Economic Chapter 4: National income

Definition of national income

National income is the measure of the total monetary value of all goods and services which arise from the economic activities of the country in a given time, usually one year. When estimating national income, the following points should be noted:

- National income is a flow and not a stock of goods and services. The output of goods and services is a continuous process so that in trying to measure what is produced, we are dealing with a flow and not a stock of goods and services. This flow should therefore be measured over time, usually in one year.

- National income includes goods as well as services. Therefore production is defined as any economic activity which leads to the creation of utility in goods and services in order to satisfy human wants (needs) and for which people are prepared to pay the price.

- National income is measured in monetary terms. However it is the value of the commodity which is important and not the money itself.

- National income figures exclude incomes/rom illegal activities like prostitution and gambling.

- Only the market prices of the final goods and services are considered, This is intended to avoid double counting since production takes many stages before reaching the final consumer,

- Income should be derived from goods and services arising out of productive activities. Therefore incomes received for no work done for example pocket money for students, pension, unemployment benefits, bursaries, gifts from friends and organizations (transfer payments) should be excluded when estimating national income.

- Incomes should be from transactions of a particular current period. Those arising from periods other than the current period should be excluded.

Determinants of national income

- The level of investment both domestically and externally. The higher the level of investment, the higher the level of national income but a low level of investment discourages the production of goods and services hence low levels of national income.

- The level of exploitation and utilization of the available natural resources. The higher the level of utilization of natural resources like minerals and water resources in the economy, the higher the level of national income and the lower the level of utilization of natural resources, the lower the level of national income.

- The size and quality of the labour force (working population). Presence of a big and skilled labour force increases production of goods of services which leads to an increase in national income. On the other hand, a small-unskilled labour force discourages production hence low levels of income

- Level of capital stock. Availability of capital in form of machinery and equipment increases the level of output and national income while presence of limited capital stock limits production hence low level of National Income.

- The level of technological progress. Use of better and improved technology increases production at reduced average costs hence giving a bigger size of national income. On the other hand, uses of poor production techniques reduce output hence low level of national income.

- Degree of political stability. Political stability encourages investment and growth of national income while political instability leads to break down in production by discouraging investment hence a small size of national income.

- Market size within and outside the country. The large market encourages investors which lead to the production of more goods and services hence increasing national income. But a small market discourages investment and production hence low level of national income.

- The level of monetization of the economy. The higher the level of monetization of the economy, the higher the level of national income. But a large subsistence sector discourages production and exchange hence low levels of income.

- Level of specialization in production. The higher the level of specialization in the economy, the higher the level of national income and the lower the level of specialization, the lower the level of national income

- The level of entrepreneurial ability. Presence of individuals who can organize and mobilize other factors of production leads to an increase in production hence an increase in national income and absence of entrepreneurial skills discourages production hence low levels of national income.

- Degree of economic stability. A country which is economically stable in form of stable prices of goods and services encourages investments hence increase in the level of national income. But existence of high levels of inflation discourages investments hence low levels of national income.

- Level of saving

- Land tenure system

Concepts (terms) used in national income

- Gross Domestic Product (GDP). This refers to the money value of all [mal goods and services produced within the geographical boundaries of the country by both nationals and foreigners in a given time, usually one year including the value of depreciation.

GDP=C+I+G

Where, C= Consumption (Household) sector; I = Investment (Business) sector and G = Government sector

- Gross National Product (GNP). This refers to the money value of all final goods and services produced by nationals living within and outside the country in a given time, usually one year including the value of depreciation.

GNP = C + 1+ G+( X – M)

(X – M) = net property income from abroad

- Net property income (NPY). This is the difference between the property (factor) incomes earned by the country’s nationals from abroad and the property incomes paid by nationals abroad NPY = GNP-GDP

- Depreciation (Capital consumption allowance). This refers to the amount of money (funds) put aside to replace the worn-out (obsolete) parts of capital assets used in the production process.

- Net Domestic Product (NDP). This refers to the money value of all final goods and Services produced within the country by both nationals and foreigners in a given time usually one year excluding the value of depreciation.

NDP = GDP – Depreciation

- Net National Product (NNP). This refers to the money value of all final goods and services produced by nationals living within and outside the country in a given time, usually one year excluding the value of depreciation.

NNP = GNP – Depreciation

- Gross Domestic Product at Market price (GDPmp). This refers to the money value of all final goods and services produced within the country by both nationals and foreigners in a given time usually one year including the value of depreciation, valued at current market prices of goods and services

GDPmp = GDPfc + Indirect taxes – subsidies

- Gross Domestic Product at factor cost (GDPfc). This refers to the money value of all final goods and services produced within the county by both nationals and foreigners in a given time usually one year including the value of depreciation, valued at prices of factors of production

GDPfc = GDPmp + subsidies – indirect taxes (outlays).

- Gross National Product at Market price (GNPmp). This refers to the money value of all final goods and services produced by nationals living within and outside the country in a given time, usually one year including the value’ of depreciation, valued at current market prices of goods and services

GDPmp = GNPfc +Indirect taxes – Subsidies

- Gross national product at factor cost. This refers to the money value of all final goods and service produced by nationals living within and outside the country in a given time, usually one year including the value of depreciation, valued at prices of factors of production

GNPfc = GNPmp + Subsidies – Indirect taxes (Outlays)

- Net Domestic Product at Market price (NDPmp). This refers to the money value of all final goods and services produced within the country by both nationals and foreigners in a given time usually one year excluding the value of depreciation, valued at current market prices of goods and services

NDPmp = NDPfc + Indirect taxes – Subsidies

- Net Domestic Product at factor cost (NDPfc). This refers to the money value of all final goods and services produced within the country by both nationals and foreigners in a given time usually one year excluding the value of depreciation, valued at prices of factors of production

NDPfc = NDPmp + Subsidies – Indirect taxes (Outlays)

- Net National Product at Market price (NNPmp). This refers to the money value of all final goods and services produced by nationals living within and outside the country in a given time, usually one year excluding the value of depreciation, valued at current market prices of goods and services

NNPmp = NNPfc + Indirect taxes – Subsidies

- Net National Product at factor cost (NNPfc). This refers to the money value of all final goods and services produced by nationals living within and outside the country in a given time, usually one year excluding the value of depreciation, valued at prices of factors of production

NNPfc = NNPmp + Subsidies – Indirect taxes (Outlays)

- Personal income. This is the amount of money income received by individual house hold over a given time

- Disposable income. This is the income that is available to house holds for spending and saving after personal income taxes and other compulsory payments (for example NSSF) have been deducted from the gross income.

- Disposable income =Gross income – Direct taxes -Compulsory Payments + Transfer Payments

- Transfer payments. These are payments made to individuals or institutions without any corresponding economic activity done. For example gifts, pocket money, pension, donations etc.

- Nominal National income. This refers to national income expressed in monetary terms. OR. It refers to national income valued at current market prices of final goods and services without adjusting for price changes.

- Real national Income. This is the purchasing power of nominal national income. It is the amount of goods and services that nominal national income can purchase at a given time.

![]()

Adjustments in National income Figures

- From gross to net figures, subtract depreciation value (capital consumption allowance).

- From net to gross figures, add depreciation value (capital consumption allowance).

- From domestic to national, add net property income from abroad

- From national to domestic, subtract net property income from abroad

- From factor cost to market price, add indirect taxes and subtract subsidies

- From market price to factor cost, subtract indirect taxes and add subsidies.

Example 1

Given GDP at market price what adjustment can be made to arrive at NNP at factor cost?

Solution

NNPfc = GDPmp+ (X – M) – Depreciation +subsidies +Indirect taxes

Example 2

Given that GDPmp = 100 million, Depreciation = 8 million, Subsides = 15 million, Out lays = 20 million, Net property income ( NPY) = 12million. Calculate the following.

(a)GNPmp (b)GDPfc (c)NDPfc (d)NDPmp (e)NNPmp (f)GNPfc (g)NNPfc

Solutions

(a)GNPmp =GDPmp +Net property Income

= l00million +15million – 20million

= 112million

(b)GDPfc =GDPmp + Subsidies-Outlays

= l00million + 12million

= 95million

(c) NDPfc = GDPfc – Depreciation

= 95million -8million

= 87million

(d) NDPmp= GDPmp– Depreciation

= 1OOmillion- 8million

= 92million

( e) NNPmp = GNPmp– Depreciation

=117million – 8million

= 109million

(f) GNPfc =GNPmp + Subsidies – Outlays

= 112million +15million – 20 million

= 107million

(g) NNPfc = GNPfc – Depreciation

= 107million – 8million

= 99million

Methods (approaches) of measuring national income

- Income approach

- Expenditure approach

- Output(product/value added) approach

Income approach

Here the incomes received by factors of production are added. Such incomes include rent, salaries, wages, interest and profits in a given period usually a year.

National income = wages (w) + rent(r) + interest (i) + profits (p)

Note.

In order to avoid double counting, transfer payments are excluded from measuring national income using this approach

Transfer payments refer to incomes received by individuals or institutions without any economic exchange of goods and services, e.g. pension, gifts, donations etc.

Limitations (Problems) of using income approach in estimating national income

- Lack of information. Many people are self-employed and they are not willing to declare their income. This leads to under estimation of national income.

- It is difficult to estimate incomes earned from abroad

- Transfer payments are difficult to identify and yet when included lead to double counting.

- Depreciation incurred during the year is difficult to determine yet an allowance for this must be included when estimating national income. Depreciation represents the cost of production since the asset must be replaced when it becomes completely won out.

- It is also difficult to identify incomes from illegal activities since they are not supposed to be included in estimating national income

- Shortage of qualified and motivated manpower to compile data

Expenditure approach

Here we add up the value spending on all final goods and services. Such expenditures include consumption, investment, government expenditure and net exports in a given period usually a year

The approach centers on the component of [mal demand which generates production

NY =C+I +G+(X-M)

Where C = Expenditure by private consumers (Households)

I = Expenditure by firms on capital goods

G = Expenditure by government on services like education, health, infrastructure etc.

X – M = Net export earnings from abroad

Export (X) are included because they lead to inflow of income while Imports (M) are excluded because they lead to outflow of income

Limitations (Problems) of using the expenditure approach

- Government utilities like roads, security etc. are usually subsidized and thus it is difficult to determine their actual value.

- Net exports and income earned from abroad are not easy to determine. For example foreign exchange from smuggled output is unknown; some income earned abroad is not declared and therefore not recorded.

- There is insufficient funds and facilities to compile data

- Illegal activities e.g. prostitution, gambling, smuggling generate income which is difficult to measure.

- The effect of inflation is difficult to adjust and is likely to be misinterpreted to mean increase in output.

- It is difficult to differentiate between expenditure on final and intermediate goods yet it is only expenditure on final goods which must be included. This is because people do not keep records.

- Lack of information on private consumption and investment expenditure

- Difficult to identify expenditure on transfer payments which is supposed to be excluded when estimating national income

Output (product/value added) approach

This is the most direct and preferred method of estimating national income. It involves summing up the contributions (value added) of all firms or sectors at each stage of production of final goods and services in the economy. This is done in order to avoid double counting. Value added is the contribution made to the value of the final product at each stage in the production process

Example to illustrate value addition (Stages in production of the final cloth)

| Stages

Cotton sold |

Cost(shs)

6000 |

Value ‘added (shs)

6000 |

| Middlemen transport | 6500 | 500 |

| Ginneries | 7000 | 500 |

| Weaving | 8000 | 1000 |

| Dying | 8100 | 100 |

| Final Cloth | 9000 | 900 |

| Total | 46000 | 9000 |

To get the total value of output, we do not simply add the value of all these transactions to obtain the total of 46000. This would involve double counting because the value of these stages is included in the price of final good (cloth). To avoid double counting, the value added at each stage of production is considered which is equivalent to 9000.

Limitations (problems) of using the output approach

- Non-monetary output; commodities which are not taken to market are difficult to give value e.g. subsistence output, work done by house wives, leisure foregone when work is done, houses built by owners.

- It is difficult to determine when output was produced e.g. perennial crops.

- The effect of inflation is difficult to adjust and is likely to be misinterpreted as increase in output.

- There are difficulties of determining what to include and what to exclude (subsistence output) and determine methods of valuing different items.

- Lack of information on what is produced by all enterprises or sectors within a year in the economy

- There is problem of double counting due to failure of distinguishing between intermediate goods and final goods. This results into counting the value of the item more than once hence over estimating national

- Problem of inventories. Inventories are goods produced but not sold in the previous The value of such goods is not supposed to be included when estimating the national income of the current year.

Why most developing countries prefer to use the Product approach

- Data on output is readily available as compared to data on income and expenditure

- Individuals are willing to reveal information on output than on income and expenditure

- It eliminates double counting since only value added is considered

- The approach is not affected by transfer payment as for the case of income and expenditure approaches.

- It does not include the effects of illegal activities

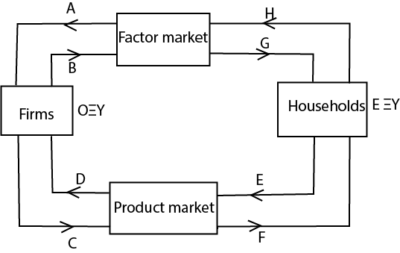

Circular flow of income

Circular flow of income

A simple circular flow of income describes how incomes in a two sector economy flow between households and firms. Each time an item is produced and sold, it is observed that its value is equal to the consumer’s expenditure (Expenditure Approach). The same, amount of expenditure is received as income by various people who contributed to its production (income approach). And the same value of expenditure is as a result of value added at various stages of production (value added or product approach).

Therefore, the expenditure, income and output approaches are .supposed to give identical results when estimating the level of national income. That is E ≡ Y ≡ 0

Assumptions of the circular flow of income

- There are only two sectors in the economy that is the households sector (consumers) and business sector (producers).

- There are no leakages and injections in the economy.

- Households are the only owners and suppliers of factors of production.

- All the income received by households is used to buy goods and services.

- Firms (business enterprises) are the only producers of goods and services.

- All output produced by firms is sold in the market

- There is full employment of factors of production

Illustration

- In the figure above, firms demand for factors of production (A) supplied by households (H) through the factor market. In return, the households earn income from the supply of factors of production (G) which is equivalent to the costs of production by firms (B).

- Firms use the factors of production to produce goods and services(C) which are demanded by households (F) through the product market. In return, the firms earn revenue from the sale of goods and services (D) which is equivalent to consumption expenditure by households (B)

Importance/use national income statistics

- National policy analysis. National income data forms the basis of national policies such as employment policy. The figures enable the government to determine the direction in which the industrial output, investments and savings change such that proper measures can be adopted to match population growth and economic growth. .

- National development planning and budgeting. National income figures are important in economic development planning. It is essential that data concerning output, savings and consumption is made available if planning and budgeting is to be effective.

- Research purposes. National income statistics are used by researchers in the area of economics and other scholars to carry out research. They make use of-the data about the country’s output, incomes and expenditures obtained from national income accounts to determine and predict relationships between economic variables.

- Determination of standards of living. National income data is used in measuring the countries per capita income which is good indicator of the economic welfare of the people.

- Determination of the nature of income distribution. National income statistics are used to show income distribution among sectors and regions of the economy. From the data relating to wages, rent, interest and profits, the disparities in the incomes among different groups of people and regions in society is determined. This enables the government to come up with corrective measures to reduce income inequalities.

- International comparisons, National income figures are used to compare the growth rates of different sectors, regions and countries.

- National income figures are used to show the contribution made by different sectors of the economy to development especially when the output method is used. This helps to identify which sectors are lagging behind such that appropriate policies are designed to improve on their performance.

- National income figures are used to show the rate of resource utilization in the economy. The increase in national income is as a result of increased utilization of natural resources in the economy.

- They show the pattern of expenditure by the private sector and the government. This is shown by figures of private expenditure which is important in making the National budget where there is need to balance between private and public expenditures.

- National income figures are used to attract foreign investment into the country. National income figures are an indicator to the outside world about the performance of the economy. High and increasing national income figures encourage foreigners to invest in the economy.

- National income figures are used to solicit for foreign aid. Donor countries and other financial organizations base on national income figures to give foreign aid.

Problems involved in calculating (estimating) National income

- Inadequate accurate and unreliable statistical data. There is always inadequate information due to limited facilities like computers and lack of proper record keeping by producers and consumers.

- Double counting. This refers to counting of the value of the item more than once when estimating national income. It is as a result of failure to distinguish properly between the final goods and intermediate goods. It also occurs when government gifts and pension which should be excluded as transfer payments are included in national income figures. This leads to over estimation of national income figures.

- Difficulty in determining the boundary of production. This is concerned with which items should be included or excluded when estimating national income. This is particularly a problem due to failure to define some services for example whether child labour or the services of a house wife should be included or excluded from the estimation of national income.

- Price changes (Inflation). This is a problem because price changes affect the value of national income. When there is inflation, national income shows an increase yet the real production of goods and services might have reduced hence over estimation of national income.

- It is difficult to measure depreciation: This makes it difficult to determine the net income because firms use different methods of measuring depreciation

- Problem of non-marketed It is difficult to estimate the monetary value of goods and services which are not put in market. Such values have to be imputed for inclusion in the national income estimation. For example the services house wife, owner occupied houses, leisure foregone when income is earned and subsistence output

- Poor social and economic For example inaccessible roads, poor communication networks and limited banking facilities limit the national income estimation exercise.

- Omitted market In an economy, a large number of transactions take place in the market but not all transactions are included in estimating national income. Omission of transactions leads to under estimation of national income figures.

- Inadequate skilled and qualified personnel. There is a limited number of staticians, economists and accountants required to collect, compute analyze and interpret national income figures.

- Difficult in measuring Net income from abroad. This is difficult to determine since import and exports are carried out by many individuals, with little data available to verify the, amount imported, and exported by private firms and At times it is difficult to identify the smuggled commodities. In addition, some nationals stay abroad and take up jobs illegally, making it difficult for the government to determine their actual contribution to national output.

- Problem of timing of production. It is very difficult to determine output produced in the country during a particular This is true especially for agricultural output in which it becomes hard whether to consider the time of production or the time of harvesting when estimating national income.

- It is difficult to determine the actual value of public utilities. This is because they are usually subsidized by the government

- It is difficult to identify inventories due to overlapping

- It is difficult to identify incomes from illegal activities such as smuggling, gambling, prostitution etc. Such income is not supposed to be included when estimating national income.

- Inadequate facilities and equipment used to collect, analyze and estimate For example there is shortage of funds and computers required to carry out the exercise successfully.

- Political instabilities and insecurity in some parts of the country. This makes it difficult to access some parts of the country to collect data for purposes of estimating national income

Cause of low level of national income in developing countries

- low level of natural resource exploitation

- small size of the market

- low level of infrastructural development

- political instabilities

- high population growth rate

- low level of income

- low levels of saving

- high inflation

- large subsistence sector

- low level of education

- low levels of techology

- high corruption

- negative attitude towards work

- high dependence of foreign aid

- low levels of industrialization

Measures to increase the level of national income

- Increase the level of exploitation and utilization of national resource

- Expand/widen market for good and services

- modernize/commercialize agriculture

- encourage further diversification of agriculture

- improve entrepreneurship skill through education/training

- encourage further privatization of public enterprises

- offer investment incentives to attract foreign investors

- ensure political stability

- ensure economic stability/control inflation

- liberalize economy

- undertake land reforms

- offer cheap credit facilities.

Reasons to stabilize agricultural prices

- to stabilize incomes of farmers

- to stabilize balance of payment

- for stabilize government revenue

- to stabilize foreign exchange earnings

- to control rural-urban migration

- to minimize unemployment

- to discourage speculations in the agriculture

- to ensure stable foreign exchange rate

- to encourage investment in agriculture

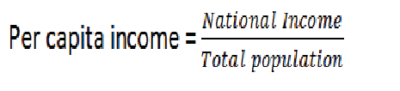

Per capita income and standards of living

- Per capita Income refers to the average income of the individuals of a country in a particular year.

- Standard of living. This refers to the level of economic welfare enjoyed by a person; family or nation which is achieved by consuming a variety of goods and services, including leisure, security, accommodation, employment, freedom, self-esteem and human

- Cost of living. This refers to the amount of money required to buy goods and services to sustain a given standard of living .

- Since income per capita shows the volume of goods and services available to an individual in a given period usually one year, it is often used to measure the standards of living of citizens in a particular It is also used, to compare standards of living between countries. However, there are many limitations in using per capita income to measure the standards of living in a given country.

Limitations of using per capita income in measuring standards of Living

- Per capita income does not reveal the nature of distribution of income. Per capita income figures may be high when there is high degree of income inequality in the economy. The high income figures may be as a result of a few rich individuals yet the majority of the population is poor.

- High per capita income may be, as a result of increase in prices of goods and services in the country due to inflation. This may, not necessarily show an improvement in standards of living.

- Per capita income does not consider the amount of leisure available to citizens in the country. Output may increase as the result of over working labour which does not reflect a high standard of-living.

- Per capita income does not show the degree of freedom, security and self-esteem enjoyed by the citizens. Per capita income figures may be high when the majority of the population have no freedom and have low esteem.

- Per capita income does not reflect the level of unemployment in the country. The per capita figures Play be high as a result of using capital intensive techniques of production yet the majority of the people have no jobs.

- The county’s per capita income may increase as a result of producing capital goods at the expense of consumer goods which do not improve directly the standards of living of the citizens.

- Per capita income does not show the quality of goods produced in the economy. The per capita income figures may be high yet the quality of the products produced in the country is poor.

- Per capita income does not consider other factors which contribute to the standards of living. For example per capita income may increase when there is high level of pollution; accidents and political wars in the country.

- Per capita income may increase as a result of underestimating population figures. This does not necessarily imply high standards of living.

- Per capita income may be low due to the presence of a large subsistence sector. Output from the subsistence sector may not be included when estimating national income yet goods and services produced under this sector contribute to the welfare of the

Limitations of using per capita income in comparing standards of living between countries

- Differences in income distribution. Per capita income does not show the nature of income distribution in the different countries. A country may be having a high level of per capita income yet there exists high levels of income inequalities

- Differences in the quality and composition of goods and services consumed in different countries. A country may be having a high per capita income when the economy is concentrating on the production of capital goods which do not directly contribute to the welfare of the people.

- Differences in the accuracy and tools used to estimate population and national income figures. The country’s high per capita figures may be as a result of under estimating the population figures and over estimating national income figures and this may not necessarily reflect better standards of living

- Differences in the levels of inflation (prices).The per capita income may be high when the general price level of goods and services in the country is high. This does not necessarily imply high standards of living but high cost of living in the country;

- Differences in the size of the subsistence sector. The per capita income figures may be low due to the existence of a large subsistence sector in the country. This is because it is difficult to include subsistence output when estimating national income. This does not necessarily imply low standards of living.

- Differences in production and transport costs. The per capita income may be high when the country is High production and transport costs. This does not imply better standards of living.

- Differences in the amount of leisure enjoyed in the two countries. The country may be having high per capita income figures at the expense of leisure. This leads to low standards of living

- Differences in non-material benefits enjoyed by the people, for example freedom of expression and self-esteem which is not reflected in the per capita The per capita income figures may be high when the citizens are not allowed to freely express themselves.

- Differences in availability of social services like education, health and communication services. The country’s per capita income figures may be high when social services are either of poor quality or inadequate. This does not imply better standards of living.

- Differences in the levels of employment. Per capita income figures may be high when there are more unemployed people in one country as compared to the other. This does not imply better standards of living in that country.

- Differences in tastes and preferences. The per capita income of the country may be high when the goods and services produced do not meet the tastes and preferences of the consumers.

- Differences in boundary of production. The per capita income of the country may be high when certain items are included in the calculation of national income and yet they are excluded from another country. This does not imply low standards of living in the country where they are excluded. For example incomes from gambling and

- Differences in currencies. Countries use different currencies and therefore their per capita income figures appear in different A country may be having high per capita income figures when the exchange rate value of its currency low as compared to another country. This does not imply high standards of living.

- Differences in the methods used to measure national income. The per capita income figures may be high when the country uses the expenditure approach instead of the output The high expenditures may be as a result of the high prices of goods and services which does not reflect high standards of living.

- Differences in political climate between countries. The per capita income figures may be high when the country is experiencing political instabilities especially when the country uses the expenditure approach of measuring national This does not imply better standards of living.

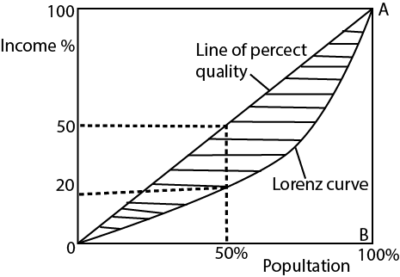

Income distribution

Income distribution refers to the extent to which various social economic groups are able to access incomes in a given country. This is reflected in the investment and consumption patterns.

Income inequality (disparity) refers to the economic gap between the rich and the poor within the same country. The income disparities can be illustrated by the use of a Lorenz curve .The Lorenz curve shows the relationship between the population and its relative income share.

- The diagonal line OA (line of perfect equality) in the figure above shows that any point on the diagonal, any income received is exactly equal to the percentage of the population that receives it. Therefore the diagonal1ine represents perfect equality in the distribution of national income.

- However, in reality perfect equality does not exist even in socialist economies. This illustrated by the Lorenz curve which shows the actual income ‘distribution between the percentage recipients and the percentage of the total income they receive in a given time

- The more the Lorenz curve lies away from the perfect equality line, the greater the degree of income inequality

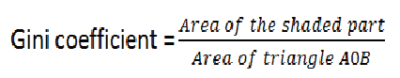

The Gini – coefficient

The Gini coefficient (Gini index or Gini ratio) is a statistical measure of economic inequality in a population. It is the ratio of the area between the line of perfect equality and the Lorenz curve to the total area of the square below the Lorenz curve.

In the figure above, the gini – coefficient is the ratio of the shaded area to the total area of the triangle OAB

The gini – coefficient varies from zero to one. The higher the coefficient, the higher the degree of income inequality.

Causes of Income Inequalities

- Difference in talents (natural ability) those who are naturally talented e.g. footballers, musicians usually earn higher incomes than their counterparts that are not talented.

- Differences in resource endowment. Places rich in productive resources usually earn more than others

- Differences in opportunities/luck: people with good paying jobs earn more than others with low paying jobs

- Level of education and training; highly educated and well- trained people tend to earn more than those with low education and training e.g. Doctors versus nurses.

- Differences in physical and mental abilities; the mentally sound and physically strong tend to have ability and willingness to work and hence have higher incomes compared to those that are insane and physically weak

- Differences in age, sex, tribe and race; labour discrimination is based on these factors to determine individual income.

- Inheritance; those from rich families inherit and get rich unlike those from poor families.

- Differences in wages; some people earn higher wages compared to others

- Differences in infrastructure distribution. Area with even distribution of infrastructure tend to have high productivity hence higher incomes than others with under developed infrastructures

- Differences in mobility of factors of production; mobile factors of production can easily move from areas of low payment to areas of high wages unlike immobile factors of production.

- Political stability/climate; areas that are politically stable attract investment than those that are unstable.

- Influence of trade unions. Strong and sound trade unions agitate for favorable conditions of work.

- Government policy; government tend to favor some parts of the country when allocating resources. These get higher incomes

- Uneven distribution of industries between urban and rural area. This is as a result of concentration of industries and other social infrastructures in urban areas which leads to imbalances in income generating activities in favor of urban areas hence income

- Poor land tenure system; land is not evenly distributed making those with land to produce and earn income than those without.

- Globalization – Lesser-skilled Ugandan workers have been losing ground in the face of competition from workers in Asia and neighboring countries.

- Skills– The rapid pace of progress in information technology has increased the relative demand for higher-skilled workers.

- Social norms –CEO pay is very much higher than a normal worker

Advantages (Merits) of income inequality

- It increases efficiency in resource allocation. The major aim of private firms is profit maximization Therefore, they employ efficient techniques of production which leads to the production of more goods and services hence economic growth and development.

- It encourages competition in production. This leads to the production of high quality goods and services at reduced prices hence better standard of living.

- The system facilitates investment, exploitation and utilization of resources in the economy. This increases the production of goods and services hence economic growth and development.

- It leads to the production of a wide range of commodities. This widens the choice to the consumers hence better standards of living through utility maximization.

- Generates government revenue. The rich are taxed more than the poor through progressives taxation and enable government to get more tax revenue.

- Encourages hard work

- Income inequality guarantee labour supply to unattractive jobs like toilet cleaning

- Income inequality encourages geographical labour mobility where individuals move from one place to another in search for better opportunities.

- Encourages better working relation where employees respect their rich employers.

- It helps to create more employment opportunities. The high profits are made by private individuals are used to expand business activities hence creating more employment opportunities.

- It encourages development of entrepreneurial skills in the economy. This is because it promotes individual initiatives and creativity.

- It reduces government expenditure in form of administrative costs. This is because it does not require government officials to monitor the economic activities.

- It encourages technological progress. This is achieved through inventions and innovations due to competition among private individuals, This leads to the production of better quality goods and services. .

- It promotes consumer sovereignty in the economy. This is because consumers are given freedom to decide on what to consume.

- There is no resource wastage during the production process. This is because resources are allocated with the aim of maximizing profits.

Disadvantages (demerits) of income inequality

- Rural-urban migration in search of better pay.

- Worsen dependency burden: majority of the poor depend on the rich for sustenance.

- Limits domestic market; a situation where the majority is poor; they tend to have high MPC and low saving and investment reducing productivity.

- It increases government expenditure to support the majority poor in form of social services like education and health.

- Income inequality leads to balance of payment problems because of increased importation to satisfy the rich’s needs.

- There is over exploitation of the poor by the rich.

- Loss of human capital through brain drainage where skilled individual move out of the country in search for better opportunities.

- Income inequality leads to profit repatriation when the rich are foreigners. This leads to slow development.

- Misallocation of resources in the country where most productive resources are channeled towards the production and importation of luxuries for the rich leaving the poor with no essential goods.

- Encourage social evils and high crime rate such as prostitution and theft by the poor for survival.

- Government revenue is reduced especially where the majority is poor.

- Social tension between the rich and the poor.

- Leads to social and economic conflicts between regions causing political instability

- Viscous circle of poverty arises in the poor communities

- Income inequality leads to underdevelopment of social and economic infrastructures such as poorer public health. Living in an unequal society causes stress and status anxiety, which may damage your health. In more equal societies people live longer, are less likely to be mentally ill or obese and there are lower rates of infant mortality.

- Lower average education levels since majority are poor and uneducated.

Policy measures to reduce income inequality

- Adoption of progressive taxation. High taxes should be imposed on the rich and the income earned from such taxes should be used to subsidize the poor.

- Land reforms. Land ownership and use should be changed from individual ownership to communal ownership system so that poor people can have access to productive land and generate income

- Price controls. Government should fix maximum prices to basic goods and services.

- Minimum wages polity of setting and maintaining high minimum wages to increase incomes of the employees.

- If the private market fails to provide enough jobs to achieve full employment, the government must become the employer of last resort.

- When growth is below capacity and the job market is slack, apply fiscal and monetary policies aggressively to achieve full employment.

- Modernization of agriculture. Agricultural sector should modernized to absorb unemployed educated people.

- Infrastructural development throughout the whole country to allow everybody to participate in productive activities.

- Rural development policies such as rural electrification schemes to encourage rural development and curb rural-urban migration.

- Education reforms that encourage job makers rather than job seekers.

- Fight corruption and embezzlement through anticorruption agencies.

- Formation of credit scheme to provide initial capital to businesses.

- Level the playing field for union elections to bolster collective bargaining while avoiding, at the state-level, anti-union, so-called “right-to-work” laws.

- Price stabilization to stabilize real wages

- Population control measures aimed at reducing the high dependence burdens and diminishing returns in agriculture and increase income per capita for farmers

- Decentralization of regions and delocalization of industries ensure even development of the country.

- Promote political stability to encourage investment

- Liberalization of economy to encourage people to freely participate in economic activities as a way to boost their income

Revision questions

Section A questions

1 (a) Distinguish between nominal income and real income

(b )Give any two determinants of real income.

2 (a.) Distinguish between disposable income and personal income

(b) Mention two factors which limit the value of real income in your country.

3 (a) Distinguish between personal income and per capita income

(b) Mention two reasons why per capita income is computed.

4 (a) Define the term National Income

(b) Mention three conceptual problems encountered when compiling national income figures in your country

5 (a) Given GDP at factor cost, how would you derive NDP at market price

(b) State two uses of National income: statistics in your country.

6 (a) Distinguish between Gross Domestic Product and Gross National Product.

(b) Given that GDP at factor cost is 2,500 million, capital consumption allowance is 150 million and Net income from abroad is 800 million. Calculate the net national product.

7 Given the country’s GDPmp = 500m, outlays = 50m, subsidies = 25m, capital consumption allowance = 15m and income from abroad = 125m. Calculate

(a) NNP at factor cost

(b) GNP at factor cost

8 (a) Distinguish between Transfer Earnings and Transfer payment (2 marks)

(b) Mention two sources of Transfer payments. (2 marks)

9 Define the following terms:

(a) Net property income from abroad

(b) Double counting

(c) Depreciation

(d) Inventories

(e:) Transfer payments

10 (a) Distinguish between Net National product and Gross Domestic Product

(b) State two reasons for your country’s preference to use GDP and not NNP.

11 (a) Given a country’s net national product at market price. What adjustments would you make to get the country’s Gross National Income at factor cost.

(b) State two assumptions underlying the circular flow of income.

12 Given that National output at market prices = Shs. 760nbn, Out lays = Shs. 120bn and

Negative taxes= Shs. 72bn. What is the National output at factor cost?

13 (a) What is value added?

(b) How is value added measured in your country 14 (a) What is meant by circular flow of income

(b) Give three assumptions of the circular flow of income.

Section B questions

1 (a) Discuss the methods of measuring National Income,

(b) Explain the importance of compiling National Income data in your country.

2 (a) Why is the computation of National income necessary in your country?

(b) Explain the problems faced when compiling National Income statistics in your country.

3 (a) Explain the factors that limit the high level of National income figures in your country?

(b) Suggest the policies that should be taken to increase the level of National Income in your country?

4 (a) Distinguish between nominal income per capita and real income per capita

(b)Explain why the high income per capita figures may not necessarily imply high standards of living.

- (a) Distinguish between real per capita income and nominal per capita income.

(b) Explain the problems encountered when using per capita income for comparing the standard of living in the economy overtime.

6 (a) Distinguish between standard of living and cost living.

(b) Account for the low standards of living in your country.

7 (a) Define the term income per capita

(b) The per capita income of Britain is five times greater than that of Uganda. This means that the average Briton is 5 times better off than an average Ugandan. Discuss.

8 (a) Why is inequitable income distribution necessary at early stages of development,

(b) Why is income inequality a hindrance to the development of your country?

9 (a) O ≡ Y ≡ E. Discuss

(b) Explain the factors which limit the size of Uganda’s GDP.

10 (a) Account for Income inequalities in your country

(b) What measures are being taken to ensure equitable income distribution in your country?

11 (a) Explain the factors responsible for income distribution among households in your country.

(b) Examine the adverse implications of income inequalities in your country.

Consumption, savings and investment

Consumption theory

Consumption is the act of using final goods and services to satisfy human needs.

Consumption = Disposable income -savings

Concepts used in Consumption theory

- Autonomous consumption. This is consumption that is independent of the level of income. That is, it is income inelastic.

- Induced consumption. This is consumption which depends on the level of income. An increase in income leads to an increase in consumption and vice versa.

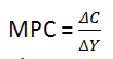

- Marginal Propensity to Consume (MPC). This refers to the proportion (fraction) of the additional income that is consumed. It is expressed as the ratio of a change in consumption (ΔC) to a change in income (ΔY).

The marginal propensity to consume tends to reduce with increase in income. That is, it is high among the low income earners and low among the rich

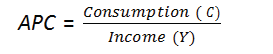

- Average Propensity to Consume (APC). This refers to the fraction of total income that is consumed. It is expressed as the ratio of total consumption expenditure to total income.

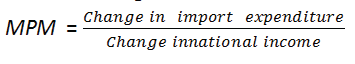

- Marginal propensity to import (MPM). This refers to the fraction (proportion) of additional national income spent on the imports of the country. It is expressed as the ratio of a change in import expenditure to a change in national income

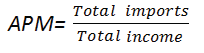

- Average Propensity to import (APM). This refers to the fraction of total national income that is spent on imports. It is expressed as ratio of total expenditure on imports to total national income

Determinants of (Factors influencing) consumption

- Level of disposable Income. The higher the level of disposable income, the higher the level of consumption and the lower the level of disposable income, the lower the level of consumption.

- The level of savings. The higher the level of savings, the lower the level of consumption and the lower the level of savings, the higher the level of consumption.

- The level of wages. An increase in the wage rate leads to an increase in consumption and a reduction in the wage level leads to a fall in the level of consumption.

- Level of direct taxation. An increase in direct taxes reduces the disposable income of people and hence reduces consumption. But a reduction in direct taxes increases disposable income of people and increases consumption.

- Level of government expenditure. Increase in government expenditure for example on transfer payments leads to an increase in consumption and a reduction in government expenditure reduces consumption.

- Rate of interest on deposits. An increase in interest rate on bank deposits reduces consumption and a decrease in interest rates on deposits increases the level of consumption.

- Level of liquidity preference. The higher the level of liquidity preference, the lower the level of consumption and the lower the level of liquidity preference, the lower the level of consumption.

- Consumer’s expectations, An expected future increase in inflation by the consumer increases the current consumption of goods and services but an expected future price fall reduces the current consumption.

- Nature of income distribution. Consumption is low where there is high level of income inequalities. But with fair income distribution, consumption increases.

- Cost and availability of credit. Availability of credit facilities in form of hire purchases, cash discounts etc. Increase consumption and absence of such credit facilities reduce the level of consumption.

- Size of the population. An increase in population leads to increase in the level of consumption but a fall in population leads to a reduction in the level of consumption.

- Level of Inflation in the economy. An increase in the general price level reduces the real value of money hence a fall in consumption. But a decrease in the general price level increases the real value of money which leads to an increase in income

- Level of retained profits. The more profits the company retains in business the lower the level of consumption while the lower the amount of retained profits the higher the level of consumption

Savings

- Savings refer to the part of disposable income that is not spent on the current consumption of goods and

- Dissaving refers to negative It occurs when consumption is greater than disposable income.

Concepts used under the savings theory

- Contractual savings. These are savings where an individual is supposed to save a fixed amount of money in a given time for example per month. They include savings with insurance companies, pension schemes etc.

- Discretional savings. This is where people are not obliged to save a specific amount in a given time for example bank deposits, building societies etc.

- Marginal propensity to save (MPS). This is the proportion (fraction) of the additional income that is saved. It is expressed as the ratio of change in savings (ΔS) to the change in income (ΔY).

![]()

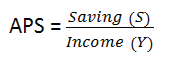

- Average propensity to save (APS) refers to the proportion (fraction) of the total income which is saved. It is expressed as the ratio of total savings to total income.

Note: MPC + MPS = 1

Proof

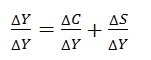

Proof Y = C + S => ΔY = ΔC + ΔYS

Divide through by ΔY

1=MPC + MPS

Determinants of (factors influencing) the Level of savings in the Economy

- Rate of interest on bank deposits. The higher the interest rate, the higher the level of savings and the lower the interest rate, the lower the savings.

- The level of income. The higher the level of income, the higher the level of savings and vice versa.

- The rate of inflation. The higher the rate of inflation, the lower the level of savings. This is because with a general increase in the price level, the real money value reduces hence discouraging people from saving their money in cash form.

- Age of an individual. People tend to save and dissave at different times of their life cycle. Young people tend to save less while relatively older people tend to save for their retirement at old age.

- Degree of occurrence of unforeseen circumstances. Most people put some money aside, if they can, when they expect things like wife’s delivery, sickness, unemployment etc.

- Habits and customs. Some people and societies have a higher saving culture than others for example members belonging to a saving association are more likely to save than those ones who do not belong to any saving association.

- Health status of the person. Ill health discourages savings. This is because it sickly person who is expecting death in the near future will only consume all that he/she has instead of saving.

The investment theory

Investment is the process of devoting part of national income to create capital goods. OR Investment refers to the act of purchasing capital goods and establishing capital assets with the aim of increasing on the level of capital stock in the economy

Net investment. This refers to the total amount of total capital invested minus depreciation (Capital consumption allowance)

Types of investment

Autonomous investment. This is the form of investment which is independent of the level of income. It is influenced by other factors such as war, climate, population growth, labour force, government policy etc.

Induced investments. This is the form of investment which depends on the level of income and profits. The higher the level of income, the higher the level of induced investment and the lower the level of income, the lower the level of induced investment.

Factors that determinants of the level of investment in the Economy

- The level of infrastructural development: well laid and developed social economic infrastructure encourages the level of investment is it is easier to transport raw materials to the factory and finished goods to the market

- The level of interest rate. When the rate of interest rate is low, it becomes cheaper for investors to borrow money from financial institution leading to increased investment.

- Availability and size of the market. Presence of big size market for output encourages investment

- The level of income. Increase in level of income increases the level of saving leading to increase in level of investment

- Political stability increases the confidence and level of investment

- Business expectations. When there is expectation of income boom, the level of investment increases.

- Marginal efficiency of capital(MEC). This refers to the expected return from employing additional unit of capital.

![]()

The high the marginal efficiency of capital the higher the level of investment.

- The amount of liquid assets available to the investor. Physical assets cannot be invested alone. Therefore investors need to have additional liquid assets (cash) to buy raw materials as well as rewarding other factors of production. Thus the more liquid assets available the higher the level of investment.

- Invention and innovation. These normally reduce average cost of production as well as introducing new fashions and products that increase marketability of output. This increases the level of investment

- The government policy. This can take the form of taxation as well as subsidization. When the government offer subsidies to investor and tax holidays, the level of investment increases.

- The need to develop new products such as in telecommunication; increase the level of investment.

- Wage costs; if wage costs are rising rapidly, it may create an incentive for a firm to try and boost labour productivity, through investing in capital stock.

- Depreciation; Some investment is necessary to replace worn out or out-dated equipment.

- Population growth; high population provide market and labour required for investment

- Nature of entrepreneur abilities. High level of entrepreneurial skills increase investment and low entrepreneurial skills in economy discourage investment

The multiplier and accelerator principles

The multiplier

This is the number of times the initial change in a given expenditure multiplies itself to give the final change in income

![]()

Where ΔY = change in income, ΔE= change in initial expenditure

From (i)

ΔY = KΔE …………………………………………………………………………….. (ii)

Note. The size of the multiplier depends on the marginal propensity to consume (MPC) and the marginal propensity to save (MPS). Therefore the multiplier can be expressed in terms of MPC and MPS as follows

![]()

Example 1

Given that in an economy, MPC = 80% and the change in a given expenditure is 200 million. Calculate

- Size of the multiplier

![]()

- Change in final income

Change in income, ΔY = 5 x 200million = 100million

Example 2

Given that a country’s income is 100 million and MPC =0.6.If government expenditure increases from 120m to 600m, calculate the final level of income

![]()

ΔG = 600m – 120 = 480m

Change in income, ΔY = KΔG = 480 x 2.5 = 1200m

Example to illustrate the operation of the multiplier process in an economy

Suppose the government increases investment expenditure by 1m shillings, assuming that money is invested in an industrial project where MPC = 80% (0.8) and MPS = 20% (0.2), using the table below, the multiplier process can be illustrated to determine how much money is created in the economy as follows.

| Time period | ΔY | ΔC(MPC = 0.8) | ΔS (MPS = 0.2) |

| 1 | 1,000,000 | 800,000 | 200,000 |

| 2 | 800,000 | 640,000 | 160,000 |

| 3 | 6040,000 | 512,000 | 128,000 |

| 4 | 512,000 | 409,600 | 102,000 |

| – | – | – | – |

| – | – | – | – |

| – | – | – | – |

| n | |||

| Total | 5,000,000 | 4,000,000 | 1,000,000 |

![]()

Money created, ΔY = KΔE = 5 x 1,000,000 = 5,000,000/=

Types of multiplier

- Income multiplier. It refers to the number of times the initial change in total expenditure (ΔE) multiplies itself to give a final change in income (ΔY)

![]()

- Consumption multiplier. It refers to the number of times the initial change in consumption expenditure multiplies itself to give the final change in income.

![]()

- Investment multiplier. It refers to the number of times the initial change in investment expenditure multiplies itself to generate a final change in national income

![]()

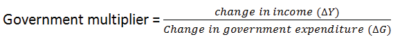

- Government multiplier. It refers to the number of times the initial change in government expenditure multiplies itself to generate a final change in national income.

- Tax multiplier. This refers to the number of times the initial change in taxation multiplies itself to generate a final change in national income

![]()

- Export multiplier (Foreign trade multiplier). It refers to the number of times the initial change in export earnings multiplies itself to generate a final change in national income

![]()

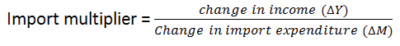

- Import multiplier. It refers to the number of times the initial change in import expenditure multiplies itself to generate a final change in national income

Factors limiting the Multiplier Process in Developing Countries

- High degree of income inequalities. In developing countries, there are few rich people with high marginal propensity to save and low marginal propensity to consume. The majority of the people are low income earners. This reduces the aggregate demand hence low levels of investment.

- Limited resources for investment. In developing countries, there is limited capital and other resources like raw materials necessary for investment and this limits the multiplier process.

- High population growth rates. This results in high dependence burdens and low savings hence low levels investment in developing countries.

- Limited credit facilities for investment. In developing countries, there are few financial institutions and they are concentrated in urban areas. Most people do not have collateral security and therefore cannot access loans from the banks. This leads to low levels of investment.

- Limited entrepreneur skills. In developing countries, there is a limited number of entrepreneurs with the required skills to take on risks and increase investments. This limits the multiplier process.

- Poor social and economic infrastructure. Existence of poor social and economic infrastructure in form of poor roads, poor health facilities and poor communication networks discourage investments.in developing countries.

- Limited domestic and foreign markets. In developing countries; there is limited market for goods and services which discourages investment hence limiting the multiplier process.

- High levels of corruption and mismanagement of funds. The resources meant for investment are used for personal gains and some are mismanaged due to limited skilled personnel. This limits investment and the multiplier process in developing countries.

- Overdependence on imported technology. The use of inappropriate technology imported from developed countries in form of capital intensive technology leads to high levels of unemployment. This limits the number of people involved in production activities hence low levels of investment

- High levels of liquidity preference. Most people in developing countries prefer to keep their wealth in cash or near cash form instead of investing them in income generating activities. This limits the multiplier process.

- Existence of the large subsistence sector in developing countries. There are a limited number of economic activities and this leads to low incomes which cannot support meaningful investments. This limits the multiplier process in developing countries.

- High levels of political instabilities. These create a poor investment climate which discourages the potential investors hence limiting the multiplier process.

- Unfavorable government policies in form of high taxation. These together with other bureaucratic processes which are not clear discourage investments hence limiting the multiplier process.

- Poor land tenure systems. The system of ownership and use of land is mainly based on individuals and makes it difficult for the government to allocate land to potential investors. This limits investments and the multiplier process in general.

Accelerator Principle

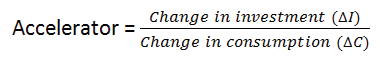

This explains the relationship between consumption and investment. It states that any change in consumption spending leads to a change in investment spending. Therefore; investments are accelerated when there is an increase in consumption in the short run.

The accelerator refers to the number of times the initial change in consumption(ΔC) multiplies itself to give a final change in induced investment(ΔI).

Example 3

In an economy, the increase in consumption of maize from 10,000kg to 20,000kg led to an increase in investment from 50 million to 100 million. Given that the price per kg of maize is 1000/=,

Calculate the accelerator

Solution

ΔC = (20,000 – 10,000) x 1000 = 10,000,000/=

ΔI = 100,000,000 – 50, 000,000 = 50,000,000/=

Assumptions of the Accelerator principle

- There is full employment of resources

- The change in consumption is permanent such at the producers are confident to invest in more capital

- It assumes that producers have no foresight to forecast for increased consumption

- It assumes a closed economy

Limitations of the Accelerator Principle

- Investments in most cases are not always initiated by change in consumption only but also by increase in autonomous government expenditures.

- The principle assumes existence of full employment of resources which is not always the case. Due to the existence of excess capacity in plants, production can be increased by using the idle resources without necessarily increasing investments.

- Due to limited resources like capital in developing countries; investments may not increase even if consumption increases.

- The principle ignores the possibility of importing goods and services from other countries to meet the increased consumption without increasing investments

- The principle ignores the restrictive policies used by the government which are aimed at controlling and regulating the economy. For example use of restrictive fiscal and monetary policies.

Macroeconomic equilibrium and disequilibrium macroeconomic equilibrium

The economy is in equilibrium when there is no tendency for the macroeconomic forces to change.

There are two methods of determining equilibrium national income

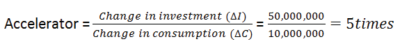

(a) Aggregate demand Aggregate supply approach (Keynesian approach)

(b) Leakages – injections approach (Classical approach)

(a) Aggregate demand – Aggregate supply approach (Keynesian Approach)

- In this case, equilibrium of the economy is determined at a point where aggregate demand equals to aggregate supply at full employment level of resources.

- Aggregate demand is the amount of all goods and services required by all sectors in the economy in a given time. That is the consumers, business sectors, government and the foreign sector.

- Aggregate supply is the total amount of output that all sectors of the economy are willing and able to produce and sell in a given time.

(b) Leakages – injections approach (Classical approach)

In this case, equilibrium income is determined at a point where leakages are equal to injections in the economy. That is Injections = Leakages.

Injections (Additions)are items (elements) which increase the level of circular flow of income.

OR.

Injections are the additions to the circular flow of income. They lead to an increase in the amount of money flowing in the circular flow of income.

Examples of injections include export earnings(X), investments (I) and government expenditure (G) .

Leakages (Withdrawals). These are items (elements) which reduce the level of circular flow of

OR.

Leakages are subtractions from the circular flow of income. They lead to decrease in the amount of money flowing in the circular flow of income.

Examples of leakages include savings(S), import expenditure (M) and taxes (T).

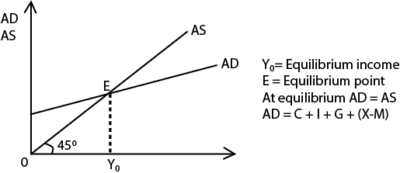

Macro- economic disequilibrium

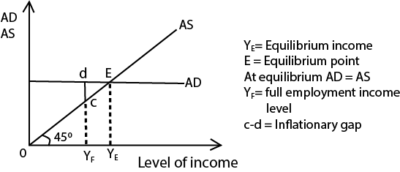

According to Lord Keynes the economy is in dis-equilibrium when aggregate demand is not equal to aggregate supply. This gives rise to either the Deflationary gap or Inflationary gap.

Deflationary gap

Deflationary gap is the amount by which aggregate supply exceed aggregate demand at level of full employment. As shown in the figure below deflationary gap is a measure of amount of deficiency of aggregate demand.

The bigger the gap the national income since the income increases from YE to YF.

Deflationary gap causes a decline in output, income and employment along with persistent fall in prices.

Measures (Policies) to eliminate the deflationary gap

Increase demand or supply through:

- Fiscal policy: the government should reduce taxes on people’s personal income so that they are left with enough disposable income to spend.

- The government should increase her expenditure on social services so as to increase the amount of money in the circulation which leads to increase in aggregate demand.

- There is a need to reduce the interest rates so that people can be encouraged to borrow for consumption which increases aggregate demand

- Government should increase wages as well as encouraging trade unions to demand increases in wages from private institutions to increase aggregate demand

- The government should encourage tourist and immigrants into the country to increase aggregate demand.

- The government should encourage export of excess output to reduce on the aggregate supply and the earnings to increase aggregate demand

- The government should control political instability so that people are encouraged to work and earn incomes to increase aggregate demand

- Adopt expansionary monetary policy: the government through the central bank print or issue more currency to increase the level of aggregate demand.

- Discourage imports which tend to increase aggregate supply and reduce aggregate demand for domestic good and service

- Encourage subsidies, the consumer can be offered subsidies to increase their levels of consumption thereby increasing aggregate demand.

- Reducing direct taxes on incomes of the people. This increases their deposable incomes hence increasing aggregate demand in the economy.

- Improvement in the infrastructure for example transport network to ease movement of surpluses through arbitrage

Inflationary (negative output) gap

Inflationary gap is the amount by which aggregate demand exceed aggregate supply at level of full employment. As shown in the figure below Inflationary gap is a measure of amount of deficiency of aggregate supply.

- The diagram above shows that the bigger the inflationary gap, the smaller the level of national income since income increases from Yf to YE.

- Inflationary gap causes a rise in price level which is called inflation and leads to an increase in employment and income.

Measures (policies) to eliminate the inflationary gap

Decrease aggregate demand or increase supply through

- Reducing government expenditure for example cutting down wages and salaries paid to workers

- Encouraging investors as a way of increasing the production of goods and services

- Increasing direct taxes so as to reduce on the disposable incomes of the people

- Using restrictive monetary policies aimed at reducing money supply and aggregate For example selling government securities to the public and increasing the bank rate.

- Increase interest rates on loans to discourage borrowing

- Discourage the exportation of goods and services which are scarce in the economy

- Encourage importation of goods and services which are scarce in the economy.

- Maximum wage policy aimed at decreasing the wages and salaries of employees so as to decrease aggregate demand in the economy.

- Increase interest rate to discourage borrowing and reduce money supply

- Price control

Price indices

Price index refers to a figure which measures the relative changes in the prices of goods and services from one period which is usually the base year to another period which is the current year.

The magnitude of the percentage change in the price of commodities from the base year to the current year indicates a fall or a rise in the cost of living.

Types of Price Indices

Consumer Price Index (CPI). This is a figure which measures the relative changes in the prices of consumer goods and services used by people. It indicates the real value of money between the base year and the current year.

Cost of Living Index (CLl). This is a figure which measures the relative changes in the prices of

the basic needs of people from the base year to the current year. The percentage change in the prices of basic needs of people between the base year and the current year gives a change in the cost of living.

GNP Index (GNP Deflator). This is a figure that is used to convert the nominal GNP at current market price to real GNP at a base year

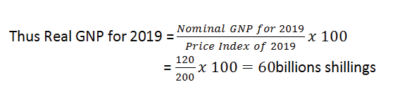

Example 4

Suppose the GNP was 120billion shillings and price index for 2019 was 200. Taking 2012 as the base year, determine the real GNP 2019.

Concepts of Price index

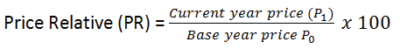

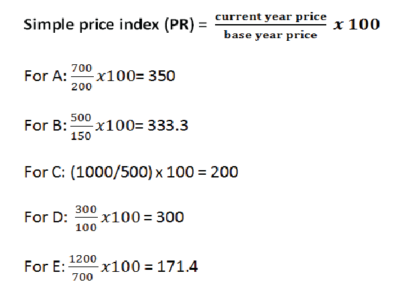

- Price Relatives (PR). This is a figure which measures the relative changes in the prices of a single commodity between the base year and the current year. It is referred to as the price relative because it relates the prices of the same commodity between the two periods.

- Base Year. This refers to the year in which prices were stable as compared to other years. The base year is given an index of 100 which is used as a reference figure to indicate whether there has been a fall or rise in the price of a particular commodity.

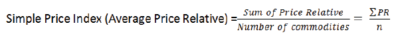

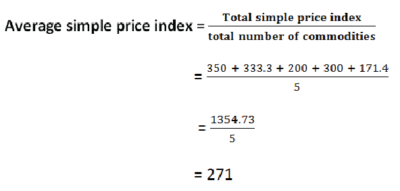

- Simple Price Index (Average Price Relative). This is a figure which measures the relative changes in the prices for a number of commodities between the base year and the current year.

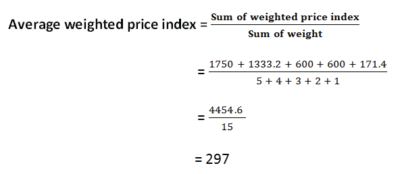

- Weighted Price Index. This refers to the product of the price relatives and the weights attached to the commodities indicating their degrees of importance. The weights can be in terms of the quantities of the commodities consumed, values of items consumed or figures attached to commodities.

Weighted Price Index = Price Relatives x Weights

It is noted that simple price indices (average price relatives) do not tell us much about the relative importance the consumer attaches to the commodities. Therefore weights are used under weighted price indices to indicate the relative importance the consumer attaches on the various commodities (basket of goods) consumed.

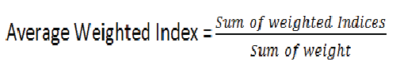

- Average Weighted Index. This is the ratio of the sum of the weighted indices to the sum of the weights. It is given by the formula;

Procedure for Computing Price Indices

- Define the objectives of calculating the price index e.g. wage determination.

- Choose an area where the data is to be collected

- Get the price for each good in a basket ( A basket of commodities are a sample of goods consumed by most people)

- Choose a base year (a year when prices were relatively stable)

- Simple index of the base year should be given unit 100

- Attach weights to each good in the basket

- Obtain prices in the current year

A hypothetical table is shown below

| Commodity | Base year prices | Base year simple index | Current year prices (4years later) | weight |

| A

B C D E |

200

150 500 100 700 |

100

100 100 100 100 |

700

500 1000 300 1200 |

5

4 3 2 1 |

Simple calculation/illustration

Weighted price index = simple price x weight

A: 350 x 5 = 1750

B: 333.3 x 4 = 1333.2

C: 200 x3 = 600

D: 300 x 2 = 600

E: 171.4 x 1 = 171.4

Conclusion

There was overall increase in general price level by 297%

Importance (Uses) of Price Indices