Economic Chapter 13: International trade (foreign trade)

International trade

International trade refers to the exchange of commodities across the national boarders of the country.

OR

International trade refers to the exchange of commodities between residents of one country and those of other countries.

International trade can be visible or invisible trade.

Visible international trade refers to the exchange of goods between countries.

Invisible international trade refers to the exchange of services between countries for example tourism, electricity.

Foreign trade is divided into two forms

Bi-lateral trade is trade between two countries

Multi -lateral trade is trade among many countries,

Note.

If a country sells commodities to other countries, they are called exports. The activity is called export trade.

If a country buys commodities from another country, they are called imports and the activity is called import trade.

Why do countries carry out international trade?

- Differences in natural resource endowments. Different countries have different natural resource endowments in form of minerals, forests etc. Therefore there is need for counties to specialize and exchange in order to get what they do not have through international

- Lack of self-sufficiency in terms of goods and services. No country can satisfy all her needs therefore countries trade together in order to get what they cannot produce locally.

- Need for foreign exchange. There is need for international trade for countries to acquire foreign exchange which can be used for import purposes.

- Need to dispose of the surplus output. Some countries produce more than what they .can consume, therefore there is need to sell off the excess output to other countries in order to avoid resource wastage.

- Need for specialization. There is need for specialization among countries in the production and exportation of commodities that they can produce at lower costs than other countries and import commodities that they can produce at high cost hence international trade.

- Need to promote international relations among countries through international trade. In addition, some countries need international trade in order to further their political economic ideologies.

- Differences in tastes and preferences among citizens of different countries. Some citizens prefer imported better quality products to the poor domestically produced goods. Therefore there is need for international trade in order to acquire such products.

- Need to import modern technology and capital. Some countries have natural resources but lack enough capital and technology to exploit them. Therefore there’s need for international trade for such countries to acquire capital and technology to full utilize their resources.

- The vent for surplus theory of international trade. This theory states that opening up of world markets through international trade encourages the use of formerly idle resources in countries. This theory explains how international trade creates an out let for the use of some resource possessed by some countries for export purposes.

Principles (theories) of international trade

(a) The Principle of absolute advantage.

(b) The principle of comparative advantage

(a) The Principle (Theory) of Absolute advantage

This theory was advanced by Adam Smith. It states that given two countries producing two commodities using similar resources, a country should specialize in the production of the commodity where it can produce more units at less costs than the other country.

Example

| Country | Tons of cotton | Tons of coffee |

| Kenya | 10, 000 | 90,000 |

| Uganda | 50,000 | 100,000 |

From the table above, Uganda has absolute advantages in the production of both commodities. This is because given the same amount of resources, Uganda is able to produce more units of cotton and coffee than Kenya.

(b) The Principle (Theory) of Comparative advantage

- This principal states that given two countries producing two commodities using similar resources, a country should specialize in the production of a commodity where it incurs the least opportunity cost than the other.

- According to this theory, a country is said to have comparative advantage if it can produce commodity at a lower opportunity cost than the other country irrespective of the absolute advantage.

Example

| Country | tons of Cotton | Tons of Cofiee |

| Kenya | 4000 | 16,000 |

| Uganda | 10,000 | 20,000 |

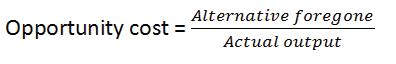

Opportunity cost of producing cotton

This means that to produce one unit of cotton, Uganda foregoes 2 units of coffee.

![]()

This means that to produce one unit of cotton, Kenya foregoes 4 units of coffee.

Therefore Ugandan should specialize in the production of cotton since it has a lower opportunity cost (2 tons of coffee) than Kenya (4 tons of coffee). This means that Uganda has comparative advantages in the production of cotton.

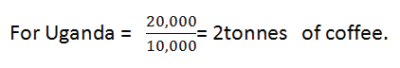

Opportunity cost of producing coffee

This means that to produce one unit of coffee, Uganda foregoes ½ units of cotton.

![]()

This means that to produce one unit of coffee, Kenya foregoes ¼ units of cotton.

Therefore Kenya should specialize in the production of coffee since it has a lower opportunity cost (¼ tons ) than Kenya (4 tons of coffee). This means that Uganda has comparative advantages in the production of cotton.

Assumptions of the theory of Comparative advantage

- It assumes only two countries participating in trade in the world.

- It assumes that each country produces only two commodities

- It assumes free trade that is international trade is free from trade barriers

- It assumes constant technology in the two countries.

- Is assumes absence of the law of diminishing returns such that there are no economies and diseconomies of scale.

- It assumes perfect mobility of factors of production within the country but perfect immobility of factors of production between the two countries.

- It assumes full employment of factors of production in the two countries that is there is no excess capacity.

- It assumes similar tastes and preferences in the two countries.

- It assumes existence of perfect competition in the international markets.

- It assumes barter system of exchange

- It assumes that labour is the only factor of production and all labour units are homogeneous in the two countries that is labour has the same efficiency and skills in the two countries.

- It assumes the same exchange rate for the two countries,

Weaknesses (Criticisms/Limitations) of the theory of comparative advantage

- The assumption that the world is composed of two countries is unrealistic. In the real world there are many countries producing a variety of commodities.

- Factors of production are not perfectly mobile as assumed by the theory. Some factors like land are highly immobile.

- It assumes free trade, yet in the real world, international trade is dominated by restrictions and other trade barriers in form of tariffs, quotas etc.

- The assumption that factors of production are equally efficient in two countries is unrealistic. This is because different factors of production have different efficiency and productivity between countries.

- It assumes constant technology, yet technology is constantly changing and this leads to changes in efficiency and comparative advantage.

- It assumes absence of diminishing returns, yet production in countries is characterized by the law of diminishing returns due to poor farming methods especially in the agricultural sector.

- The assumption that there are no transport costs in international trade is unrealistic. Transport costs do exist and they determine the nature and pattern of international trade.

- It is possible for two countries to have the same opportunity cost and in this case it is hard to determine which country should specialize in the production of a given commodity.

- The theory does not take account the need for diversification. Instead it encourages specialization which under mines the countries need for self-reliance and independent.

- The theory assumes perfect competition which does not exist in the real world.

- The theory assumes full employment or resources yet there are high rates of unemployment and under employment of resources in all countries.

Relevance (Applications) of the theory of comparative advantage

- The theory emphasizes specialization which forms the basis of international trade. This is because countries should specialize in the production of commodities where they have greatest comparative advantage over others.

- The theory is relevant in the process of bi-lateral trade. This is because it assumes countries which apply under this form of trade.

- The theory is applicable under economic (regional) integration where certain countries remove or eliminate certain trade barriers in order to encourage free trade in the integrated region.

- Due to differences in resource endowments, some countries have managed to produce commodities at lower costs than others and have become major suppliers to other countries basing on the theory of comparative advantage.

- The theory is relevant under barter trade between two countries where they exchange commodities for commodities basing on the law of comparative advantage. For example Uganda used to exchange beans for oil in the late 1870’s with Libya

- According to this theory countries have been able to acquire more goods and services from other countries which have ability to produce them more cheaply.

- The theory is relevant because it encourages market expansion which forms the basis of international trade.

The role of international trade in the development process

Advantages/Positive role/Arguments for international trade

- It encourages the exploitation and utilization of idle resources like land labour in the country through the vent for surplus theory. This is because the opening up of external market opens up the opportunity for the country to produce for export.

- It enables the country to earn foreign exchange from her exports. This foreign exchange is used for importation of capital and other manufactured goods from other countries which the country cannot produce.

- It promotes competition which leads to efficiency in production hence high quality products. This leads to more output and consumption at low prices hence improved standards of living.

- Market expansion. International trade widens the market for the countries product which leads to increased production hence economies of scale.

- Government revenue. It helps the government to earn revenue in form of export and import tariffs. Such revenue is used to construct social and economic infrastructure which is vital for economic development.

- It enables the countries to acquire a variety of commodities which they cannot produce locally. This improves and increases the choice of the people hence improved welfare.

- It helps the country to overcome shortages which can be caused by unforeseen circumstances for example drought, famine etc.

- It promotes specialization. Countries specialize in the production of commodities for which they have the resources and they can produce efficiently. This increases output of high quality hence economic growth and development.

- Creation of employment opportunities. This is as a result of increased resource exploitation, export and import activities, investments and market expansion resulting from international trade.

- Technology transfer. International trade promotes the movement of modem techniques, ideas, knowledge and skills especially to developing countries from developed countries. This promotes rapid economic growth and development.

- It encourages capital inflow from rich developed countries to poor countries in form of loans, grants, foreign capital investment. This leads to transformation of economies of developing countries.

- It promotes mutual understandings and diplomatic relations among countries. This enhances peace and economic stability among trading partners.

Demerits (Disadvantages/Arguments against/Negative role) of international trade

- Dumping problem. International trade encourages dumping which retards the development of local infant industries in the countries where the commodities are dumped.

Note. Dumping refers to the selling commodities in foreign markets at lower prices than the price charged in the domestic market.

- Increase in economic dependence and reduction in self-reliance. It encourages the dependence syndrome in countries most especially for developing countries which have to depend on imports from developed countries in form of consumer and capital goods.

- Imported inflation. It leads to imported inflation especially when imports are bought at higher prices from countries experiencing inflation.

- Balance of payment problems. It results into unfavorable balance of payments That is when the country spends more on imports than what it receives from exports. This is true for Uganda as it imports expensive manufactured goods and exports primary or agricultural products. .

- It worsens the terms of trade for the country when the import prices are higher than exported prices.

- It encourages the importation of dangerous and harmful products to the country in form of drugs, pornographic materials etc. Such products may adversely affect the country economically, culturally and socially

- Demonstration effect. International trade encourages demonstration effect where by local people tend to consume luxurious expensive commodities from foreign countries and neglect the domestically produced goods. This undermines the growth of local infant industries.

- It encourages brain drain. Brain drain refers to the massive movement of skilled labour from one country to another especially from developing, to developed countries. This leads to lack of skilled manpower in the developing countries.

- It leads to political instabilities especially in developing countries. This is because they import fire-arms and military hard ware from developed countries. This contributes to under development of developing countries.

- It perpetuates political ties and economic dominance by developed on to developing countries. In this case developing countries have to accept political and economic policies from developed countries which may not be in their line of development.

- It leads to under development and collapse of local infant industries as they are exposed to foreign competition in form of high quality imported commodities as compared to the locally produced domestic products. This undermines the countries need to industrialize.

- It acts as disincentive to work for the local people since they are assured of the supply of commodities from foreign countries in form of imports. This discourages production activities in the country.

- It promotes international inequalities where by developed countries benefit more as compared to developing countries. This is because developed countries produce and export expensive manufactured products while developed countries produce and export cheap primary products to developed countries.

Commercial policy

This refers to the set of rules and measures adopted by the country for the conduct and regulation of its foreign and domestic trade in order to achieve the desired economic objectives.

Objectives of the commercial policy

- To encourage exports and discourage imports in order to achieve favourable balance of payment position.

- To increase foreign exchange earnings in form of increased revenue from exports

- To increase government revenue through import and export duties.

- To increase employment opportunities.

- To encourage industrialization by protecting domestic infant industries.

- To encourage foreign investments and capital inflow inform of loans and grants

- To encourage and promote cooperation with other trading partners.

Tools (Instruments) of the Commercial policy

- Tariffs

- Quotas

- Exchange rate policy

- Trade agreements

- Economic integration

- Dumping

- State trading

- Export credit

Note. Beggar -my-neighbor policy refers to the measure adopted by the country to improve on its economic conditions but with adverse effects on economies of its trading partners, for example dumping.

Protectionism (trade barriers/restrictions)

- Protectionism refers to the measures employed by the government (country) to regulate international trade.

- Free trade occurs when there are no trade barriers in international trade.

Tools (Instruments) of Protectionism (Trade barriers)

- Tariffs. A tariff refers to the tax imposed on imports (import tariff) or exports (exports tariff) of the country. If the country wants to reduce imports, it increases import tariff (duties) and if the country wants to encourage exports, it reduces the export duties.

Tariffs can either be Advalorem or specific.

Advalorem tax. This refers to the tax imposed on commodities basing on their monetary value. For example 30% of the value of the imported commodity as a tax

Specific tax. This is the tax imposed on commodities basing on their quantities or units imported for example a tax of 500/= imposed on each unit of the commodity imported.

- Quotas. These are physical or quantitative restrictions on the amount of a commodity imported into or exported from the country in a given time. Import quotas restrict the amount of imports to the country and export quotas are restricts the amount of exports.

- Foreign exchange control. This is where the government restricts the supply of foreign exchange for import purposes. For example it can allocate foreign exchange at lower rates to importers of essential commodities and at high rates to importers of non-essential and luxurious commodities so as to reduce on their importation.

- Trade embargoes (sanctions). This is where the government prohibits the importation of commodities from certain countries and exportation of commodities to certain countries in form of economic sanctions. Such sanctions are aimed at promoting peace, harmony and human rights. For example the economic sanctions imposed on Iraq and Zimbabwe by U.S.A.

- Deflationary policy. This is where the government through the central bank: uses the restrictive fiscal and monetary policies in order to reduce on the amount, of money circulating in the economy so as to check on the aggregate demand for imports. This can help to reduce on the quantity of imports to the country.

- Total ban (Complete ban). This is where the government completely prohibits the importation of a certain commodity from a given country. This is done when the commodity is either harmful, when there is political crisis between the two countries or when the commodity is security risk to the country.

- Administrative controls (restrictions). This is where the government sets bureaucratic formalities or procedures which the importers or exporters have to follow in the process of international trade. These procedures tend to be lengthy and costly such that it becomes uneconomical to import or export certain products hence controlling international trade.

- Subsidization. This is where the government gives assistance to the producers of certain products. Such economic assistance can be in form of soft loans and subsidized inputs particularly to the domestic producers of essential products. This lowers the production costs and enables the home producers to sell their commodities at fair prices in order to compete favorably with the imported products.

- Import licenses. The government can restrict licenses given to importers and exporters of certain commodities hence controlling international trade.

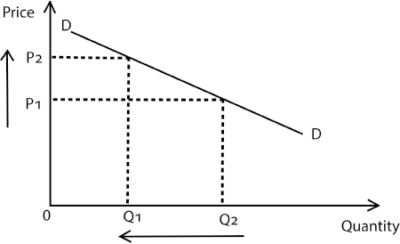

- Devaluation. This refers to the deliberate government policy of reducing the value of domestic currency in terms of other currencies. Devaluation discourages imports and encourages exports. This is because it makes exports cheap to the foreigners and imports expensive to the locals. However, this policy can be effective if imports and exports have elastic demand.

- Transport discrimination. This is where the government discriminates against imports in form of high transport charges while the locally produced goods are transported at low changes. This discourages the imports into the country.

- State trading. This is where the government takes over the importation of certain commodities from private individuals. In this case the government restricts the amount to be imported hence controlling international trade.

- Special import deposits. This is where the government requires the importers of certain commodities to first deposit a given amount of money with the central bank before being licensed to import. This reduces on the number of importers hence discouraging imports in the country.

- Quality control standard agencies such as UNBS and National drug authority are used to prevent inferior products from entering the country.

Merits (Advantages /Arguments) for Protectionism

- It encourages the exploitation and utilization of domestic idle resources. This is because protectionism against imports increases aggregate demand for the locally produced commodities. This increases the productive capacities in the economy hence economic growth and development.

- 2. It helps to control dumping. Dumping refers to selling of commodities in foreign market at a high price as compared to the price charged in the domestic market This discourages production in the country where commodities are dumped hence the need for protectionism.

- It helps to raise government revenue. This is realized from the tariffs imposed and trade licenses issued in the process of protectionism. The revenue is used to finance government re- current and development expenditures

- It facilitates the development of domestic infant industries. Infant industries produce at high costs and their products are of poor quality. Therefore, there is need to protect-such industries from competing with the cheap high quality imports in order to enable them to develop.

- For Health reasons. Protectionism discourages the importation and consumption of harmful and dangerous imports by the local population. Such commodities are in form of expired drugs, food stuffs and other substandard commodities.

- 6. It helps to control imported inflation. Trade restrictions are used to reduce on the importation of commodities from countries affected by inflation hence controlling imported inflation.

- It improves the balance of payment position of the country. Protectionism encourages the production of formally imported commodities locally through the establishment of import substituting industries. This reduces expenditure on imports hence improved balance of payment position.

- It saves the scarce foreign exchange earnings of the country. Protectionism encourages the production of formerly imported commodities locally. This reduces foreign exchange outflow hence accumulating foreign exchange reserves.

- It increases employment opportunities. Through protectionism, the money which would be spent on imports is diverted to the consumption of domestically produced commodities. This increases domestic production and other economic activities hence creating more employment opportunities.

- It leads to the development of social and economic infrastructure. Protectionism promotes the development of the social and economic infrastructures in form of roads, schools, hospitals, financial institutions etc. required for import substituting industries.

- It promotes self-sufficiency and reliance of the economy. Protectionism encourages the production of a number of formally imported goods and services locally. This leads to increased self-reliance and sustenance of the economy hence reducing the problem of foreign dependence.

- It facilitates the development of skills for local entrepreneurs. This promotes managerial capacity building through on job training and helps to reduce government expenditure on training costs.

- For retaliation purposes. Some countries impose restrictions to retaliate against restrictions made by other countries on their exports.

- National security argument. A country may impose restrictions on the importation of certain commodities for security reasons .For example restricting the importation of fire arms for security purposes.

- For political purposes. Trade restrictions can be used to promote and achieve political objectives. For example African countries managed to reduce apartheid rule in South Africa by imposing trade embargoes on the South African government of that time.

Demerits (Disadvantages/ Arguments against) Protectionism

- It leads to technological unemployment. This is true if the protected industries use capital intensive techniques of production which in the long run replaces labour hence technological unemployment. This is true especially with foreign investors who prefer to use capital intensive techniques of production.

- It increases economic dependence of the country. This is true if protected industries continue to import raw materials and spare parts from foreign countries. This increases the production costs hence high prices for goods and services.

- It promotes profit repatriation. This is true if the protected industries are owned by foreign investors and this promotes capital flight hence limited capital accumulation in the economy.

- 4. Protectionism in form of regional integration leads to trade diversion. Countries within the integrated region may end up buying raw materials from within the region at high costs instead of importing them from nonmember countries at cheaper This increases the costs of production.

- It reduces the welfare of the local consumers. This is protectionism reduces the choice of consumers and it leads to the production of poor quality and expensive goods and services as compared to the imported commodities. This leads to poor standards of living.

- It leads to balance of payment problems in the country. This is due to increased importation of expensive factor inputs in form of raw materials, intermediate goods and expatriates.

- It increases government expenditure. This is because it is costly for the government to implement and enforce the protectionism policy. This makes it difficult for the government to meet her recurrent and development-expenditures.

- It leads to the emergency of local monopolies. The protected domestic industries end up becoming monopolies. They restrict output and charge high prices hence exploiting the consumers.

- It encourages retaliation and tariff wars among trading partners. This is because protectionism is used as a beggar-my-neighbor policy whereby a country uses it to improve on its economic conditions at the expense of its trading partners.

- It promotes inefficiency in production. Local producers are sheltered from foreign competition and this leads to the production of poor quality products

Revision questions

Section A questions

1 (a) Define the term “Dumping” as used in economics

(b) Give three demerits of dumping policy in the importing countries.

2 (a) State the vent for surplus theory of international trade

(b) Give three circumstances under which protectionism may fail to achieve economic development in an economy.

3 (a) State the “vent-for surplus” theory of international trade.

(b) State three assumptions underlying the principle of comparative advantage

4 (a) Define the term commercial policy.

(b) Outline three instruments (tools) of commercial policy used in your country.

5 (a) What are non-tariff barriers?

(b) Mention any three non-tariff barriers to trade.

6 (a) What is meant by the term beggar-my-neighbor policy?

(b) State three objectives of commercial policy in your country.

- (a) Differentiate between tariffs and quotas

(b) Mention two objectives of imposing import duties in your country

Section B questions

1 (a) Differentiate between multilateral trade and bilateral trade

(b) “Developing countries should pull out from participating in International trade. Discuss.

2 (a) Explain why your country has gained less from foreign trade

(b) What policy measures are being adopted to improve on your country’s low position in foreign trade?

3 Study the table below showing output levels of two countries in two commodities given the same units of labour, answer the questions which follow

| Country | Commodities | |

| Generators | Coffee | |

| X | 400 | 600 |

| Y | 100 | 300 |

(a) State the country with absolute advantage in the production of both commodities.

(b) Calculate the opportunity cost of producing each commodity in each country

(c) In which commodity should each country specialize?

(d) What are the limitations of the comparative cost advantage theory in international trade?

4 (a) Explain the law of comparative cost advantage?

(b) Why may the use of the law of comparative cost advantage fail to bring about closer regional cooperation in East Africa?

5 (a) Distinguish between the principles of absolute advantage and comparative advantage

(b) To what extent is the theory of comparative advantage applicable in international trade in developing countries?

6 (a) Explain the various forms of protectionism employed in international trade

(b) What are the positive implications of protectionism in an economy?

7 (a) Why may government adopt protectionism policies in an economy?

(b) What problems are associated with adopting protectionism policies in an economy?

Terms of trade (T.O. T)

Terms of trade refer to the rate at which the goods of one country are exchanged for the goods of another country. OR. Terms of trade refer to the purchasing power of the country’s exports in terms of its imports.

Types of Terms of trade

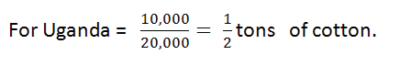

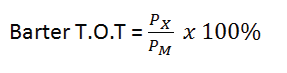

(a) Barter (Commodity) T.O.T. This refers to the ratio of export prices to the import prices. OR. It refers to the ratio of price index of exports to the price index of imports.

- If the barter T.O.T is greater than 1; the country is said to experience favorable terms of trade

- If the barter T.O.T is less than 1; the country is said to experience unfavorable terms of trade

Barter T.O.T can also be expressed as percentage using the following formula

Barter T.O.T are favorable if it is greater than 100% and unfavorable if it is less than 100%

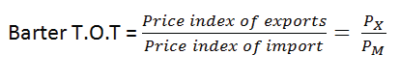

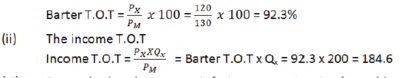

(b) Income (Monetary) T.O.T. This refers to the ratio of value of exports to the price index of imports. It shows how much a country can import using the revenue from exports

![]() where Qx = quantity of export, Px = price of export and Pm = price index of imports

where Qx = quantity of export, Px = price of export and Pm = price index of imports

![]()

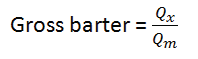

(c) Gross barter T.O.T. this refers to the ratio of the quantity of export to quantity of imports

where Qx = quantity of export, Qm = quantity of imports

where Qx = quantity of export, Qm = quantity of imports

Example

Given that the price index of exports is 120and imports is 130 and quantity of export is 200kg. Calculate

- The barter T.O.T

- State whether the country is facing or experiencing favorable and unfavorable T.O.T

The country is experiencing unfavorable terms of trade because the barter terms of trade is less than 100%

Causes of unfavorable terms of trade in developing countries

- Production and exportation of similar products by developing countries. This leads to excess supply on the world market hence low export prices as compared to import prices.

- Discovery of synthetic substitutes by developed countries for exports from developing countries. This has greatly reduced the demand for exports from developing countries hence low export prices.

- Development of raw material saving technology by developed countries. This has reduced the demand for raw materials from developing countries hence low export prices.

- 4. Production and exportation of cheap primary products (raw, materials) by developing countries. Such products fetch low prices on the world market hence unfavorable terms of trade.

- International commodity agreements favour developed countries by fixing low prices for exports from developing countries and higher prices for exports from developed countries hence deteriorating terms of trade

- Weak bargaining power among developing countries due to limited economic integration leads to low prices for their exports.

- Some developing countries (like Uganda) are land locked. This leads to high costs of transport for their exports and imports. The high transport costs reduce the prices for their exports and increase the prices for their imports hence unfavorable terms of trade.

- Protectionism by developed countries against exports from developing countries in form of tariff and non-tariff barriers. This is aimed at protecting their economies as a way of achieving self-sufficiency and reliance. This has greatly reduced the demand for exports from developing countries hence unfavorable terms of trade.

- Developing countries have a high marginal propensity to import. This enables developed countries to fix high prices on their products hence unfavorable terms of trade.

Measures (solutions) to improve the Terms of trade in developing countries

- Promote export diversification including the production of industrial products so as to avoid over flooding of the world markets by similar products produced by developing countries. This helps to increase the export prices hence favourable terms of trade.

- Embrace regional integration and economic co-operation so as to promote trade among developing countries. This can help them to avoid being exploited by developed countries.

- Establish export promotion industries to add value to the exports as a way of increasing the export prices.

- Adopt technological development in order to improve on quality and quantity of exports. This can help to increase on the export prices.

- Encourage manufacturing and processing plants or industries so as to add value to their exports. This can help to improve on the quality of their exports hence high export prices.

- Formation of strong commodity associations so as 1:0 jointly bargain for fair prices for their exports on the world market. For example coffee producers Association (CPA).

- Adopt favorable policies like subsidization of local producers and privatization of the inefficient parastatals. This can help to improve on quality and quantity of their exports hence favourable terms of trade

- Carry out market research and advertisement as a way of improving on the marketability and prices of their exports.

Balance of payments (B.O.P)

This refers to the difference between the country’s total receipts from exports and total expenditure on imports in a given time.

If the country’s receipts (revenue) from exports exceed her expenditure on imports, the country is said to have a balance of payment surplus and therefore it experiences favourable balance of payment.

If the country’s expenditure on imports exceeds her receipts from exports, the country is said to have balance of payment deficit and therefore it experiences unfavorable balance of payment.

Balance of Payment Account

Balance of payment account is a systematic record of all a country’s economic transactions with the rest of the world in a given time.

The balance of payment account takes the form of double entry accounting system like balance sheets of business enterprises. Exports and other transactions that lead to inflow of foreign exchange are recorded on the credit side while imports and other transactions that lead to outflow of foreign exchange are recorded on the debit side of the balance of payment account. Like all balance sheets, the balance of payment account must balance.

Components of the B.O.P Account

The B.O.P account has four major components;

(a) The current account

(b) The capital account.

(c) The monetary (cash) account.

(d) Errors and the omission’s account.

(a) The current account

This is summary record of international transactions in goods, services and transfers. The current account is divided into;

- Visible trade account. This records receipts from exports and expenditure on imports resulting from the exchange of goods only (Visible trade}.The difference between receipts from visible exports and expenditure on visible imports is called Balance of trade (visible balance of trade)

- Invisible trade account. This records receipts from exports and expenditures on imports resulting from exchange of services only (invisible trade). For example tourism, transport, medical, education etc.

- The difference between the receipts from services exported and expenditure on services imported is called invisible balance of trade.

- Transfer payments (Unilateral transfer) account. This records donations by the country and donations to the country. For example gifts and grants

- Current account balance = visible balance (trade balance) + invisible balance + net transfer payments.

(b) The capital account

This is a record of capital movements which are either be capital inflows or capital outflows of the country. Capital movements (flows) are in form of private or public foreign investments, loans, debt payments and repayments etc.

Balance of payments = Balance on Capital account + Balance on current account

(c) Monetary (cash) account

- This is also called the official settlement or financing account. It is a record of how foreign exchange reserves change in response to current and capital transactions. This account indicates a surplus or deficit on the B.O.P account and it shows how the dis equilibrium can be corrected

- When there is a surplus on the combined current and capital account, it implies an increase in the foreign exchange, reserves (Net inflow in the foreign exchange reserves). A deficit implies a net out flow (a decrease in foreign exchange reserves).

A balance of payment deficit can be offset (financed) by using accommodating items on monetary account. Accommodating items methods used by the central bank to establish a balance by offsetting a deficit in the balance of payment account. The process of financing a deficit using accommodating items is called accommodating the balance.

Examples of accommodating items include;

- Selling the country’s investments abroad.

- Using foreign exchange reserves available in the central bank.

- Selling gold stock held in the central bank.

- Borrowing from international lending institutions like IMF and World Bank.

- Borrowing from friendly countries.

- Selling government securities abroad i.e. Treasury bills and bonds.

A balance of payment surplus can be offset (financed) by using autonomous items on the monetary account. Autonomous items are methods used by the central bank to bring about a balance by disposing off the surplus in the balance of payment account. The expenditure incurred in disposing off the surplus is called autonomous expenditure. .

Examples of autonomous items include;

- Making investments abroad

- Buying gold so as to increase on its stock in the central bank.

- Offering loans to other countries.

- Giving donations to other countries.

- Offering loans to international institutions like I.M.F.

- Increasing on the stock of foreign exchange reserves in the central bank.

(d) Errors and Omissions account

This is also called a balancing item account. This part of the balance of payment account records errors and omission which may have been made in the process of making the balance of payment account In this case the figure representing the errors and omissions made (Balancing item) is added or subtracted on any side of the balance of payment account for purposes of balancing.

Format of the balance of payment account

| Debt side | Credit side |

| Imports

Current account Goods imported ……………………………xx Services imported ………………………….xx Transfer payment ………………………….xx

Capital account Loans to foreigners ……………………….xx Investment in other countries ………..xx

Cash account Accommodating items ……………………xx

Errors and omissions account Balancing items …………………………….xx

|

Exports

Goods imported ……………………………xx Services imported ………………………….xx Transfer payment ………………………….xx

Loans from foreigners ………………….xx Investment by foreigners……. ………..xx

Autonomous items ………………………xx

Balancing items …………………………….xx

|

Causes of persistent balance of payment problems (Deficits) in Developing countries

Persistent balance of payment deficits are experienced by the country when its foreign exchange expenditure exceeds its foreign exchange earnings year after year. Balance of payment deficits are caused by factors which;

(a) Reduce foreign exchange earnings and increase foreign exchange expenditure.

(b) Increase capital outflow and reduce capital inflow. These factors include:

- High levels of inflation in developing countries. Inflation increases production costs and discourages exports by making them expensive. This leads to low demand for exports hence low foreign exchange earnings.

- Low export prices. Since developing countries mainly export primary products where prices are low on the world market, they get less foreign exchange earnings hence balance of payment.

- Excessive reliance on imports in form of consumer and capital goods. Developing countries import expensive manufactured products leading to high foreign exchange expenditure hence balance of payment deficits.

- Low productive capacities in developing countries. This is due to limited co-operant factors used in the production process like limited capital, use of poor technology, unskilled man power etc. This leads to low output for export purposes hence balance of payment deficits.

- Excessive capital out flow in forms of profit repatriation, public debt servicing and capital flight by the nationals.

- Wide spread political instabilities in developing countries. Political instabilities discourage investments and production which leads to a decline in exports. In addition political instabilities increase expenditure on military equipments which leads to borrowing hence balance of payment deficits.

- Poor and inadequate social and economic infrastructures .The existing infrastructure is in a bad state. For example, there exists poor transport, storage and communication facilities which greatly discourage the production and distribution of commodities for export purposes hence balance of payment deficits.

- Use of poor technology. This results into inefficiency in resource use and the production of low quantity and poor quality exports which fetch low prices on the world market.

- Protectionism by developed countries. The high tariff and non-tariff barriers imposed by developed countries against exports from developing countries lead to a reduction in exports and foreign exchange earnings hence balance of payment deficits.

- Discovery of synthetic fibers by developed countries. Synthetic fibers like Nylon, Rayon, silk and the use of raw material saving technology by developed countries have led to a decline in demand for agricultural raw materials from developing countries hence a decline in foreign exchange earnings.

- 11. High population growth rates and dependence burdens. These force developing countries to import more foodstuffs and medical services in order to support the rapidly growing In addition, a rapidly growing population has led to an increase in consumption of commodities which would otherwise be exported hence balance of payment deficits.

- Existence of natural disasters. These include floods., drought, pests and diseases which adversely affect the agricultural sector hence a decline in agriculture export and export earnings.

- High levels of corruption and embezzlement of scarce economic resources. Resources meant for domestic and export production and embezzled for personal gain. This increases government expenditure on un productive public enterprises forcing the government to keep on importing hence balance of payment deficits.

- Limited economic diversification by developing countries. Developing countries tend to concentrate on the production and exportation a few traditional cash crops which face unfavorable terms of trade on the world market hence balance of payment deficits.

Measures (Policies) of solving balance of payment problems in developing countries

The measures taken should be aimed at;

(a) Increasing exports and export earnings.

(b) Decreasing imports and import expenditure.

- port promotion policy. This policy is aimed at increasing the export base and reducing the obstacles in the export process through subsidization of producers and trade liberalization. This leads to increased exports and export earnings.

- Devaluation policy. This is the deliberate government policy of reducing the value the country’s currency in terms of other currencies. Devaluation helps to discourage imports by making them expensive for the locals and encourages exports as they become cheaper to the foreigners. This can be successful if both imports and exports have elastic demand.

- Import substitution policy. This policy is aimed at establishing industries to produce commodities formally imported by the country as a way of reducing imports and import expenditure.

- Economic diversification. Developing countries need to diversity their economies so as to reduce their over dependency on a few traditional cash crops .like cotton and Instead, they should carry out a number of economic activities in order to diversity their export base and increase on their foreign exchange earnings.

- Economic integration. Developing countries should encourage economic integration within themselves in order to promote market expansion. This will not only encourage production for export purposes but also widen the source of foreign exchange earnings for the integrated countries.

- Foreign exchange control. The government should control the issuing of foreign exchange for import purposes. It should give foreign exchange at lower rates to importers of essential commodities which are scarce in the economy and at high rates to importers of non-essential commodities. This helps to regulate foreign exchange expenditure.

- Political stability and security. Governments of developing countries should promote political stability through democratic means and peace This will not only create a conducive investment climate but also a reduction in expenditure on defense.

- Infrastructural development. The government should encourage the development of social and economic infrastructures in form of transport network, communication facilities, banking and insurance services. This can help to facilitate production, distribution and exchange of commodities among countries.

- Divesture. The government should completely privatize all its inefficient parastatals in order to minimize corruption and embezzlement of government funds. This will not only reduce government expenditure but also promote efficiency in production hence better quality exports.

- Encourage foreign investors. Foreign investors bring in foreign exchange and increase on capital inflow through their private foreign investment within the country. This also increases production of better quality products for export purposes.

- Use of restrictive fiscal and monetary policies. Such policies can be used to encourage export production and to discourage demand for imports. For example use of restrictive fiscal policies like increased taxation, reduced government expenditure and restrictive monetary policies should be applied to reduce on aggregate demand for imports and to control inflation in the economy.

- Import restrictions. Developing countries should use appropriate import restrictions like import quotas and increasing import duties as a way of reducing imports and import expenditure.

- Seeking foreign aid. Developing countries should seek for foreign aid in form of donations and grants from developed countries with surplus resources. This can help them to finance their productive activities hence increasing production for experts.

- Promoting tourism. Developing countries should promote tourism as a way of earning foreign exchange. This is possible if they maintain political stability and security.

Exchange rates

- Exchange rate refers to the value of the country’s currency in terms of other currencies. For example $1 = UG shs. 3670.

- Hard currency. This refers to the currency which can easily be converted into other currencies and it is internationally recognized and accepted. For example pound, dollar, euro etc.

Types of exchange rates

(a) Fixed (Pegged) exchange rate. This is where the value of the county’s currency in terms of other currencies is fixed by the monetary authority (government)

Merits of (Arguments for) a fixed exchange rate

- It facilitates international trade by ensuring certainty of prices of exports and imports.

- It ensures stability in foreign exchange market. This creates confidence in the value of the domestic currency.

- It encourages long-term capital inflows thereby promoting investments in the economy.

- It discourages currency speculation in the foreign exchange market. Currency speculation refers to the act of buying and selling foreign currency with the aim of marking profits.

- It is possible under the fixed exchange rate to use government policies like devaluation to achieve certain economic objectives. .

- It is easy to control and regulate by the government (monetary authority) unlike other types of exchange rate.

- It reduces exploitation and cheating of foreign exchange buyers by foreign exchange dealers (sellers).

- It facilitates planning since the foreign exchange earnings can easily be predicted according to the fixed exchange rate.

- It helps to impose discipline on monetary authority to follow responsible financial policies with in the country. For example it may stop the government from perusing inflationary policies which may discourage investments in the country.

Demerits of a fixed exchange rate

- It is too rigid and therefore, it may not respond to the changes in the economy.

- It is expensive to maintain since it requires complicated exchange rate control measures and monitoring which may lead to resource misallocation.

- It discourages competition in the foreign exchange market and this leads to inefficiency in the foreign exchange trade.

- It makes the importation of essential commodities expensive .This results in imported inflation in the economy. This is true if the exchange rate is fixed above the equilibrium exchange rate (over valuation of the exchange rate),

- It leads to the decline in foreign exchange earnings as it discourages exports. This is true in case the exchange rate is fixed below the equilibrium exchange rate (under valuation of the exchange rate).

(b) Flexible (Free/Floating) Exchange rate. This is where the value of the country’s currency in terms of other currencies is determined by forces of demand and supply of the foreign currency.

Merits of a free exchange rate (Exchange rate liberalization)

- The system is automatic. It does not require government involvement and expenditure on foreign exchange rate monitoring.

- It does not require a lot of foreign exchange reserves since it is determined by the forces of demand and supply.

- It encourages competition in the foreign exchange market thereby promoting efficiency in the foreign exchange trade.

- It helps the country to pursue an independent monetary policy aimed at promoting economic stability.

- It helps to eliminate the problem of bureaucracy involved in acquiring foreign exchange and this promotes international trade.

- It encourages free capital movements among countries and this promotes foreign investments within the country.

- It indicates the strength of the domestic currency in terms of other currencies since it is determined by the forces of demand and supply.

- It reduces the problem associated with over valuing and under valuing of the domestic currency.

Demerits of a Flexible exchange rate (Exchange rate liberalization)

- It creates uncertainties in the foreign exchange market. This discourages trade and investment.

- It leads fluctuations in the foreign exchange earnings of the country. This makes it difficult for planning and budgeting by the government.

- It may lead to inflation since it is not controlled by the government. This occurs when importers acquire foreign exchange at high rates.

- It leads to balance of payment deficits in case of increased foreign exchange outflow for import purposes.

- It discourages long term contracts between borrowers and lenders which hinders investments and economic development. .

- It leads to resource misallocation In case the Importers of non-essential commodities acquire foreign exchange at lower rates.

- It encourages heavy speculation in the foreign exchange market. This leads to exploitation of the foreign exchange buyers as they acquire foreign exchange at high rates.

(c) Mixed (Managed float /Dirty float/Adjustable peg) Exchange rate. This is where the exchange rate is controlled by the government but it is allowed to fluctuate between certain limits. There exists the upper and lower exchange rate limits within which buying and selling of foreign exchange takes place.

(d) Dual exchange rate system. This is where there is co-existence two parallel exchange rates within the country.

(e) Multiple exchange rates. This is where there is existence of more than two exchange rates within the country. It is common where there is liberalization in selling and buying of foreign currency.

Devaluation

Devaluation refers to the deliberate government policy of reducing the value of its currency in terms of other currencies. OR. It refers to the reduction in the value the country’s currency in terms of other currencies under the fixed exchange rate system.

Example

Before devaluation $1 = UOX 3600

After devaluation $1 = UGX 4000

Currency depreciation. This refers to the reduction in the value of the country’s currency in terms of other currencies due to the forces of demand and supply of the foreign currency. OR. It is the reduction in the value the country’s currency in terms of other currencies under the floating exchange rate system.

Currency revaluation. This refers to the legal increase in the value of country’s currency in terms of other currencies.

Currency appreciation. This refers to increase in the value of the country’s currency in terms of other currencies due to the forces of demand supply of the foreign currency.

Reasons for devaluation

- To increase exports by making them cheaper to the foreigners.

- To reduce imports by making them expensive to the local people

- To reduce balance of payment deficits by increasing exports and decreasing imports.

- To control inflation by making domestically produced goods cheaper as compared to imported goods.

- To encourage domestic investments by encouraging production for exports.

- To encourage foreign exchange inflow as a result of increased export earnings.

Conditions necessary for devaluation to be successful

- The demand for exports should be price elastic such that a slight reduction in the export prices leads to a big increase in the quantity of exports.

- The demand for imports should be price elastic such that after devaluation a small increase in the import prices results into a big reduction in the quantity.

- The supply of exports should be price elastic. There should not be supply rigidities in the production of exports.

- The supply of imports must be price inelastic such that an increase in import prices should discourage their importation and the volume of imports must decrease as their demand decreases.

- The trading partners (competing countries) should not devalue at the same time. That is there should not be retaliation between trading partners if devaluation is to be successful.

- There should not be trade restrictions on the exports of the country devaluing her currency by other countries.

- High levels of Inflation should not exist in the country devaluing her currency. This is because inflation discourages exports by making them expensive to the foreigners.

- There should be a fixed (pegged) exchange rate if devaluation is to be successful, that is the exchange rate should be controlled by the government.

Factors as to why devaluation has not been successful in developing countries

- Inelastic demand for their exports. The elasticity of demand for exports from developing countries is low due to their poor quality and competition with the synthetic substitutes from developed countries

- Inelastic demand for imports. Most of the imports from developed countries are essentials for example capital goods, drugs, petroleum products etc. and this makes developing countries to continue importing despite the expensive imports after devaluation.

- Inelastic supply of exports from developing countries. This is caused by supply rigidities like pests and diseases, bad weather and lack of co-operant factors such as inadequate capital. Therefore the demand for exports has not been fulfilled in the foreign market.

- Protectionism by developed countries for exports from developing countries. This has limited the market for their exports despite their devaluation policies.

- Competitive retaliation by other trading partners in form of counter devaluation. This has made imports from those trading partners cheaper than before hence making devaluation ineffective.

- High levels of inflation in developing countries. This makes production cost high and make exports expensive while imports cheaper.

- High levels of black marketing (smuggling) in developing countries. This has led to continued flooding of the domestic markets by imports hence violating the devaluation policy.

- Political instabilities ill developing countries. These have discouraged production for exports and for domestic consumption leading to continued importation of consumer commodities to developing countries.

- Existence of multiple exchange rates in developing countries. This has made it difficult for governments of developing countries to control exchange rate for import purposes under devaluation. This is because some importers get foreign currency at cheaper rates from different sources hence failing the devaluation policy.

- Use of conflicting fiscal policies for example heavy taxation on producers in an attempt to obtain government revenue has greatly discouraged production for exports hence undermining the devaluation policy.

Economic integration (regional integration/co-operation)

Economic integration refers to the corning together of different countries in carrying out economic activities so as to benefit from the economies of scale. OR. This is where a group of countries join together in carrying out economic activities with a view of increasing social and economic benefits from trade.

Examples of Economic integration

- East African community (EAC)

- Economic community of West African states (ECOWAS)

- European Economic Union (EEU)

Conditions necessary for successful economic integration

- Geographical proximity (nearness). Member countries should be geographically close to each other so as to effect preferential treatment and to construct the necessary infrastructure jointly which link all the member countries.

- Relatively same level of development. Countries in the integrated region should be at the same level of development to ensure equal distribution of economic benefits.

- Common ideology. Member countries should possess the same ideology which may be political, economic or social. That is, they should either be capitalists or socialists if they are to harmonize their policies.

- Relatively equal size. Member countries should preferably be relatively of equal size and resources so as to contribute equally to the economic development of each member country.

- Political will and stability. All member countries should have political will, commitment and peace so as to implement what they have discussed and agreed upon.

Forms (Stages) of economic integration

The stages of economic integration are classified according to the level of development as follows.

- Preferential Trade Area (PTA). This is the stage where countries reveal the need for integration. They reduce tariffs among themselves on selected commodities.

- Free Trade Area (FTA). This is the stage where member countries eliminate all tariffs and other non-tariff barriers among themselves but each member country maintain its own tariff structure on commodities from nonmember countries.

- Customs Union. This is the stage where member countries eliminate all trade and non-trade barriers amongst themselves. In addition, they adopt a common tariff structure on commodities from nonmember countries.

- Common Market. This is the stage where member countries eliminate all trade barriers amongst themselves and charge a common tariff structure on commodities from non-member countries. In addition, they allow free mobility of factors of production within the integrated region such as capital and labor.

- Economic union (Economic community/federation). This is the stage where member countries eliminate all trade barriers among themselves, charge a common tariff structure on commodities from non-member countries and they allow’ free mobility of factors of production within the region. In addition, member countries jointly own certain enterprises like Banks, Railways, roads, Dams etc. They also adopt common economic policies and strategies and they use a common currency for example the European economic community.

Merits (Benefits) of economic integration

- Market expansion. Economic integration provides a wider export market since member countries have to import from within the region. This encourages production and use of idle resources within the member countries.

- Trade creation effect. Trade creation refers to the movement of production activities and trade from high cost nonmember countries to low cost member countries within the economic integration. This promotes trade within the region.

- Increase in bargaining power. Economic integration increases the bargaining power of member countries within the integrated region. This is because they can collectively bargain for higher prices for their exports. This improves on the terms of trade for their exports.

- It promotes healthy competition among member countries. This form of competition not only encourages efficiency in resource use but also leads to the production of better quality products for the regional market.

- If promotes economic interdependence among member countries through the exchange of commodities and factors inputs. This promotes balanced economic growth and development within the region.

- It facilitates technological transfer. Technology transfer refers to the movement of modem and better techniques of production from one country to another especially from developed to developing countries. Such technology transfer can be in form of technical knowledge, advanced equipment etc. This promotes production hence economic growth.

- It encourages industrialization through the establishment of common processing and manufacturing industries within the region. This increases the production better quality products for domestic consumption and export.

- Joint establishment of expensive and complex projects is possible under economic integration by member countries for example power generation oil drilling etc.

- Employment opportunities. It promotes the creation of employment opportunities due to increased number of economic activities and through the process of trade. This helps to increase on the incomes of individuals hence better standards of living.

- It promotes political co-operation and stability with in the region. This can be in form of member countries interacting in trade and jointly owning some enterprises which facilitates good relationship among themselves

- It reduces the costs of duplicating commodities within the countries. If an industry is established in one country, there is no need to establish a similar industry in another country within the integrated region.

- It increases the choice of consumers. This is because a variety of commodities are produced and consumed within the region and this improves the standards of living of the people in the region.

- It facilitates trade especially where countries adopt a common currency. This promotes economic stability in the region.

Demerits of economic integration

- It encourages trade diversion. Trade diversion refers to the movement of production activities and trade from low cost nonmember countries to high cost member countries within the integrated region. This discourages production and consumption within the region.

- Loss of government revenue. Under economic integration, tariffs are eliminated which would otherwise contribute to government tax revenue in form of import and export duties.

- Uneven distribution of economic benefits. Within the integrated region, some countries which are well endowed with resources benefit more than others as a result of the wide market created. This brings about regional imbalances.

- It undermines the natural sovereignty of member countries. This is because it interferes with the political, social and economic policies of countries where by individual countries may not be ill position to pursue independent policies.

- It encourages dependency syndrome as member countries greatly depend on other countries within the region for economic purposes. This undermines the countries need to be self-reliant and independent.

- It leads to colonial hang over Colonial hangover is a situation where individuals within the integrated region prefer to consume commodities from colonial masters (developed countries) to those produced within the region. This limits the market for the commodities produced within the region.

- It leads to problems in implementing and harmonizing the social economic policies discussed upon by member countries. This is true especially if countries have different political ideologies.

- It leads to quick resource exhaustion as resources are over utilized to serve the wider market created as a result of economic integration.

- Most developing countries produce similar commodities which are agricultural in nature. Therefore countries may not benefit as they need to trade with developed countries so as to acquire capital goods and other raw materials which are essential for production.

Revision questions

Section A questions

1 (a) Distinguish between Barter terms of trade and income terms of trade.

(b) Calculate the barter T.O.T for the country if her import index is 125 and her export index is 85. Comment on your results.

2 (a) Distinguish between a trade balance and accommodating item.

(b) Mention two ways of accommodating the balance under balance of payment.

3 (a) Define the term foreign exchange reserves?

(b) Give any three uses of foreign exchange reserves in your country.

(c) Mention three ways of increasing the foreign exchange reserves of the country.

4 (a) What is meant by currency devaluation?

(b) Give three circumstances under which devaluation may fail to succeed.

5 (a) Distinguish between currency appreciation and currency depreciation.

(b) Given that the exchange rate of Ugandan shillings for Us dollar is shs 1800/ = 1 Us dollar. Calculate the new, exchange rate when Ugandan shilling depreciated by 10%.

6 (a) what is the difference between a floating exchange rate and a fixed exchange rate? (b) Give any two merits of a floating exchange rate system

7 (a) Distinguish between a Managed float exchange rate and dual exchange rate.

(b) Mention any two objectives of devaluation.

8 (a) Distinguish between currency over valuation and currency undervaluation.

(b) State any two effects of currency depreciation in your country

9 (a) Distinguish between a Customs Union and a common market

(b) Give two factors limiting the establishment of a customs Union among the East African countries

10 (a) Differentiate between trade creation and Trade diversion

(b) Mention two demerits of trade diversion in an economy

11 (a) Differentiate between preferential trade area union and Free Trade Area

(b) Mention two conditions necessary for the success of economic integration

12 (a) Distinguish between transfer payments and transfer earnings

(b) Mention any three sources of transfer payments to your country.

13 Mention four factors that determine the exchange rate in an economy

- Distinguish between the following terms.

(a) Dumping and state trading

(b) Advolorem tax and specific tax.

(c) Import duty and export duty.

(d) Balance of trade and invisible balance of trade

(e) Visible trade and invisible trade.

(f) Accommodating items and autonomous items.

Section B questions

1 (a) Distinguish between Barter terms of trade and income terms of trade

(b) Account for the unfavorable terms of trade in your country

2 (a) Account for the persistent balance of payment deficits in your country

(b) What policy measures are being taken to improve on your country’s balance of payment position?

3 (a) Explain the components of the balance of payment account.

(b) Explain the methods of offsetting a deficit and a surplus in the balance of payment account.

4 (a) Explain the conditions necessary for devaluation to succeed

(b) Explain why devaluation may fail to achieve an improvement in balance of payments in an economy

5 (a) Define the term exchange rate liberalization.

(b) Explain the merits and demerits for liberalizing exchange rate.

6 (a) Explain the stages of economic integration.

(b) Examine the factors limiting of economic integration in developing countries.

7 (a) Distinguish between customs union and common market.

(b) What are the implications of creating the East African Community to your country?

8 “Protectionism rather than free trade should be adopted if the country is to benefit from international trade”. Discuss.

9 (a) To what extent is inflation the cause of balance of payment problems in your country.

(b) Explain why your country has failed to reduce balance of payment problems.

Dr. Bbosa Science +256 778 633682

It’s a great compilation with specific and simplified content thanks .