changes in the factors which influence supply

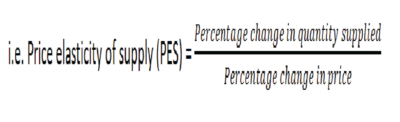

Price elasticity of supply is the measure of the degree of the responsiveness in quantity supplied due to changes in the price of commodity supplied

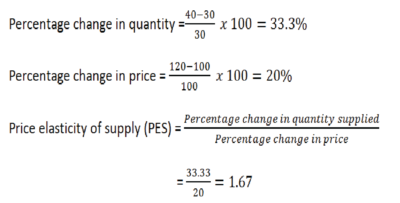

Example 8

An increase in the price of sugar from 100/= to 120/= per kilogram lead to an increase in the quantity supplied of sugar from 30kg to 40kg. Calculate the price elasticity of supply.

Solution

Example 9

An increase in the price of commodity by 40% causes an increase in quantity supplied of sugar from 200kg to 250kg. Calculate price elasticity of supply.

Solution

Interpretation of price elasticity of supply

(a)Perfectly inelastic supply (Es= 0).

In this case, quantity supplied does not respond to changes in price. For example the supply of agricultural products in short runs.

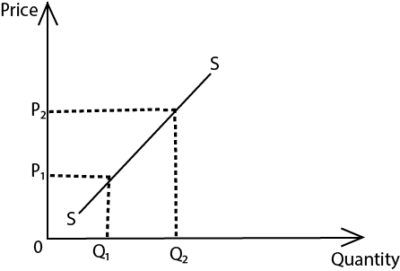

(b) Inelastic supply (EP= 0 < Es < 1).

In this case, a big proportionate change in price leads to a small proportionate change in quantity supplied

(c) Unitary supply (Es = 1)

In this case, a percentage change in price leads to an equal percentage change in quantity supplied

(d) Elastic supply

In this case, a small percentage change in price leads to a big percentage change in the quantity supplied.

(e) Perfectly elastic supply

In this case, at constant price, quantity supplied increases. This situation is not applicable in the real world.

Determinants of Price Elasticity of supply

- Cost of production. The higher the cost of production, the more inelastic the supply of the commodity and the lower the cost of production; the higher the elasticity of supply.

- Gestation period (Length of the production process). The longer the gestation period, the lower the elasticity of supply and the shorter the gestation period, the higher the elasticity of supply.

- Level of technology. The higher the level of technology e.g., use of modem techniques of production the higher the elasticity of supply while the lower the level of technology (use of inelastic production techniques) the lower the elasticity of supply

- Degree of availability of factor inputs. The supply of the commodity whose factor inputs are readily available tends to be elastic but the supply of the commodity whose inputs are scarce tends to be inelastic.

- Degree of entity of firms in the production process. Free entry of firms in the production process increases the number of producers of the product hence elastic supply while restricted entry of firms in the production process leads to inelastic supply e.g., the case of a monopolist.

- Degree of factor mobility. Factor mobility refers to the ease with which a factor of production be changed from one occupation/geographical location to another. Highly mobile factors of production make the supply of the commodity elastic while immobile factors of production make supply inelastic.

- Government policy of taxation. High taxes imposed by the government on producers increase the cost of production hence inelastic supply. However subsidization of producers by the government reduces the cost of production hence elastic supply.

- Price expectation. An expected future price fall by the producer relative to the current prices makes the current supply of the commodity elastic. But the expected future price increase by the producer relative to the current prices makes the current supply inelastic.

- The nature of the product (commodity). Durable commodities have elastic supply. This is because they can be stored for a long time and any increase in price is accompanied by an increase in price. On the other hand, perishable commodities have inelastic supply because they cannot be stored for a long time such that if there is an increase in price nothing can be supplied.

- Objectives of the firm. A firm whose objective is to maximize sales is associated with elastic supply of the commodity while a firm whose objective is to maximize profits, the supply of the commodity tends to be inelastic.

- Time. This can be short run or long run. In the long run supply becomes elastic since producers have enough time to vary (change) the factors of production so as to increase output but in the short run, supply is inelastic because it is difficult to change the fixed factors of production in order to increase supply.

Price discrimination

Price discrimination is the process (practice) of selling the same commodity to different consumers at different prices by the same seller in a given period of time, for reasons not associated with costs. For example prices of entertainment tickets at different costs for public and students or children and adults.

Conditions necessary for price is discrimination succeed

- The commodity should not have close substitute.

- Businesses must prevent resale. Prevention of re-sale could be enforced in many different ways. For example students can only receive student discounts with a legitimate student ID, children can easily be identified from adults.

- The market in question must be geographically distant /spatially separated in case of seats for football or entertainment such that it is easy for monopolist to charge different prices in the different market places or transfer of goods from one market to another is difficult

- There should be different elasticity of demand in the different markets.

- Ignorance among customers about other markets

- The seller or producer must be a monopolist or the market must be imperfect.

- Personal services that can be resold or transferred e.g. medical Doctor, teacher, entertainment etc.

- Product differentiation; artificial differences made on similar products by a way of branding, trademarks.

- Low transport costs also lead to monopoly power in that goods can be transferred from one market to another without affecting their prices.

- No government interference

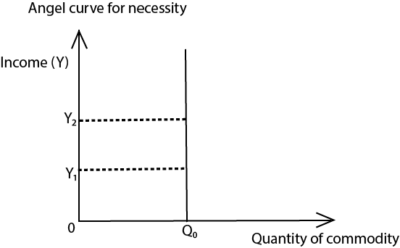

Engel curves

Engel curve describes how household expenditure on a particular good or service varies with household income

Angel curve for normal good

Quantity demanded for the commodity increases as household income increase

Angel curve for inferior good

Quantity demanded for the commodity decreases as household income increase

Angel curve for necessity

Quantity demanded for the commodity remains unchanged as household income change

Revision questions

Section A questions

1 (a) Distinguish between competitive demand and joint demand

(b) Give two examples of competitive demand

2 (a) Distinguish between market price and equilibrium price

(b) Outline any two methods of price determination in an economy

3 (a) Distinguish between normal price and Reserve price

(b) State any two determinants of Reserve price

4 (a) what is meant by the angel curve

(b) Graphically illustrate the angel curves for normal, necessity and inferior goods.

5 (a) Explain the concept of regressive demand curve.

(b) Outline any three examples of regressive demand curves.

6 Give four circumstances under which the demand for a commodity may not fall despite a rise in its price.

7 With illustrations, explain the effects of a change in supply on the equilibrium price and quantity at constant demand of the commodity.

8 Give any four circumstances under which a consumer may buy more of a commodity when its price increases.

9 (a) What is meant by resale price maintenance

(b) Give any three advantages of resale price maintenance

10 (a) What is meant by a regressive supply curve

(b) Give any three reasons why the labour supply curve may be regressive

11 An increase in income of the consumer from 10,000/= to 30,000/= led to a decrease in quantity demanded of commodity x from 50kgs to 20kgs.

(a) Calculate the income elasticity of demand for commodity X

(b) What type of commodity is X

12 (a) Distinguish between income elasticity of demand and price elasticity of demand

(b) An increase in the consumer’s income from 50,000/= to 60,000/= led to an increase in quantity demanded of commodity X by 10%. Calculate the income elasticity of demand for commodity X

13 Given that the price of commodity Y decreased from 15,000/= to 10,000/= and the quantity demanded of a related commodity Z increased from 200,000kgs to 600,000kgs, calculate the cross elasticity of demand for commodity Z. State the consumption relationship between the two commodities

14 (a) Distinguish between price elasticity of demand and cross elasticity of demand

(b) Quantity demanded of commodity X increased by 50% due to a fall in commodity price by 25%. Determine the value and nature of price elasticity of demand for commodity X

15 Calculate the cross elasticity of demand, if the price of the commodity A declined by 20% and quantity demanded of commodity B increased from 20 to 30units. How are commodities A and B related?

16 Explain in details the following concepts;

(a) Price elastic demand

(b) Price inelastic demand

(c) Price elasticity of supply

- Use the table below to answer the questions that follow

| Year | Income | Commodity X | Commodity Y | Commodity Z |

| 2020 | 40000 | 100 | 60 | 200 |

| 2023 | 80000 | 100 | 30 | 2500 |

(a) Calculate the income elasticity of demand of each commodity from 2000 to 200 1.

(b) What type of goods are X, Y and Z.

18 Study the table below and answer the questions that follow;

| Position | Price | Quantity demanded | |

| Original position | A | 40 | 400 |

| New position | B | 80 | 150 |

(a) What is the movement from A to B called?

(b) Determine the value of price elasticity of demand for commodity

19 Use graphs to illustrate;

(a) an increase in supply at constant demand.

(b) an increase in demand at constant demand.

20 with the help of the graph distinguish between “Extension in demand” and” Contraction in demand”

21 Given that quantity demanded is Qd =36- 4P and quantity supplied is Q. =-12+12P find the equilibrium price and quantity.

Section B questions

1 (a) How are prices determined in your country

(b) Examine the factors that influence quantity of a commodity demanded in an economy.

2 (a) Distinguish between a contraction in demand and an extension in demand

(b) Explain the factors that may lead to a decline in demand for a commodity.

3 (a) Distinguish between change in supply and change in quantity supplied (Use graphs to illustrate)

(b) Explain the factors which influence the supply of commodities in your country.

4 (a) Explain why demand curve slopes downwards from left to right

(b) Explain the circumstances under which the law of demand may be violated.

5 (a) Explain the causes of high price elasticity of demand for commodities in an economy

(b) What are the practical applications of the concept of price elasticity of demand?

6 (a) Distinguish between a change in supply and change in quantity supplied

(b) Explain that factors that influence the elasticity of supply for the commodity in an economy

7 (a) Under what circumstances may the law of supply be violated

(b) Under what circumstances may the elasticity of demand for a commodity be price inelastic?

8 (a) Distinguish between Arc elasticity of demand and point elasticity of demand …

(b) Explain the determinants of elasticity of demand for the commodity in an economy.

9 (a) Explain why people tend to buy more of a commodity when its price falls.

(b) What are the exceptions to tins phenomenon?

Consumers’ surplus and producer’s surplus

Consumers’ Surplus

This refers to the difference between what the consumer is willing and able to pay for the commodity and what he actually pays, whereby what he actually pays is less than what the consumer is willing to pay.

From the graph, consumer surplus is the shaded area below the demand curve and above the equilibrium price

Consumer surplus = total utility – actual expenditure

Example 10

Given the demand schedule

| Price | 1000 | 750 | 500 | 400 | 300 | 250 |

| Quantity demanded | 1 | 2 | 3 | 4 | 5 | 6 |

Calculate the consumer surplus if equilibrium price is 400/=

Solution

Total utility = (1000 x 1) + (750 x(2- 1)) + (500 x (3-2)) + (400 x (4-3))

= (1000 x 1) + (750 x 1) + (500 x 1) + (400 x 1)

= 1000 + 750+ 500 +400 = 2650/=

Actual expenditure = 400 x 4 = 1600/=

Consumer surplus = 2650 – 1600 = 1050/=

Example 11

| Price | 1000 | 750 | 500 | 400 | 300 | 250 |

| Quantity demanded | 4 | 6 | 9 | 13 | 14 | 18 |

Calculate the consumer surplus if equilibrium price is 500

Total utility = 1000 x 4 + 750 x (6 – 4) + 500 x (9 – 6)

= 1000 x 4 + 750 x 2 + 500 x 3

= 4000 + 1500 + 1500 = 7000/=

Actual expenditure = 500 x 9 = 4500/=

Consumer surplus = 7000 – 4500= 2500/=

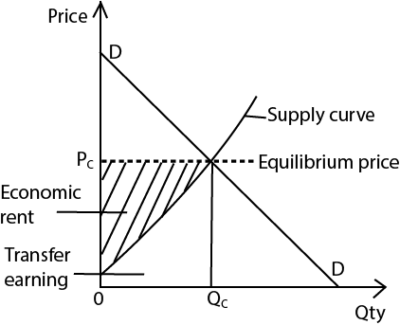

Producer surplus

Producer surplus is the difference between what the producer is willing to charge and what he actually charges for the commodity when what he actually charges is higher than what he is willing to charge.

Graphically Producer surplus is represented by the shaded area above the supply curve but below the equilibrium price.

Producer surplus = actual revenue – willingness to accept

Example 12

Given the supply schedule below

| Price | 50 | 60 | 80 | 100 | 140 | 200 |

| Quantity demanded | 1 | 2 | 3 | 4 | 5 | 6 |

Taking 100/= to be the equilibrium price, calculate the producer surplus

Solution

Actual revenue = equilibrium price x equilibrium quantity

= 100 x 4 = 400/=

Willingness to accept = (50x 1) + (60 x 1) + (80 x 1) + 100 x 1 = 290/=

Producer surplus = 400 – 290 = 110/=

Transfer earning (supply price) and economic rent

Transfer earning (supply price) is the minimum reward (payment) given to a factor of production in order to maintain its current employment (occupation)

Or

Supply price is the opportunity cost of keeping a factor of production in its current occupation

Economic rent is the payment to a factor of production over and above its supply price

Actual earnings = Transfer earning + economic rent

Example 13

Given that the transfer earnings for a factor of production is 3 times the economic rent and economic rent is 100/=.calculate the actual earnings for the factor of production.

Transfer earnings = 3 x 100 = 300/=

Actual earning = 300 + 100 = 400/=

Example 14

Given that the supply price of a worker is 5000/= and the actual payment is 7500/=. Calculate the level of economic rent.

Economic rent = actual payment – supply price

= 7500 – 5000 = 2500/=

Types of economic rent

- Quasi rent. This refers to the payment to a factor of production over and above its transfer earnings whose supply is inelastic in the short run but elastic in the long run. For example the supply of engineers and doctors. The supply of doctors is inelastic in the short run but elastic in the long run.

- Commercial rent. This refers to the hire price for a durable asset, for example rent paid for hiring a building.

Determinants of Economic rent

- Degree of specificity of the factor of production. The higher the degree of specificity of a factor of production, the lower the economic rent and the lower the degree of specificity of a factor of production, the higher the economic rent.

- Level of demand for a factor of production. The higher the demand for a factor of production, the higher the economic rent and the lower the demand for a factor of production the lower the economic rent.

- Degree of substitutability of a factor of production. The higher the degree of substitutability of a factor of production, the lower the economic rent and the lower the degree of substitutability of a factor of production, the higher the economic rent.

- Elasticity of demand for a factor of production. The higher the elasticity of demand, the higher the economic rent and the lower the elasticity of demand, the lower the economic rent

- Elasticity of supply of a factor of production. The higher the elasticity of supply, the lower the economic rent and the lower the elasticity of supply, the higher the economic rent.

Price mechanism (invisible hand)

Price mechanism is a system under the free enterprise economy where resource allocation and prices are determined by the market forces of demand and supply.

Assumptions of Price mechanism

- Consumers aim at utility maximization.

- There is no government interference (intervention) in resource allocation.

- Producers aim at profit maximization.

- There are many buyers and sellers of the same commodity

- It assumes that incomes are equally distributed and therefore individuals have the same purchasing power.

Advantages (Merits) of Price mechanism

- Increases variety of goods and service

- Encourages hard work

- It increases efficiency in resource allocation. Under price mechanism, the major aim of producers is profit maximization. This minimizes resource wastage.

- Price mechanism encourages competition in production. This leads to the production of better quality goods and services hence improved standards of living for consumers.

- The system facilitates the exploitation and utilization of resources in the economy. This increases the production of goods and services hence economic growth and development.

- It leads to the creation of more employment opportunities. The high profits made by producers are used to expand business activities hence creating more employment

- It promotes consumer sovereignty. Consumer sovereignty refers to the situation under the free enterprise economy where the consumer has the freedom to determine what to be produced in the economy by buying more of a particular commodity (casting a vote). Producers allocate more resources in the production of a commodity which is highly bought in the market.

- It promotes research, inventions and innovations due to the high profits got by producers. This leads to improvement in the techniques of production.

- Price mechanism encourages speculation. Speculation refers to the buying of commodities in periods when they are in plenty and “cheap and selling them in periods when they are scarce and at high prices. This leads to price stability.

- It facilitates arbitrage. Arbitrage refers to me geographical transportation of commodities from areas where they are at low prices to areas where they are at high prices. This helps in redistribution of resources.

- Price mechanism does not require much administrative machinery since it is automatic. This lowers the cost of administration of the economy by the government.

- It encourages flexibility in production as producers can easily adjust the production activities due to changes in price.

- It facilitates income distribution. This is because incomes go to those people who own resources and are able to buy goods and services.

- It encourages the development of entrepreneurial skills in the economy. This is because it promotes individual initiatives and creativity in the economy.

Disadvantages (Demerits) of Price mechanism

- It promotes income inequalities. This is because the more resources you have, the more the income. Therefore people who do not have resources remain poor thereby widening the income gap.

- It leads to monopoly tendencies in the economy. This is because the large efficient firms (producers) may force the inefficient firms out of the production process through competition and as a result, they end up restricting output and charging high prices hence exploiting the consumers.

- This system does not cater for public goods which are collectively consumed and that are expensive to produce. For example security, roads etc. This is because such public goods are not profit making.

- It leads to unemployment. Producers aim at maximizing profits and minimizing costs and in the process, they end up using capital intensive production techniques which leads to technological unemployment. In addition, unemployment can also be due to inefficient firms being out competed from the production process and workers from such firms remain unemployed.

- It leads to fluctuation in incomes of sellers. Individuals selling umbrellas and rain coats, their incomes are high during the rainy season and Iow during the dry season which makes planning difficult.

- It promotes the production of socially harmful products. For example cocaine, marijuana, alcohol, cigarette if not restricted. This is because such commodities’ may be fetching high profits to the producers.

- The system undermines the provision of basic and cheap essential goods and services which are non-profit making. This is because the private individuals aim at venturing in activities in which they maximize profits.

- It leads to over exploitation of natural resources. Due to competition in production and lack of government control, the producers may want to produce more output hence over exploiting the resources.

- There is consumer’s ignorance due to market imperfections

- High competition is always wasteful as it leads to duplication of activities and excessive advertisement

- It leads to exploitation of the population

- It encourages speculation and gambling

- It makes government planning difficult

- Price mechanism fail to project future needs

- Excessive price fluctuations

- Failure to respond promptly to immergences such as war and catastrophes.

- does not cater for the unprivileged and vulnerable members of the society like the poor and disabled

Ways of reducing the defects of price mechanism

- Forming consumers’ association to educate and sensitize the consumers about the quality of commodities brought in the market. This helps to reduce on consumers’ ignorance.

- Taxing the rich and subsidizing the poor. This helps to reduce income inequalities through progressive taxation where the rich are taxed more than the poor. The standards of living of the poor can be improved.

- Using price controls by the government. Government can fix either the minimum or maximum price for the commodity as a way of regulating price fluctuations in the economy.

- Using anti-monopoly This is where the government demonopolises private monopolies by setting anti-monopoly laws which help to reduce consumer exploitation by private monopolists.

- Reducing on social cost. This is done by over taxing and issuing costly licenses in order to discourage producers from over exploiting natural resources.

- Subsidizing weak and small producers by the government. This enables such producers to remain in the production process and compete favorably with the big firms. This helps to reduce on unemployment caused by firms being out competed from the production process.

- There is need for proper planning to reflect structural changes, detect future needs of society and direct economic growth through government intervention.

Price controls (price administration)

This is the act of the government intervention in price mechanism by regulating the prices of goods services. In this case, the forces of demand and supply no longer determine the prices of commodities.

Types of price control

(a) Maximum price legislation (price ceiling)

(b) Minimum price legislation (price floor)

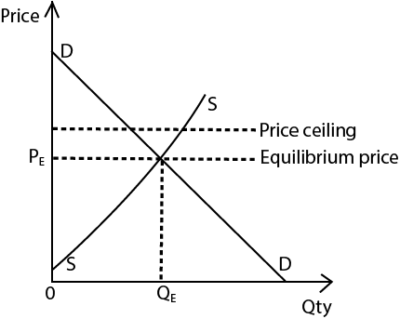

Maximum Price legislation (Price ceiling)

This is where the government fixes the price below the equilibrium price above which it is illegal to exchange a given commodity. It is fixed to favor the consumers especially in periods of scarcity.

Advantages (merits) of maximum Price legislation (price ceiling)

- It protects consumers from being exploited by monopolists who aim at maximizing profits by restricting output and charging high prices.

- It enables the low income earners to acquire necessities (essential) commodities especially during period of scarcity .This helps to improve on the standard of living of low income earners.

- It helps to ensure equal distribution of income. This is because it helps to reduce the profits of producers and expenditure by consumers.

- It helps to maintain price stability. This is because fixing the price below the equilibrium price helps to control inflation in the economy.

- Maximum price helps to discourage the production of harmful products. Examples of harmful products are alcohol, cigarette, pornographic materials etc. This is because when the government fixes a maximum price for such commodities it becomes uneconomical for producers to continue their production.

- 6. The government sets a maximum price to discourage the importation of expensive commodities and to encourage exports. This helps to increase on the foreign exchange earnings of the country.

- It helps to reduce the cost of labour in case a maximum wage is fixed for the employees. This helps to reduce the cost of production hence increase in the production of commodities.

Disadvantages (Demerits) of price ceiling

- It promotes excess capacity in production. Excess capacity refers to a state of underutilization of resources. This is because the maximum price set does not encourage producers to increase production so as to exploit more resources.

- It promotes black marketing and hoarding of commodities. In this case, producers are forced to sell a commodity at a price which violates the maximum price.

(a) Black market. This is a market which involves the illegal exchange of commodities at a price which violates the one set by the government.

(b) Hoarding. This refers to the situation where producers create artificial shortage of the commodity in the market so as to sell at a higher price.

- It encourages corruption and bribery in the process of exchange. This makes the low income earners to go without the commodity hence poor standard of living.

- It encourages exploitation of workers by employers. This is because the maximum wage fixed may be too low as compared to the work done by the employees.

- It reduces labour efficiency in case workers are given a very low maximum wage.

- It encourages smuggling of goods to neighboring countries where the prices are high as compared to the low domestic prices. This creates a shortage in the local markets.

- It is expensive to implement and supervise by the government in terms of administration costs to enforce price controls.

- It encourages strikes by workers in case the maximum wage fixed is very low.

- Leads to time wastage due to long queues to obtain the scarce commodity.

Minimum price legislation (Price Floor)

Minimum price legislation is where the government sets the price above the equilibrium price below which it is illegal to exchange a given commodity. It is fixed to protect producers from being exploited especially in periods of excess supply.

Advantages of minimum price legislation (Price Floor)

- It helps to protect the producers from being exploited by middlemen and consumers. This is in form of low prices given to producers especially for agricultural products.