Economic Chapter 14: Public finance and the fiscal policy

Public finance versus private finance

- Public finance is a science which studies the principles of allocation of government revenue and distribution of Public expenditure. It is a science which deals with the principles concerning the collection of government revenue and how it is allocated for development purposes through public expenditure. ·

- Private finance deals with income and expenditure of private individuals, companies and Non-government

Public finance include the following divisions

- Public expenditure

- Public revenue

- Public debt

- Financial administration

- Fiscal policy

Public expenditure

This is the total amount of money the government spends on the provision of social services and other development activities.

Forms (Types) of Public expenditure

- Recurrent (Operating) Expenditure. This refers to government expenditure for the day to day running of the state for example expenditure of salaries of civil servants, defense, education, medical services

- Capital (Development) Expenditure. This is the form of government expenditure on medium and long-term development projects for example expenditure on construction of roads, dams, industries, buildings

Problems (Challenges) Faced in effecting Public expenditure

- It is difficult to measure the social benefit of projects resulting from government

- It is difficult to balance regional allocation of public of expenditure on public goods like roads schools, hospitals etc.

- Inadequate funds required financing all government expenditure.-This forces the government to seek for loans or print more money which leads to inflation.

- Embezzlement and mismanagement of government funds hence failure to meet the· desired government goals.

- Unplanned (Unforeseen) government expenditures for example expenditures on natural disasters like epidemics (diseases), famine, earthquake, floods etc. This makes the actual government expenditure to exceed the planned government expenditure.

- People who benefit from government expenditure are not necessarily those who pay taxes.

Public revenue

This refers to the total income received by the government from different sources in a given time.

Sources of public revenue

- Taxes (Direct and Indirect taxes). This is the main source of government revenue

- Fines and penalties of law breakers

- These are paid by individuals to the government for the services given to them for example education, medical care etc.

- Gifts and grants from within and outside the country

- Profits from government enterprises

- Sell of government properties through privatization)

- Licenses paid businessmen to get the right to sell their products in a given market

- Incomes from gambling for example national lotteries

Public debt

This studies the causes and methods of public borrowing and public debt management.

Financial administration

This involves ways of controlling public finances through budgeting public auditing

Fiscal policy

This refers to deliberate government policy of using taxation, government expenditure and borrowing to regulate the level of economic activity.

Tools (Instruments) of the fiscal policy

- Government expenditure

- Taxation

- Public borrowing

Taxation

Taxation refers to the legal compulsory transfer of money from individuals and companies to the government as a source of revenue.

A tax refers to the non-quid proquo compulsory payment to the government by public. It is non- quid proquo in a sense that services or benefits received by the payer from the government may not necessarily correspond to the amount of tax paid.

Objectives (Aims) of taxation (Fiscal policy) in an Economy

- To rise government revenue so as to meet her recurrent and development expenditures.

- To achieve equitable distribution of wealth and incomes by using progressive tax system where the tax rate increases with an increase in the tax payer’s income. ‘

- To protect the local in/an industries from unfair foreign competition through the use of high import taxes.

- To control inflation by increasing tax rates on individual’s incomes in order to check on aggregate demand in the economy

- To achieve balance of payment stability. This is done by discouraging imports inform of high import duties and encouraging exports by subsiding the exporters.

- To control monopoly powers. The monopolists are highly taxed while other firms are subsidized to allow fair competition.

- To discourage the production and consumption of harmful products for example drugs, cigarettes etc. This is done by imposing heavy taxes on the producers of those commodities.

- To reduce over dependency on foreign aid and borrowing. Taxation helps the government to generate revenue locally.

- To promote individual responsibility and self-reliance among the citizens as they have to work hard in order to pay taxes

- To allocate and regulate the use of resources in order to achieve optimum production. This is because the government revenue can be used to set up productive ventures which can be used to benefit the whole society e.g. social and economic infrastructure.

- To ensure steady economic growth and development through increased investment and production. This can be achieved by manipulating the fiscal policy e.g. giving tax holidays and exemptions to the investors.

- To reduce population growth rate in case the tax is based on the number of children born by a given family.

Principles (canons) of taxation

These are guidelines, regulations or procedures followed during tax assessment and administration. These canons were proposed by Adam Smith to ease tax assessment, collection and administration. They include;

- Places, periods and seasons in which tax dues are collected should be convenient to the tax payer and tax collectors e.g. the convenient time for the trader is when he has made profits.

- The type of tax, method of assessment and collection should be clear and simple to understand by both the tax payers and tax collectors.

- The nature of the tax base, time of payment and the amount to be paid must be known clearly by the tax payer without doubt.

- Economy (Cheapness). The cost of tax collection and administration must be must lower than the actual tax revenue connected. Collection costs must not exceed five percent of the tax yield.

- Ability to pay. This is based on the minimum sacrifice theory of taxation. It states that the tax payer should be able to pay the tax assessed on him/her and remain with enough disposable income to sustain the life style he/she is accustomed –

- Elasticity (Flexibility). The tax revenue should vary directly with the exchange in tax base e.g. is the tax base increases the tax changed on the tax base should also increase & vice

- A good tax should be able to generate enough tax revenue without discouraging investment and work efficiency in the economy.

- Equity (Fairness and justice). All tax payers should proportionately bear equal tax burdens. This principle is divided into two

- Horizontal equity. This is where similar individuals one treated equally during taxation, that is people with the same level of income and other social conditions should pay the same amount of tax.

- Vertical This is where people with different levels of income are treated differently, during taxation, that is, people with different incomes and social conditions should pay different taxes.

- Diversity (comprehensiveness). A good tax system should have a wider coverage so that all sectors and groups of society contribute to government tax

- I0. Neutrality. A good tax system should not discriminate tax payers basing on tribe, race religion etc.

Features (Characteristics) of a good tax system

- It should be comprehensive. That is it should have a wider coverage whereby a variety of taxes should be imposed on various tax bases so as to raise enough

- It should impose a minimum tax burden to the tax payer. This helps to reduce tax evasion and avoidance.

- It should be That is, there should be a balance between the tax revenue collected and the services rendered through public expenditure.

- It should be efficient. That is, the tax imposed should not involve high collection and administrative

- It should be flexible (Buoyant). That is the tax revenue should vary directly with the changes in the tax

- It should consider the principle of double taxation. This states that, the tax payer should not be taxed more than once on the same tax base in a given

- It should be productive. That is, it should yield enough revenue to the government necessary to meet her re-recurrent and development

- It should help to achieve the national objectives for example to promote economic stability, reduce income inequality, control inflation

- It should accommodate and harmonize the conflicting interests of the tax payer and tax administrators. Therefore, it should recognize the basic rights of the tax payer. The tax payer should pay the tax without harassment

- It should promote equity economically and socially so as to minimize income inequalities among tax

Concepts used in taxation

- Tax This refers to the legal tax payer’s exploitation of the loopholes (weaknesses) in the tax law as a way of dodging paying the tax.

- Tax Evasion. This refers to the deliberate refusal by the tax payer to pay the tax assessed on him or her and it is illegal.

Why people evade paying taxes

- Unfair tax assessment where by the tax administrators fix the tax without considering the income levels of tax

- Low income levels due to high levels of

- Inadequate information about the importance of paying taxes by the tax

- Discontent about the provision of services by the government as a result of the tax

- Political instabilities and sabotage especially by people who oppose the government

- Laxity (weakness) in the tax

- Taxable Income. This is the amount of income subjected to taxation after deducting personal allowances.

- Tax Threshold. This is the minimum amount of income which is not subjected to

- Tax Liability. This is the amount of money the tax payer is expected to pay as tax in a given time.

- Tax Havens. These are countries which offer very low tax rates as a way of attracting foreign investors.

- Tax Yield. This refers to the tax revenue after all the collection costs have been subtracted from the total tax

- Tax Exemption. This is where the tax payer is relieved from paying taxes by the tax

- Tax Capitalization. This is where the firm converts profits into capital as a way of paying less profit tax.

- Dead Weight Tax. This is the tax which when imposed causes the tax payer to abandon the activity he or she is undertaking which forms the tax base.

- Tax Structure. This is the composition of the tax according to either the mode of payment or percentage of income paid as tax.

- Taxable Capacity. This is the ability of the tax payer to pay the tax assessed on him or her and remain with enough disposable income to maintain the standard of living he/she is accustomed to.

- Tax Base. This is any economic activity, property, person or institution which forms the source of income from which the tax is imposed for example land, business etc.

Causes of a narrow Tax base in Uganda (Developing Countries)

- High levels of poverty among the tax payers. Many people are poor and therefore they cannot afford to pay income tax. This greatly reduces tax revenue received from incomes of tax

- High degree of tax evasion and avoidance by the tax payers. This is either due to lack of commitment by the tax officials or existence of loopholes (weakness) in the tax law. Therefore, many activities are carried out without paying taxes.

- High levels of unemployment and under employment. Many people are unemployed and therefore they cannot pay certain taxes for example pay as you earn. In addition, many tax payers are under employed and this limits the amount of money they pay in form of taxes.

- Existence of a small industrial sector. Uganda’s industrial sector is small and weak yet it is the major source of tax revenue. In addition, the high degree of tax exemptions especially on foreign investors who would otherwise be potential tax payers narrows the tax base.

- High levels of income inequalities among the tax payers. The income gap between the rich and the poor is so wide and therefore there are few individuals who can carry out economic activities to effectively pay es.

- Wide spread political instabilities and insecurity. Such instabilities discourage potential investors who would set up investments and widen the tax base.

- Poor social and economic infrastructures. For example inaccessible roads and poor telecommunication networks. This makes it difficult to access especially the rural areas to mobilize and monitor the tax collection

- High levels of corruption and embezzlement of tax revenue by tax collectors (officials).The little tax revenue collected is also diverted by the corrupt officials for personal use and this reduces the tax revenue

- Inadequate information by the tax payers about the importance of paying taxes. This mainly caused by lack of sensitization by the tax officials and therefore some people do not take payment of taxes as their

- Incompetent, inadequate and inefficient tax administrative machinery. Most of the tax officials are not well trained to carry out tax assessment and administration. They end up harassing the tax payers and this increases the chances of tax evasion hence low tax

- Low levels of entrepreneurship in Uganda. There are few individuals who can set up and sustain businesses upon which meaningful taxation can be. The existing businesses are small and they lack proper record keeping which makes tax assessment very

- Large subsistence sector in Uganda. Most economic activities are under the informal sector and therefore, it is difficult to tax them. This narrows the tax

Tax Impact versus Tax Incidence

Impact of the tax (formal incidence) refers to the person who directly bears the burden of paying the tax as soon as it is imposed.

Tax incidence refers to the final person who bears that tax burden. OR. It refers to the final resting position of the tax. For example when person A pays the tax to the government on a certain commodity, he can shift the tax burden to the consumer B. therefore the tax incidence finally rests on B.

Note. The tax incidence can be shifted forward or backward.

Forward shifting of the tax. This is where the tax payer shifts the tax burden to the next party in the distribution chain for example a retailer shifting the tax burden to the final consumer in form of increased prices on commodities.

Backward shifting of the tax. This is where the tax payer shifts the tax burden to the previous party in the production process for example the producer shifting the tax burden to the supplier of raw materials by paying low price.

Money burden of the tax. This refers to the tax burden felt when the tax is paid in monetary terms.

Real tax burden. This is the amount of the commodity foregone when the consumer buys less of the commodity due to high prices charged as a result of the tax imposed.

Tax incidence and elasticity of demand

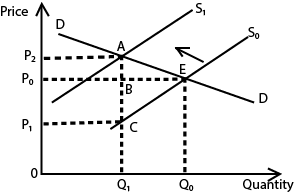

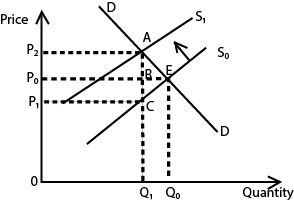

(a) Elastic demand

From the graph, when the tax is imposed on the producer, the supply curve shifts to the left from S0 to S1 (decrease in supply). The total tax is represented by AC. The proportion of the tax paid by the consumer is AB and that of the producer is BC. Since BC is greater than AB, it means that the producer bears a bigger tax burden than the consumer.

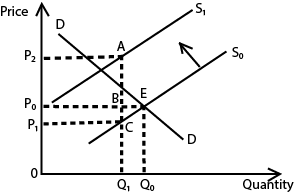

(b) Inelastic demand

From the graph, when the tax is imposed on the producer, the supply curve shits to the left from S0 to S1 (decrease in supply). The total tax is AC. The proportion of the tax paid by the consumer is AB and that of the producer is BC. Since AB is greater than BC, it means that the consumer bears a bigger tax burden than the producer.

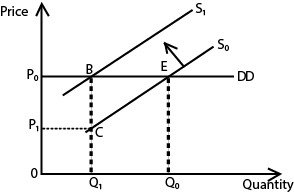

(c) Perfectly elastic demand

From the graph, when the tax is imposed on the producer, the supply curve shits to the left from S0 to S1 (decrease in supply). The total tax is BC. The proportion of the tax paid by the producer is BC; it means that the producer bears the entire tax burden.

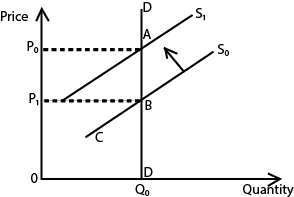

(d) Perfectly inelastic demand

From the graph, when the tax is imposed on the producer, the supply curve shits to the left from S0 to S1 (decrease in supply).The total tax is AB. The proportion of the tax paid by the consumer is AB; it means that the consumer bears the entire tax burden.

(e) Unitary elastic demand

From the graph, when the tax is imposed on the producer, the supply curve shits to the left from S0 to S1 (decrease in supply).The total tax is AC. The proportion of the tax paid by the consumer is AB and that of the producer is BC. Since AB is equal to BC, it means that the consumer and producer bear equal tax burden.

Types of taxes

Taxes can be classified according to;

- Tax to income ratio (tax rates)

- Tax incidence.

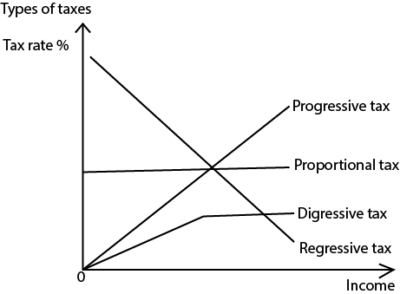

Classification according to tax income ratio (Tax rates)

(a) Proportional tax. This is where the tax rate is constant for all tax payers irrespective of the level of income. For example 10 percent as tax on the tax payer’s income

(b) Progressive tax. This is where the tax rate increases as the tax payer’s income increases. That is, the more income one earns, the more percentage of it is paid as tax.

Effect of a progressive tax

- It reduces income inequalities among tax payers

- It increases the standards of living for the low income earners as their purchasing power increases.

- It increases the marginal propensity to save for the poor and therefore, it encourages production

- High tax revenue is realized by the This is because it minimizes the’ chances of tax evasion.

(c) Regressive This is the tax where the tax rate decreases as the income level of the tax payer increases. That is the poor pay a higher proportion of their income in form of taxes as compared to the rich.

Effects of a regressive tax

- It widens the income gap between the low income earners and the rich.

- It limits consumption of consumer goods especially for the case of the This reduces their economic welfare.

- It encourages tax evasion hence low tax revenue is realized by the

- It encourages hard work for the low income This is because they have to work hard in order to pay taxes.

- It increases the marginal propensity to save for the rich. This encourages investments by the rich.

- It increases social problems among the low income

- Low tax revenue is realized by the government.

(d) Digressive tax. This is the tax where the tax rate initially increases as the tax payer’s income increase but becomes constant after a certain point as income increases

Illustration of different taxes

Classification of taxes according to Tax incidence

In this case, we have direct taxes and indirect taxes.

Direct Taxes

These are taxes imposed on income and properties of individuals and companies where by the impact and incidence of the tax cannot be shifted to a mother party.

Examples of direct taxes

- Income tax. This is a tax imposed on the incomes of individuals. This tax is progressive in nature that is, the tax rate increases with tax payer’s income.

- Sur tax. This is the tax imposed on very high incomes exceeding certain limits asset by the tax authorities in a given country. It is aimed at reducing income inequalities among the tax payers.

- Pay as you earn (PAYE). This is income tax changed on employment income.

- Wealth (property) tax. This is the tax levied on property or past accumulated savings of individuals.

- Company (corporate) tax. This is the tax charged on either net or gross profits of the company · It is usually changed as a percentage of profits.

- Capital gains tax. This is the tax levied on the gains made by the seller of a capital asset whose value has appreciated at the time of sale.

- Death (Estate) duty. This is the tax levied on the property of deceased person. It is based on the principle that a person cannot command property rights beyond the term of his/her life. Therefore, society should take part of his or her property in form of taxes.

- Inheritance tax (duty). This is the tax imposed on property or wealth inherited by a certain person.

- Land tax. This is the tax imposed basing on the ownership of land. It is aimed at breaking land monopoly and improving on land tenure system.

- Gift tax. This is the tax imposed on gifts. The principle on which the tax is levied is that the receiver of the gift has not earned it through hard work.

- Super profit tax. This is the tax imposed on profits of the company exceeding certain limits as determined by the tax authorities.

Advantages (Merits) of Direct taxes

- They are economical that is they are cheap to collect from tax payers for example pay as you earn paid on salaries of civil

- They are easy and simple to understand and administer. Therefore they fulfill the principle of simplicity.

- They are convenient to the tax payer. For example pay as you earn is paid at the end of the month when the tax payer is paid the

- They are A small increase in the tax rate yields much tax revenue .They also change with the changes in tax base.

- They are based on the principle of certainty. That is, the time of payment and the amount to be paid are all clear to both the tax payer and the tax collector in

- They fulfill the principle of equity. This is because they are progressive in nature. This promotes equitable distribution of income in the

- Their tax revenue is easy to estimate because they are fixed for a given period. This facilitates proper budgeting and planning.

- They can be used to control inflation. This is done by taxing heavily the disposable incomes of the tax payers so as to reduce aggregate

- They are used to cultivate a sense of civic responsibility among the The citizens get concerned about the affairs of the state and how their taxes are used in the provision of social services.

Disadvantages (Demerits) of Direct taxes

- High direct taxes discourage savings, investment and consumption. This leads to low production hence unemployment in the

- They are easy to avoid and This leads to loss of government revenue.

- It is difficult to determine the tax payer’s taxable capacity under direct taxes. This is because individuals have different sources of income which may not be known by the tax

- The cost of collection is high especially in rural areas where people are scattered and where there is presence of poor ·

- They are inconvenient to the tax payer because they are paid in lump sum and in advance. This increases the chances of tax evasion.

- High direct taxes increase the cost of production. The high direct taxes force workers to demand for higher wages forces the producers to increase in the prices of commodities hence cost push inflation.

- High direct taxes reduce work effort for the workers. They reduce the take home pay for the workers and this reduces their efficiency. This not only results into low profits for firms but also leads to loss of government tax revenue.

- Direct taxes have limited coverage. This is because they do not include all income groups. For example the young children, retired workers, tourists etc.

- Direct taxes have a direct impact on the tax payers. This is because they are paid directly out of their incomes. This makes them unpopular which may lead to political sabotage in the country.

- They are associated with a high degree of corruption, embezzlement and sectarianism during tax assessment and collection.

Indirect taxes (Outlays/ Expenditure taxes)

Indirect taxes are taxes imposed on commodities where the tax incidence and tax burden can be shifted by the tax payer to other parties for example by increasing commodity prices.

Examples of indirect taxes

- Customs duty. This is the tax imposed on commodities leaving or entering the country. OR. This is the tax imposed on imports and exports of the country.

- Excise This is a tax levied on domestically produced commodities.

- Turn over tax. This is the tax levied on the total sales of the business at each stage of transaction of the

- Sumptuary tax. This is a special tax levied on consumption of certain commodities which may be dangerous to human health. For example a tax on cigarettes, alcoholic drinks

- Octori tax. This is tax levied on commodities in transit from one country to another through the territory of another country. For example commodities from Japan through Kenya to Uganda are charged octori tax by the Kenyan

- Value added tax. (VA]). This is the tax imposed on the value of the commodity added at each stage of

Note: (a) Exempted goods. These are goods on which no VAT is imposed

(b) Zero rated goads. These are goods on which VAT is charged at a rate of zero percent but the rate can be increased any time

Advantages (Merits) of VAT

- It is difficult to evade and avoid by the tax payer.

- It increases government revenue. This is because it has a wider coverage.

- It reduces corruption since payment is through the bank.

- It is economical in terms of administration and collection

- It promotes efficiency in business management .This is because it encourages proper book keeping

- It helps to distribute the tax burden since it is paid at different stages during the production process.

- It helps to avoid double taxation since the taxed commodities have VAT receipts at each stage.

- It minimizes discrimination in taxation basing on income levels of the tax payers.

- It increases employment opportunities since business units employ accountants for book keeping while the URA (Uganda Revenue authority) employs personnel in tax administration.

Disadvantages (Demerits) of VAT

- It is difficult to assess because most traders do not keep proper

- It violates the principle of This is because it is the poor and the rich are subjected to the same tax.

- It discourages This is because it increases the costs of production.

- It leads to inflation. This because producers increase prices in response to A.T.

- High rates of VAT may cause unemployment as it discourages production and

- It is costly in terms of administration and tax education in form of administration and tax education in form of seminars, Radio programs

- High rate of VAT scares away investors and this leads to capital out

- It reduces the economic welfare of people as it reduces their real income in terms of the number of commodities purchased

- A.T has loop holes during tax administration. Tax payers try to under value their commodities as a way of paying less tax.

- It is used by political opportunists to sabotage the This leads to political unrest and instabilities.

Advantages (Merits) of Indirect taxes

- They have a wider coverage. That is, they cover a variety of tax bases hence yielding more tax revenue to the

- They are used to discourage the production and consumption of harmful products for example alcoholic drinks, cigarettes etc.

- They are more This is because they involve low costs in assessment, administration and collection as compared to direct taxes.

- They are flexible. They are easily adjusted according to the government policies and performance of the

- They are used to protect domestic infant industries by charging high import duties. This promotes the creation of employment opportunities in the

- They are convenient to the tax payer. This is because it is only paid when the person buys the commodity.

- They are used to improve on the Balance of payment position of the country. This is done by imposing heavy taxes on imports to discourage their importation.

- They are difficult to avoid and evade. This is because they are included in the prices of consumer goods and services.

- They are useful in resource allocation and income re-distribution. This is done by the discriminatory taxation where some commodities are taxed highly while other commodities are taxed less to encourage their

- They can be used to check on imported This done by imposing heavy import taxes on commodities from countries experiencing inflation so as to discourage their importation.

- The tax burden of indirect taxes is not directly felt by the tax payer. This is because they are paid as the tax payer consumes the

Disadvantages (Demerits) of Indirect taxes

- They tend to be inflationary. This is because they increase the prices of commodities taxed especially when they are imposed on essential

- They are regressive in nature. The rich and the poor pay the same amount of tax and therefore they fail to fulfill the canon of

- High indirect taxes discourage the consumption of commodities due to high prices. This discourages production and investment hence

- It is difficult to determine revenue from indirect taxes. This is because it is hard to accurately determine the effect of such taxes on demand and supply of

- They are hard to assess, understand and administrator for example A.T.

- They violate consumer sovereignty. This is because they increase the prices of consumer goods which force consumers to opt for cheap inferior

- Import duties discourage in inflow of scarce and cheap commodities which may be lacking in the This leads to low standards of living for the local consumers.

- They inconvenience the tax payers. This is because some indirect taxes are paid before the commodities are

Why Uganda (LDC’s) rely (depend) more on Indirect taxes than on Direct taxes

- The low taxable capacity due to wide spread poverty is not suitable for direct taxes but appropriate for indirect taxes. This is because they are included in the prices of consumer commodities and therefore their impact is not directly

- Indirect taxes have lower chances of tax evasion and avoidance as compared to direct taxes. This enables the government to raise more tax

- Indirect taxes have a wider coverage than direct taxes. This is· because they are levied on variety of commodities which are consumed by all people in the

- Indirect taxes are less felt and resented as compared to direct taxes. This is because they do not impose a direct tax burden to the tax This minimizes the chances of political sabotage in the country.

- Uganda greatly depends on international trade. Therefore it is likely to raise more revenue from indirect taxes than direct taxes in form of import and export duties which form a big percentage of the tax revenue.

- Indirect taxes are more productive than direct taxes. This is because they are convenient to pay and more economical in terms of collection costs than direct

- The Ugandan economy is dominated by a large subsistence sector and a small industrial sector which is more appropriate for indirect taxes than direct The indirect taxes can used to trap all possible tax bases in such sectors.

- High direct taxes discourage production and investment as opposed to indirect taxes. This is because they have a direct impact on the tax payer

- Direct taxes are associated with high degree of discrimination and sectarianism as opposed to indirect taxes during the process of tax administration and collection.

- Indirect taxes are used to protect the domestic industries and to correct the balance of payment problems which is not possible with direct taxes.

Problems faced by the Tax authority in Uganda (LDC’s)

- It is difficult to determine the taxable capacity for the tax It is difficult to determine how much tax is to be paid by each tax payer and yet remain with enough disposable income which is enough to enable him/her to enjoy the desired standards of living.

- Narrow tax base due to high spread of poverty. This hinders the government plans of raising enough tax revenue to finance its recurrent and development

- Inadequate skilled and well trained manpower in the field of taxation. Some tax officials are incompetent and therefore they cannot effectively assess and administer

- High degree of tax evasion and avoidance by tax payers. This is due to the loopholes within the tax system which enables the tax payers to dodge paying taxes. This greatly reduces the government tax

- High levels of inflation in the country. This reduces the real value of nominal tax revenue which makes government planning and budgeting very

- High degree of corruption, embezzlement and nepotism in tax assessment and collection by tax officers. Many tax officials are corrupt and this makes the government to lose a lot of revenue which is much needed for developmental purposes.

- Inadequate facilities such as computers and other materials required for tax collection and administration. This makes the tax assessment process very difficult.

- High degree of illiteracy among the taxpayers. The majority of the population is not sensitized about the importance of paying taxes. In addition some taxes are difficult to understand by different tax payers. This leads to high costs of tax education.

- Poor social and economic infrastructure. Most of the rural areas are remote and therefore, they are difficult to reach. This increases the costs of collecting taxes.

- Political instabilities and insecurity. Many potential investors are scared and this greatly reduces the tax base hence limited government tax revenue.

- Most tax payers are scattered most especially in rural areas. This leads to low tax compliance and it increases the collection costs hence low tax revenue.

Ways of improving Tax revenue and Tax collection in Uganda (LDC’S)

- Massive tax education. There is need to sensitize the people about the different types of taxes and the importance of paying taxes through seminars, workshops radio programs etc. This helps the masses to develop the culture of paying

- Diversification of taxes. A variety of taxes should be imposed on different economic activities as a way of increasing government tax revenue.

- Need to fight corruption in tax assessment and administration. The corrupt officials should be prosecuted in the courts of law. This helps to minimize on the loss of government tax revenue.

- Putting in place the anti-smuggling unit. This can help to reduce on the smuggling of commodities in and outside the country hence increasing tax revenue from imports and exports.

- Training of tax officials. The tax officials should be provided with the necessary skills required to improve on the efficiency of tax assessment administration. This helps to increase on the tax revenue collections.

- Putting in place the facilities required to facilitate tax assessment and collection. for example computers and other logistics. This can help to improve on tax administration and collection.

- Review the existing tax laws. Many laws existing in the tax system are out dated. Therefore there is need to plug the loop holes within the tax system by reviewing the existing tax laws as a way of minimizing the loss of tax revenue through tax avoidance.

- Improving on the existing and constructing new social and economic infrastructures, for example roads especially in rural areas. This helps to lower the transport costs hence reducing the costs of tax revenue collection.

- Ensuring political stability and security in the country. This is done by promoting democratic governance in the country. In addition, peace talks with the rebels can be emphasized as a way creating peace in the country so as to promote investment hence widening the tax base.

- Proper and efficient allocation of tax revenue. There is need for the government to properly and effectively use the tax revenue in order to provide the social services to encourages people to pay taxes.

- There is need to expand the industrial sector. This is because industries have the potential to increase tax revenue as compared to other sectors like agriculture.

Taxation financing versus debt financing

- Taxation financing is when government expenditure is fulfilled by using government tax revenue.

- Debt financing is when government expenditure is fulfilled by using borrowed funds got from internal or external , -,

- Deficit financing refers to the excess of government expenditure over public government revenue.

Methods (ways) of Deficit financing (Methods of financing a Deficit budget)

- Borrowing internally from the public by selling bonds and treasury bills.

- Borrowing from the central

- Use of the gold reserves in the central bank to finance the deficit

- Printing of more money by the central

- Borrowing externally from international financial institutions like IMF and World

Advantages (Merits) of Debt financing over Taxation financing

- Debt financing has a wider source of rising government revenue as compared to taxation. Unlike taxation which is limited to one country in mobilizing and rising financial resources, borrowing enables the country to raise revenue from internal and external

- Borrowing reduces the negative effects of taxation such as reduced investments, low aggregate demand, reduced savings etc. which are associated taxation

- Borrowing is the more reliable and quicker source of rising government revenue. It is not associated with tax evasion and avoidance which makes tax revenue highly unreliable for government planning and

- In case of a narrow tax base, borrowing acts as a suitable alternative for rising government revenue

- Borrowing can be used to raise government revenue in case of political instabilities and other emergences like earth quakes, floods, epidemics

- Unlike taxation, borrowing limits political resistance and unrest in an economy which is mainly caused by high tax burdens imposed on the people in form of paying

- Unlike taxation, borrowing tends to be regressive in nature especially the indirect taxes. This greatly affects the poor so much and also widens the income gap between the rich and the poor. This is true with indirect taxes imposed on consumer commodities e.g. salt, sugar

- Unlike taxation, borrowing improves on the country’s relationship with other countries and international organizations like IMF and World Bank. This promotes international co-operation and friend ship.

- Unlike taxation, external borrowing is a major source of foreign exchange which is scarce in the economy like Uganda. This is mainly used to import commodities (consumer and capital goods) which cannot be produced locally.

- Unlike taxation, borrowing is associated with a lower degree of corruption and embezzlement of government revenue. There is a high degree of corruption during tax assessments, administration collection which lowers the revenue under taxation financing.

- Unlike taxation, borrowing helps in deficit financing in case revenue is inadequate to finance government expenditure.

Demerits of Debt financing (Borrowing)

- It promotes external dependence syndrome. This undermines the country’s need to become self-reliant and self-sustaining.

- It leads to inflation in case of external borrowing. This is because it increases money supply and aggregate demand in the economy hence demand pull inflation.

- It worsens the Balance of payment position of the country. This is because it involves capital out flow in form of debt

- It increases the debt burden on the current and future generation. The current generation foregoes consumption and the future generation suffers the burden of debt payment.

- It increases political and economic dominance of the economy by the lenders. The lenders can influence the social economic policies carried out in their favor even if they are not in line with the needs of the people.

- Borrowing increases income inequalities among people .This is true especially when the borrowed funds are used to develop one region or misused through corruption to benefit a few individuals.

- It limits capital accumulation and investment. This can occur when the borrowed funds are used to service the debts contracted in the past or to finance the recurrent expenditure of the government.

- It does not promote a sense of civic responsibility among the citizens towards nation building. This is because the citizens do not contribute to the government revenue and therefore they are not concerned how the government allocates the borrowed funds.

Revision question

Section A questions

- (a) Distinguish between public finance and private finance

(b) Give any two problems faced in effecting public expenditure

2. (a) Distinguish between recurrent expenditure and capital expenditure

(a) Give two factors which influence public expenditure

(b) Give four ways of reducing government expenditure

3. (a) What is meant by public revenue

(b) Give any four non tax sources of government revenue.

4. Give four objectives of the fiscal policy

5. (a) Distinguish between tax incidence and tax impact

(b) With the help of the graph illustrate the tax incidence when demand is inelastic

6. (a) What is fiscal policy?

(b) State any three instruments of fiscal policy

7. (a) Differentiate between tax evasion and tax avoidance

(b) Mention any two causes of tax evasion in your country

8. (a) Distinguish between a proportional tax and a regressive tax

(b) Mention two effects of a regressive tax

9. (a) Distinguish between a progressive tax and digressive tax

(b) State any two merits of a progressive tax

10 (a) Distinguish between octori tax and sumptuary tax

(b)Mention two ways of widening the tax base in your country

11 (a) Distinguish between tax base and taxable capacity

(b)Give two causes of low taxable capacity in your country

12 (a) What is meant by ‘tax structure’ of a country?

(b)Mention three salient features of Uganda’s tax structure.

13(a)What is meant by VAT

(b) Given that Value Added Tax (V.A.T) is levied at a rate of 18% in Uganda, a registered supplier buys raw materials at Ug. 200,000 and sell the final output at Ug. shs 300,000, Calculate the amount of V.A.T. payable to Uganda Revenue Authority (U.R.A.) by the registered supplier

(c) What are the advantages and disadvantages of VAT.?

14 (a) Distinguish between recurrent expenditure and development expenditure

(b) Give two examples of recurrent expenditure incurred by the government of your country

15 (a) Define the term fiscal policy

(b) Outline three instruments of the fiscal policy in your country.

16 (a) What is meant by deficit financing?

(b) Outline three methods of financing a deficit

17 Distinguish between the following terms;

(a) Forward shifting of the tax and back ward shifting of the

(b) Money tax burden and real tax

Section B questions

1 (a) Distinguish between tax base and tax structure

(b) What are the implications of levying indirect taxes in an economy?

2 (a) Account for the low tax revenue in low developing countries

(b) Suggest the ways of improving tax collection in your country

3 (a) Explain the principles (cannons) of taxation

(b) Explain why your country prefers indirect taxes to direct taxes

4 (a) Distinguish between Direct taxes and expenditure taxes

(b) Why does the government impose taxes in the economy?

5 (a) Why is it necessary to levy different forms of taxes in an economy?

(b) Examine the role of taxation in the economic development process of your country

6 (a) Distinguish between debt financing and taxation financing

(b) Explain why the government of your country prefers to finance its expenditure by borrowing instead of using tax revenue

The government budget/ national budget

The budget is a financial statement showing the estimated (planned/anticipated) government revenue and the estimated government expenditure in a given financial year.

Types of budgets

Balanced budget is a budget where the planned government revenue is equal to the planned government expenditure in a given financial year.

Unbalanced budget is a budget where the planned government revenue is not equal to the planned government expenditure in a given financial year.

Note. The unbalanced budget may either be surplus budget or deficit budget.

Surplus budget is a budget where the planned government revenue exceeds the planned government expenditure in a given financial year.

Reasons as to why the government may deliberately plan for a surplus budget

- To check on excessive aggregate demand and to control inflation in the economy through reduced excessive money supply.

- To pay off the government debts contracted in the past using the excess revenue.

- To improve on the balance of payment position of the country. The excess revenue can be used for investments to produce goods and services for export.

- To reduce on the huge burden of government expenditure.

- To increase on the economic base of the country through the accumulated government reserves

Negative effects of a Surplus budget

- It increases the tax burden on the citizens. This is true when the government tries to raise more revenue through taxation. ,

- It leads to unemployment due to reduced aggregate demand.

- It leads to political resistance as a result of high tax burden imposed on the tax payers.

- It discourages savings and investment in case of increased taxation on investors.

Deficit budget

This is the budget where the planned government expenditure exceeds the planned government revenue in a given financial year.

Reasons as to why the government may deliberately plan for a deficit budget

OR. Why may the government under take Deficit financing?

- To stimulate aggregate demand by increasing money supply in the economy

- To improve on the standards of living by increasing disposable incomes of the

- To lift the economy out of a depression (stagnation) through increased government

- To increase employment opportunities by increasing production and investment in the

- To cater for the effects of the unforeseen circumstances, for example drought, epidemics, earthquakes

- To raise government revenue especially in situations where borrowing is a quicker and cheaper source of government revenue as compared to

- To reduce the tax burden on the tax payers especially in situations where taxable capacity is too low due to high levels of

Why may the planned budget differ from the Actual budget OR. Why is it difficult to achieve a balanced budget?

- Presence inflationary tendencies in the economy which may lower the real value of 1ic planned government revenue hence a deficit budget.

- Occurrence of unforeseen circumstances in the economy e.g. famine, floods, drought, epidemics which may end up increasing government expenditure.

- Failure to raise the planned financial resources in form of loans, grants, in a given financial year.

- Mismanagement, corruption and embezzlement of the planned funds may lead to a deficit budget.

- Improvement in the economic performance which may help the government to raise more revenue than what is expected hence a surplus

- External influence from international organizations, for example IMF which may force the government to change its budget before the end of the financial period e.g. in case the government is not using the borrowed funds for the intended

- Existence political instabilities and insecurity in the country which may force the government to increase expenditure so as to facilitate and maintain the security of the

Objectives of the Budget as an instrument of Social and Economic development

The budget can be used as an instrument of social and economic policy to achieve the following objectives.·

- To reduce income inequalities. This is done by taxing the rich heavily and subsidizing the poor. The tax revenue received can also be used to provide the people especially the poor with social services. For example free education, medical services

- To protect the domestic infant industries from unfair foreign competition. This is done by imposing high import duties so as to discourage

- To control inflation. This is done by deliberately reducing government expenditure.

- To discourage the production and consumption of harmful commodities like cigarettes. This is done by imposing high sumptuary taxes on such commodities

- To improve on the balance of payment position of the country. This is done by rising import duties as a way of discouraging imports hence saving the scarce foreign

- To control monopoly power. This is done by imposing heavy taxes on the super normal profits earned by the monopolist hence making it possible for other firms also to

- To raise government revenue through taxation and borrowing. The revenue can be used to finance the government re-current and development

- To discourage dumping. This is done by taxing the dumped commodities heavily so as to raise their prices and discourage their consumption by the local

- To increase employment opportunities in the country. This is done by adopting a deficit budget as a way of increasing aggregate demand in the economy. This helps to stimulate investments and production which generates more employment

- To allocate and regulate the use of the scarce resources so as to achieve maximum economic growth. This is done by using the government revenue collected to set up productive ventures which benefit the whole economy e.g. setting up power generation projects, construction of social and economic infrastructure

- To control population growth. This is done by imposing heavy taxes on people with large families as a way of discouraging child birth.

- To attract foreign aid by informing donors how resources are to be used

- Guide the government on how to spend public funds in order to achieve economic stability and national growth.

- It helps the country in manpower planning by increasing expenditure on education.

- To inform government on the performance of the previous budget and fix loop holes in the current budget.

- To encourage capital inflow by providing incentive to foreign investors.

The public debt

Public debt refers to the debt contracted by the central government, local authorities and cooperate organizations as a result of borrowing from within and outside the country.

National debt refers to debt contracted only by the central government on behalf of its citizens by borrowing from within or outside the

Sources of Public debts

- Borrowing externally from friendly countries and international organization. For example IMF and World

- Borrowing directly from the central bank.

- Borrowing from the public using the sale of government securities. For example Treasury bills and

- Use of government assets abroad to act as collateral security in order to acquire loans from external sources.

- Borrowing from rich companies and individuals within the

Reasons for public debts (Why countries borrow?)

- To fill the savings investment gap

- To fill the foreign exchange gap

- To reduce the burden of taxation on citizens

- To repay the debts contracted in the past without imposing a bigger tax burden on the tax

- To meet the effects of unforeseen

- To cover the revenue expenditure gap

- To control inflation through internal borrowing by the sale of government securities to the

- To expand and rehabilitate the social economic For example roads.

Types of Public debts

- Internal debt. This is the debt contracted from within the country e.g. selling government securities to the public by the government, borrowing from the central bank

- External debt. This is the debt contracted from sources outside the country. For example borrowing from friendly countries and multinational organizations like IMF and World

- Reproductive (Self-liquidating debt). This is the debt contracted whereby the money received is used to set up productive ventures which generate more incomes that can be used to repay the debt. For example a loan for constructing an industry, a dam

- Dead Weight (Unproductive) debt. This is the debt contracted to finance activities which are not used to generate more incomes. For example loans for financing a war, buying consumer goods, wages for workers

- Funded debt. This is a long-term debt where the date of paying back is not known by the

- Unfunded (Redeemable) debt. This is debt where the date of paying back the loan is clearly known by the

- Floating (Marketable) debt. This is a form of unfunded debt contracted by government through the sale of government securities to the For example treasury bills and bonds.

- Concessional Loan (Soft loan). This is a loan extended to the borrower at a very low interest rate with a long redemption

- Hard loan. This is a loan extended to the borrower at a very high interest rate with a short redemption

Public debt Management

This refers to the act of the fiscal authority (government) to regulate the size and structure of the outstanding public debt so as to achieve the set objectives. OR. It refers to the ways and means of how the public debt is administered by the fiscal authorities. That is how it is contracted and serviced.

Objectives of Public debt management

- To minimize the public debt burden by influencing the market interest

- To regulate money supply in the economy as a stabilization

- To attract and encourage investments in the

- To minimize government

Tools (methods) of Public Debt management

- Debt Contraction refers to the act and the terms of acquiring the debt that is the nature of the debt, maturity period, conditions of borrowing etc.

- Debt Redemption refers to the act of repaying back the debt that is both the principle and the interest.

- Debt Servicing (Nursing) refers to the process of paying the interest on principle with outpaying back the principle

- Debt rescheduling is where the borrower negotiates with lender to adjust the terms of debt servicing. For example redemption period, interest rate etc.

- Debt Retirement is where the government borrows money to pay the old debt. This works only if the borrowing conditions of the new debt are better than the conditions of the old

- Debt conversion is where one form of debt is converted into another form e.g. Converting a short term loan (debt) into a long-term loan (debt) at lower interest rates.

- Debt cancelling is where the lender removes the debt burden from the borrower by writing off the debt.

- Debt repudiation is where the borrower refuses to honour the debt obligations.

- Grace period is the period between debt contraction and when debt servicing begins.

- Sinking fund is money set aside by the government in the budget with the aim of paying the the debt.

Ways of Clearing (Paying back) the Public debt Internal debt

- Obtaining fresh debts at lower interest rates to clear the old

- Borrowing from the central bank

- Obtaining a grant/foreign aid

- Use of co-operate profits from Parastatals

- Increasing taxes to get more tax revenue to clear the debt

- creating a sinking fund

- Use of a surplus budget

Ways of Clearing (Paying back) the external debt

- Use of foreign exchange reserves in the central bank

- Selling government investments abroad.

- Use the export promotion strategy to increase on export and export earnings.

- Debt conversion

- Debt canceling

- Debt retirement

- Debt

- Debt repudiation

- Creation of a sinking fumets

- Use of grants

Causes of a huge Public debt (budgetary deficits) in Uganda (LDC’s)

- Low tax base. This is due to a narrow range of tax sources which limit the tax revenue. This forces the government to borrow hence a huge public

- High levels of inflation in the country. This leads to loss of the real value of the government revenue making it difficult to finance the estimated expenditure hence

- Persistent debt servicing. The need for the government to repay the debts contracted in the past forces it to continue borrowing hence a huge public

- Great demand for investment in the presence of low savings. This forces the government to borrow in order to close the savings investment gap through borrowing hence a huge public

- Political instabilities and insecurity in the country. This forces the government to borrow in order to finance wars and maintain the army hence increasing the public debt burden.

- Increased expenditure on the adverse effects of unforeseen circumstances. For example famine, drought, floods, epidemics etc. This forces the government to borrow in order to cater for people affected by such

- Under taking over ambitious projects like Universal Primary Education (U.P.E), Universal Secondary Education (U.S.E), and Poverty alleviation programs etc. without enough resources. This forces the government to borrow hence a huge public

- Misuse of public funds through corruption and embezzlement. This leads to wastage of scarce government resources meant for productive activities hence continued borrowing.

- Huge government administrative expenditure in form of salaries and other allowances on politicians and civil servants. This is reflected by a big parliament cabinet. This forces the government to borrow in order to meet such recurrent ·

- The large number of government activities. For example presidential and parliamentary elections, presidential trips which require too much spending hence borrowing.

- High population growth rates leading to high dependence burden. This forces the government to borrow in order to cater for the social needs of the rapidly growing population e.g. education, medical care

- Excessive capital out flow inform of profit repatriation. This leads to loss of public revenue hence balance of payment deficits for the

Measures to reduce the budgetary deficits (Curb the huge public debt) in Uganda

- Use of the Privatization This can help reduce on government expenditure on non performing Parastatals hence reducing the budgetary deficits.

- Cost sharing especially in providing public services to the people. The cost of providing social services can be shared between the government and the people as a way of reducing government expenditure.

- Widening the tax base. This can be done by creating a variety of taxes on different economic activities as a way of increasing tax revenue g land tax.

- Trade liberalization. This not only encourages competition but also to promotes efficiency and proper resource use in the economy. This leads to improvement in the quality and quantity of exports hence more export

- Reducing borrowing for dead weight debts. Borrowing should be restricted to investments in productive ventures which can be used to generate more income and savings necessary for economic growth and

- Maintaining political stability and security in the country. Democratic governance should be promoted and practiced. In addition peace talks and amnesty laws should be respected as a way of promoting peace in the This can also help to reduce defense spending.

- Export promotion policies g. improving on the quantity and quality of exports through value addition. This can help to increase on foreign exchange earnings of the country.

- Combining two or three ministries into one as a way of minimizing public expenditure. In addition size of the parliament can also be reduced and the creation of new districts can be stopped to reduce government

- Fighting corruption and embezzlement of government funds by imposing stringent penalties on corrupt

- Controlling inflation through the use of appropriate restrictive monetary and fiscal policies, e.g. increasing the bank rate to reduce money supply in the economy by the central

- Checking on the high population growth rate. This can be done by encouraging people to use family planning methods as a way of controlling population growth.

- Rehabilitation and construction of new social and economic infrastructures especially in rural areas. This can help to facilitate production and transportation of produce to the market areas from which the government can tax to raise

Revision questions

Section A questions

- (a) Distinguish between a surplus budget and a deficit budget ,

(b) Outline two effects of a surplus budget on an economy

2. Mention four ways of financing a deficit budget

3. (a) What is meant by a national budget?

(b) State four objectives of a national budget

4. (a) Distinguish between external public debts and internal public debts.

(b) Give two demerits of external borrowing to the economy.

5. Distinguish between the following terms

(a) Reproductive debt and dead weight debt .

(b) Funded debt and unfunded ebt.

(c) Debt redemption and debt rescheduling

(d) Debt Conversion and debt retirement

6. (a) Distinguish between Balanced budget and a deficit budget.

(b) Give two ways of financing a deficit budget in an economy.

7. (a) Distinguish between a public debt and a national

(b) Mention two ways of redeeming a public debt in your country.

8. (a) Distinguish between public debt and national debt

(b) Suggest two ways in which an external public debt may be cleared.

9. (a) What is meant by public debt management?

(b) Mention three tools of public debt management in your country.

10. Mention four objectives of public debt management.

11. (a) Distinguish between the internal debt and external debt

(b) Mention two reasons why countries incur public debts

12Give any four sources of public debts in an economy

Section B questions

- (a) Distinguish between a balanced budget and unbalanced

(b) How can the national budget be used an instrument of fiscal policy?

2. (a) Account for the persistent budgetary deficits of your country

(b) Suggest the measures that should be taken to reduce the huge public debt in your country

3. (a) Distinguish between a balanced budget and a surplus budget

(b) Outline the effects of a surplus budget on an economy

4. Explain the role of the national budget in the development process of your country

5. (a) Distinguish between a balanced budget and unbalanced

(b) Why is it difficult to achieve a balanced budget?

6. Explain why the government may plan for;

-

- a surplus

- a deficit budget

7. (a) Why do countries borrow?

(b) Explain the ways of clearing;

(i) Internal public debt

(ii) External public debt

Dr. Bbosa Science +256 778 633682