Economic Chapter 8: Monetary and financial systems

Money

Money is anything which is legally acceptable for carrying out transactions and discharge of debts. To settle legal payments, money must be legal tender meaning that it must be acceptable by everyone in the country in the settlement and discharge of debts.

Functions of money

- Money is a unit of account. This means that it is used as a unit of value for carrying out calculations and accounting procedures so as to effect business transactions.

- Money is a medium of exchange. Money makes it possible to determine the value and quantity of commodities to be exchanged hence facilitating business transactions.

- Money is a standard measure of value. Through the use of money, the relative values or prices of commodities can be determined. Money therefore reflects the quantity and quality of goods sold and bought in the market.

- Money is a standard measure of deferred payments (future payments).Money facilitates payments of debts and transactions to some future time. This makes it possible to carry out transactions without immediate cash payments.

- Money is a store of value or wealth. When properties like land or buildings are converted into monetary terms, the money can be stored. This is because money is not bulky and it is not perishable.

- Money helps in the planning process and budgeting. This is because the estimation of costs and benefits of projects is done in monetary terms.

- Money serves as a tool which the government uses in monetary policy. This is because monetary policy involves the adjustment of volume and value of money in circulation in order to bring about general economic stability.

- Money facilitates one way payments. This helps to simplify the misunderstandings between the parties concerned e.g. taxes are paid in monetary terms.

- Money makes it possible for price mechanism to operate since prices are determined in monetary terms.

Qualities (characteristics/features) of money

- Relative scarcity. Money must be relatively scarce. This is because, if it is in plenty it loses value and fails to perform the useful role of exchange.

- Acceptability. Money must be generally acceptable by the public for the discharge of debts and other purposes for which money is needed. The general acceptability is based on the confidence of the population and the concept of legal tender.

- Durability. Money should be able to last longer and it should not be easily damaged or destroyed during the process of exchange.

- Homogeneity (Uniformity). The identical coins and bank notes must look the same and must have the same purchasing power i.e. a 5,000/= note should be similar to all the other 5,000/= notes used in the country.

- Portability (Convenience). Money should neither be too heavy nor too bulky to carry. It must not be heavy relative to its value.

- Divisibility. Money should be easy to divide into smaller denominations without losing value in order to make it possible for smaller transactions.

- Stability in value. Money should have a stable value over a long period of time.

- Hard to forge. Money should be difficult to forge or copy by other individuals. This reduces its supply and the loss of value,

- Identifiable. Money should be easy to recognize and distinguish from fake or forged money.

- 10. Economy. Money should be convenient and cheap for the government to print. The printing costs should not exceed the value of money printed.

Barter trade

This is the exchange of commodities for commodities between individuals or countries. For barter trade to take place, it is necessary to have double coincidence of wants, that is, seeking for one who has the commodity you want and who wants the commodity you have.

Limitations (Problems/Defects) of Barter trade

- It is not easy to establish the double coincidence of wants which satisfy both parties, that is, it is difficult to find one party who exactly has the commodity you want and who wants the commodity you have.

- It restricts the number of transactions that could take place in the economy. This limits trade in the economy.

- It is difficult to measure the relative value of one commodity in terms of another commodity under barter trade.

- It is difficult to store commodities for future exchange especially when the commodities are highly perishable for example tomatoes.

- There is lack of divisibility of some commodities during the exchange process e.g. a person who has a goat and wants maize faces this problem.

- Most of the commodities appear in plenty and therefore, they can easily lose value.

- It does not promote specialization and efficient allocation of resources. This is because there is no common medium of exchange acceptable to both consumers and producers.

- Some commodities are bulky and therefore, it becomes difficult to transport them from one place to another for exchange purposes.

Definitions of concepts

- Token money. This is money whose metal value is less than the face value. For example, coins, paper money etc.

- Intrinsic money. This is money whose metal value is equal to its face value. That is, it is money in terms of metal value. For example gold money

- Commodity money. This is money in terms of the value of commodities. For example beads, tobacco, cowry shells etc.

- Flat money. This is money issued on the directive of the government irrespective of the level of economic activity.

- Fiduciary issue. This is the money issued by the central bank which is not fully backed by gold reserves (foreign exchange reserves) but by government securities.

- Hot money. This is money in liquid or cash form.

- Quasi (Near) money. This is money which can easily be converted into cash. For example cheques, postal orders etc.

- Dear money. This is money borrowed at very high interest rates.

- Narrow money. This is currency circulating in the economy plus demand deposits (demand deposits is money deposited on current accounts).

- Broad money. This is the sum of currency in circulation, demand deposits, savings and time deposits.

- Nominal value of money. This refers to the monetary (face) value of money. For example 2,000/=.

- Real money value (Value of money). This refers to the amount of commodities a unit of money can purchase. This depends on the general price level. The higher the price level, the lower the value of money.

Real money value =Nominal money value/price index

- Foreign exchange reserves. This is foreign currency held by the country’s central bank.

- Convertible (Hard) currency. This is currency which can be exchanged for other currencies and it is internationally accepted in carrying out transactions. For example pounds, US dollars etc.

I5. Soft (Managed) currency. This is currency which is used only within the country and cannot be accepted in carrying out international transactions. For example Ugandan shilling

Money supply

This refers to the amount of money circulating in the economy at a given time.

Types of Money supply

- Endogenous (Automatic) Money Supply. This is money supply which is determined by the level of economic activity. For example level of output, interest rates, etc.

- Exogenous (Discretionary) Money Supply. This is Money supply which is determined by the monetary authority (Central Bank or Ministry of finance) and it does not depend on the level of economic activity.

Determinants of money supply

- Amount of money printed by the Central Bank (government). If the central bank prints more money, money supply increases, but if the central bank does not print money, money supply remains constant or decreases.

- Balance of payment surplus or deficit. When export earnings exceed import expenditure, money supply increases as a result of excess foreign exchange earnings. But when import expenditure exceeds export earnings, money supply reduces in the economy.

- Level of credit creation by the commercial banks. The more the credit created by commercial banks, the more the money supply. This leads to an increase in money supply through the multiplier process and vice versa.

- Level of foreign capital inflow or outflow. Net capital inflow increases money supply but net foreign capital outflow decreases money supply in the economy.

- Level of economic activity. An increase in the level of economic activity increases money supply and a decrease in the level of economic activity reduce money supply.

- Activities of open market operations. This involves which is buying and selling of government securities. When the central bank buys government securities (Bonds and treasury bills) from the public, money supply increases. But when it sells securities to the public, money supply decreases.

- The level of monetization of the economy. The greater the subsistence sector, the lower the money supply. As the economy becomes highly monetized, the need for money increases hence increased money supply.

- The amount of gold reserves held by the central bank. The higher the gold reserves, the higher the money supply and the lower the gold reserves, the lower the money supply.

- Manipulation of the Bank rate (that is, the rate at which commercial banks borrow from the central bank) when the central Bank. increases the Bank rate, money supply reduces and when the bank rate is reduced, money supply increases

- The level of legal reserve requirements (that is, the amount of bank deposits which the commercial banks have to deposit with the central bank).The higher the legal reserve requirement, the lower the money supply and vice versa

Demand for money (liquidity preference)

Money demand (liquidity preference) refers to the desire by individuals to hold wealth in cash or near cash form.

Factors that influence the level of liquidity preference

- The income levels of individuals

- The degree of economic uncertainty

- The general price levels of goods and services (level of inflation)

- The level of monetization of the economy

- The level of development of financial institutions

- The level of interest rate offered on deposits

- The degree of political stability

- The nature of time preference. That is whether positive or negative time preference

Theories of money demand

(a) Keynesian theory of money demand

(b) The Classical quantity theory of money demand

(a) The Keynesian theory of Money Demand

According to Lord John Maynard Keynes, individuals demand for money for three major reasons

(motives). These include;

- Transaction motive. Here, individuals demand for money in order to meet their day to day purchases of commodities (transactions). The level of transactions depends on the individual’s income and the prices of commodities.

- Precautionary motive. Individuals demand for money in order to meet the unforeseen circumstance expenditures for example expenditure on sickness, car break down etc. This also depends on the individual’s income.

- Speculative motive. Individuals demand for money for earning income through buying and selling government securities. This depends on the interest rates on the government securities (treasury bills and bonds). When the interest rate on bonds falls, the speculators prefer holding cash and when interest rates on bonds increases, the speculators prefer holding bonds to cash.

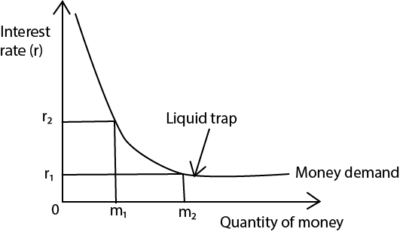

From the graph, when interest rate is expected to fall from 0r2 to 0r1, speculators convert bonds to cash and therefore demand more money m1m2 to avoid losses. When the interest rate is expected to increase from 0r1 to 0r2, speculators buy more bonds and hence demand less money 0m1.

- Liquidity trap. This refers to the point below which the interest rate is too low to encourage speculators to invest in bonds and as a result, they only hold money. OR. It is the point below which the interest rate is too low to break the liquidity preference.

(b) The Classical Quantity theory of Money Demand

The classical quantity theory of money demand states that, keeping the level of transactions and velocity of money constant, the general price level of goods and services is determined by the stock of money circulating in the economy.

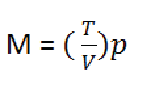

This theory is illustrated by Irving fisher’s equation of exchange which states that MV = PT

where;

M is the stock of money (money in circulation)

V is the velocity of money (that is, the number of times money changes hands)

P is the general price level

T is the level of transactions

From the equation above, assuming V and T constant, the stock of money (M) is directly proportional to the general price level. That is an increase money supply keeping the level of transactions and velocity of money constant increases the general price level of goods and services in the economy. That is

The theory is based on the following assumptions;

- Price is only affected by changes in money supply

- There is full employment of resources in the economy

- All money earned is spent on the consumption of goods and services

- Money is only demanded for transaction motive.

- Absence of barter trade

- The volume of transactions is constant

- The velocity of money in circulation is constant

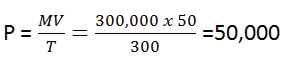

Example 1

Given that in the economy, M = shs.300,000, V = 50, T = 300. Calculate the general price level.

Solution

MV=PT

Criticisms (Limitations) of the classical Quantity theory of money demand

The quantity theory of money is criticized on the following grounds;

- The theory only emphasizes the transaction motive of holding money and it ignores the precautionary and speculative motives of money demand.

- It is just a truism and not a theory. It merely shows that the four variables M, V, P and T are related.

- The theory ignores commodities that are transacted through barter trade as a system of exchange.

- The theory only explains the changes in the value of money but not how the value of money is determined.

- The assumption that the velocity of money (V) and the level of transactions (T) are constant is unrealistic. This is because they are affected by the expenditure behavior and hoarding habits of individuals.

- It assumes a general price level which is unrealistic. This is because there may be a series of price levels of commodities in the economy.

- The four variables M, V, P and T are not independent of one another as the theory assumes. This is because a change in one induces a change in other variables.

- If the country has many unemployed resources, the increase in money supply leads to an increase in output of goods and services which makes the price to fall or not to change at all.

- An increase in money supply may result into higher savings if the marginal propensity to save is high. This reduces the velocity of circulation and prices may fall.

- The theory ignores haggling as a method of price discrimination in the market. That is haggling between buyers and a seller to reach an agreeable price is not taken into account.

- It does not take into account other causes of price increases (inflation) like cost push, break down of infrastructure etc.

- It ignores influence of interest rate. The theory cannot be complete without mentioning interest as the major determinant of money demand in the economy.

- The theory ignores government control of prices in the market as a way of ensuring price stability.

- The theory does not take into account the demand for money. It only looks at money supply.

Interest rate

Interest is the reward for use of capital in the production process.

Interest rate refers to the price at which money is lent out or borrowed.

Why interest is paid or charged

- Reward for savings that is, interest is paid to reward those who postpone their consumption to the future.

- It is paid to reverse the positive time preference of individuals that is, it is paid to encourage individuals to save.

- It is charged for management that is, it is paid to meet the expenses of the lending institution. For example files, stationery, manpower etc.

- It is paid for use of loanable funds.

- It is a charge for inconvenience to cover the opportunity cost of lending.

- It is a charge for risk taking for example parting with cash involves the risk of losing it.

Determinants of interest rate

- The level of demand for loanable funds (that is, funds available in financial institutions for lending). The higher the demand, the higher the interest rate and the lower the demand, the lower the interest rate.

- The level of liquidity preference. The higher the liquidity preference by individuals, the higher the interest rate and the lower the liquidity preference, the lower the interest rate.

- The period taken to repay the loan. The longer the period, the higher the interest rate and the shorter the period, the lower the interest rate.

- The level of money supply. Increased money supply reduces interest rates and decrease in money supply increases interest rates.

- The level of inflation in the country. The higher the level of inflation, the higher the interest rate and the lower the inflation rate, the lower the interest rate.

- Amount of money borrowed. The higher the amount, the higher the interest rate arid the lower the amount, the lower the interest rate.

- Risks involved in lending. High risks increase the interest rate while low risks reduce the interest rate.

- The nature of time preference. Time preference refers to the extent to which individuals prefer consumption in the present than in future. Positive time preference (that is, when the individual prefers consumption today than in future), increases the interest rate while negative time preference (that is, when the individual prefers consumption in future than today) reduces the interest rate.

Revision questions

Section A questions

1 (a) What is meant by liquidity preference

(b) Mention three factors which determine liquidity preference in an economy

2 (a) Define the term Barter trade.

(b) Give four limitations of Barter system of exchange.

3 (a) What is meant by the term “Legal tender”

(b) Mention three circumstances under which an increase in money supply may not necessarily lead to inflation in an economy?

4 (a) Define the term interest rate

(b) Mention three determinants of interest rate in your country

5 (a) What is meant by the Liquidity trap

(b) Explain the relationship between interest rate and money demand

6 (a) what is meant by instruments of credit?

(b) Mention three instruments of credit in an economy

7 (a) What is meant by the term “money supply”?

(b) Give three factors that influence money supply in your country.

8 Distinguish between the following terms

(a) Nominal money value and real money value

(b) Fiat money and fiduciary issue

9 (a) State the quantity theory of money exchange

(b) Given an economy where the quantity of money in circulation is $300 million, volume of production is $100 million and the velocity of money in circulation is 50 times. Determine the general price level.

10 The total money supply in an economy is Ushs150 billion. 40% of this is held for transaction purpose, while the balance is held equally for the other Keynesian purposes for holding money. How much is held for precautionary motive?

Section B questions

- (a) Explain the qualities of good money

(b) Explain the functions of money in an economy

(c) What factors limit the quantity of money supplied in the economy?

2 (a) Explain the quantity theory of money according to Fisher.

(b) Explain the limitations of the Fisher’s quantity theory of money exchange.

Financial intermediaries

These are financial institutions which bring together the deficit spending units (borrowers) and the surplus spending units (lenders) together. They trade in money as their commodity and charge a price called interest. There are two types of financial intermediaries that is;

- Banking financial These are financial institutions which create secondary deposits (create credit) and advance short term loans mainly to less risky investments. Examples are commercial banks.

- Non-bank financial These are financial institutions which do not create credit but they assist in channeling long term loans from surplus spending units to deficit spending units. Examples include building societies, Insurance companies, Post office, saving banks, development banks etc.

Differences between Banking and Non-banking financial intermediaries

| Banking Financial Intermediaries

|

Non-Bank financial Intermediaries |

| 1. They create credit which is considered as money (deposit money)

2. They lend on short term basis 3. They pay lower interest rates on deposits 4. They maintain short term deposits 5. They undertake less investment risks 6. They charge high interest rates on borrowers. |

1. They do not create credit. They just lend funds got from surplus spending units.

2. They usually lend on long term basis. 3. They pay higher interest rates on deposits. 4. They maintain long term deposits. 5. They undertake greater investment risks. 6. They charge low interest rates on borrowers |

Central banking

A Central bank is a financial institution established by the government with the aim of controlling the quantity and use of money in the economy so as to facilitate the implementation of the monetary policies.

Functions of the Central bank

- Banker to the government. It keeps government funds and cash balances. It also carries out transactions on behalf of the government and it acts as a financial and economic adviser to the government.

- Monopoly of issuing legal tender notes and coins. The central bank has the sole right of issuing, printing and renewing legal tender coins and notes of the country.

- The lender of last resort to commercial banks. This means that in case of financial problems, the central bank provides liquidity (money) to commercial banks and other financial agents when they have failed to get money from other sources.

- Banker to commercial banks. The central bank accepts deposits from commercial banks and it acts as a clearing house for commercial banks, that is, they settle their debts through the central banks.

- It controls credit (money supply) in the economy. The central bank regulates the amount and availability of credit in the economy. This helps to ensure economic stability.

- It is the manager and custodian of foreign currencies. It is the task of the central bank to maintain a stable foreign exchange rate so as to maintain the value of the domestic currency.

- It helps to formulate and execute the monetary policy so as to influence the level of economic activity.

- It supervises and examines the activities of all commercial banks so as to promote sound commercial banking. It also advises them on issues like closing time, opening of branches, lending policies etc.

- Banker to International Institutions. The Central bank keeps funds of International institutions working in the country for example IMF, World Bank, and Red Cross etc.

- It controls the activities of foreign banks operating within the country. Such activities may not be in line with the national development strategy of the country for example profit repatriation.

- It regulates the country’s balance of payment position through the management of external debt.

The monetary policy

This refers to the measures used by the Central bank to control the demand and supply of money together with the interest rate in order to influence the level of economic activity.

Aims (Objectives) of the monetary policy

- To maintain domestic price stability

- To stimulate economic growth and development

- To ensure equitable income distribution

- To help to achieve full employment of resources in the economy

- To maintain a stable foreign exchange rate

- To ensure balanced sustainable growth and development of the economy

- To create a broad and continuous market for government securities (bonds and treasury bills)

- To help establish and develop financial institutions

- To ensure Balance of payments stability in the economy

- To encourage savings through the manipulation of interest rates.

Instruments (Tools) of the monetary policy

- The bank rate (discount rate) policy. The bank (discount) rate refers to the interest rate charged by the Central bank on commercial banks. This occurs when the commercial banks borrow cash from the Central bank as a lender of last resort. If the Central bank wants to reduce money supply, aggregate demand and to check on inflation, it increases the bank rate. Consequently, Commercial banks also increase the interest rate charged on loans to their customers hence limiting money supply. If the Central bank wants to increase money supply, aggregate demand and to check on deflation, it reduces the Bank rate. Commercial banks also reduce their interest rates hence increased borrowing by customers.

Note. Rediscount Rate. This refers to the interest rate charged by the Central bank on commercial banks by buying short term securities from them at a discount.

- Open Market Operations (OMO). This refers to the act of buying and selling of government securities (bonds and treasury bills) by the government through the Central bank. If the Central bank wants to reduce money supply and check on inflation, it sells government securities to the public (individuals). This leads to a fall It money supply. However, if the aim is to increase money supply and to check on deflation, the central bank buys securities from the public.

Note. Treasury Bills are short term financial assets which are used by the government when borrowing from the public. .

Bonds are long term financial assets which are used by the government when borrowing from the public.

- Selective Credit Control (Credit squeeze). This is where the Central bank directs or instructs commercial banks to give credit (loans) to specific sectors of the economy for example giving loans to priority sectors like agriculture. This reduces the number of sectors getting loans hence reducing money supply in the economy.

- Legal reserve requirement (Reserve requirement ratio). This refers to the percentage of bank deposits required by law to be deposited by commercial banks with the Central bank. The Central bank sets the minimum amount of bank deposits which commercial banks should deposit with it. If the central bank wants to reduce money supply, it increases the legal reserve requirement so that commercial banks have less loanable funds. However, if the Central bank wants to increase money supply, it reduces the legal reserve requirements so that commercial banks have more loanable funds.

- Cash ratio (cash reserve). This refers to the fraction of the total bank deposits which remain in the Commercial bank in cash form to meet the daily requirements of the customers (depositors). In this case, if the central bank wants to reduce money supply, it instructs commercial banks to increase the cash ratio. However if the central bank wants to increase money supply, it instructs commercial banks to reduce the cash ratio.

Note. Reserve ratio. This refers to the fraction of the total bank deposits that is not lent out by the commercial bank. Liquidity ratio is the proportion of Commercial bank assets that it keeps in liquid (cash) and near liquid (cash) form.

- Moral suasion. This is where the central bank persuades and requests commercial banks to follow the general monetary policy. In periods of inflation, the central bank may persuade commercial banks not to give out credit and in periods of depression (deflation), commercial banks may be persuaded to expand credit so as stimulate economic activity,

- Special deposits (Supplementary reserve requirement). This is where the central bank instructs commercial banks to make certain deposits over and above the minimum legal reserve requirement. This reduces the money available for lending (loanable funds) in commercial banks hence reducing money supply. .

- Margin requirements. In this case, the commercial bank does not lend up to the full amount of the value of the collateral security, but it lends some amount which is lower. The central bank may direct commercial banks to rise or reduce their margin requirements in order to regulate money supply. A higher margin requirement reduces the amount of loans given by commercial banks and this is done in times of inflation. A lower margin requirement raises the loanable funds and this is favourable in times of economic depression in order to stimulate economic activity,

- Currency reforms. This refers to the act of changing money by the government from one form to another. It is aimed at reducing money supply and knowing the amount of money in the economy. It is normally done when the currency has totally lost value due to high levels of inflation.

Limitations of the application of the monetary policy in developing countries

- Lack of well-developed financial markets. In developing countries, there are no well-developed security markets. This makes the use of open market operations makes ineffective.

- Concentration of banks in urban areas. Most of the banking business is concentrated in few urban centers. The rural sector is still under banked. This limits the scope and effectiveness of the monetary policy.

- Presence of a large subsistence sector. The existence of a large non-monetary sector limits the operations of the monetary policy. This is because many transactions are made through barter trade

- Many Commercial banks in developing countries enjoy a lot of liquidity. This makes the use of bank rate policy and increasing legal reserve requirement ineffective.

- Presence of foreign owned commercial banks. Foreign owned commercial banks may not implement the restrictive effects of the strict monetary policy as required by the central bank.

- Ignorance of the public about the availability of credit facilities in commercial banks. A Monetary policy like selective credit control favoring a sector like agriculture may not be utilized due to ignorance of the farmers about such a credit facility.

- High levels of liquidity preference. Most people in developing countries do not keep their money with commercial banks. This makes it difficult for the central bank to control money which is outside the banking system.

- Inadequate entrepreneurs in developing countries. In most developing countries, there is lack of enough entrepreneurs who can use the expanded credit for investment. This is due to low levels of education and entrepreneurial ability.

- High levels of corruption. There is a high degree of corruption among the bank officials who violet the monetary policy for their personal benefits. This makes the policy ineffective.

- Limited trained personnel in the banking sector. There is limited trained personnel and -funds to finance manpower necessary to effectively monitor the activities of the monetary policy.

- Existence of political Instabilities. These force the governments in developing countries to increase money supply on political grounds hence conflicting with the objectives of the monetary policy.

- High degree of openness of the economies. Many economies of developing countries are highly open and this makes it difficult to control money supply from abroad by the central bank.

Commercial banking

A Commercial bank is a financial intermediary which collects surplus funds from the public (that is, accepts deposits), safe guards them and makes them available to the true owners on demand. It also lends money (credit) not required by the true owners to those who are in need at an interest rate and who can provide collateral securities.

Functions of commercial banks

- They accept deposits and safe guard them on the behalf of their customers. This is done by opening up an account with the bank.

- They give loans and overdrafts to their customers. The loans may be short term, medium term or long term.

- They exchange currencies for their customers. This aids international trade.

- They keep valuable articles and documents in safe custody on the behalf of their clients e.g. wills, land tittles etc.

- They facilitate easy and quick payments of debts on the behalf of their customers through the use of cheques or standing orders.

Note. A standing order is a document from the customer authorizing the bank to make regular payments on his behalf to his creditors for example rent, Insurance expenses, water bills, electricity bills etc.

- They look after the property of the deceased customers and distribute their assets as laid down in the will.

- They give financial advice and offer technical services to customers on business and money.

- They create deposit money (secondary deposits) through the process of credit creation.

- They participate in the implementation of government policies for example the monetary policy.

- They facilitate the transfer of money from one place to another by use of travelers’ cheques

Types of deposits (Accounts)

- Current accounts. These are accounts where the depositor can withdraw any amount at any time by use of the cheques. For this reason, no interest is payable on this account. Current accounts are also called Demand deposit account.

- Savings accounts. This is where a pass book with a customer’s photograph is used instead of a cheques when depositing or withdrawing. Withdrawal on this account is restricted to a certain maximum amount. The owner of this account earns an interest but it is less than that earned on the fixed deposit account.

- Fixed/time deposit) account. Under this account, withdrawal cannot be made before the stated maturity period. The customer who owns this account earns a high interest rate depending on the maturity period.

Assets and Liabilities of Commercial banks

Assets of commercial banks

Assets are items from which the bank receives income and profits and claims against other institutions. They include;

- Reserves with the central bank.

- Deposits with other banks and non-banks.

- Fixed assets e.g. buildings, furniture, vehicles etc.

- Loans, advances and overdrafts to customers

- Acceptances and guarantees made by other parties.

- Investments in securities and shares in other companies.

- Retained profits

- Bills discounted for customers (that is, the bank pays less money than that stated on bill before the maturity period.)

Liabilities of Commercial banks

Liabilities are claims against the commercial bank, that is, what the bank owes to other banks and non-bank institutions. They include;

- Deposits of customers

- Deposits in the bank by other banks

- Money borrowed from the Central banks

- Capital contributed by shareholders (Paid up capital)

- Acceptances, receivables and guarantees on behalf of the customers

- Dividends payable to shareholders

- Reserve funds.

CREDIT

- Credit is when an individual borrows money or buys commodities without making cash payment.

- Credit instruments refer to the written documents which guarantee payments at a given future date and they give the holder the right to receive money. Credit instruments include the following:

- Cheques. This is an order by customers to the bank to make specific payment to the required person(s) on their behalf.

- Promissory notes. This is a written promise by the buyer to the seller to make a specific payment at a future date.

- Bills of exchange discounted before the maturity period.

- Credit cards

- Bank drafts. This is a form of a cheque which is issued by one bank to another bank. It reduces the burden of carrying large sums of money from one bank to another by the individuals.

- Overdraft. This is where the customer withdraws more money than what is on his/her account. Interest is paid on the amount over drawn.

- Government securities (bonds and treasury bills)

Credit creation

Credit creation is the process by which money lent out by commercial banks using the cheque facility expands to result into greater volume of credit than the amount originally lent out. OR. Credit creation is the process of creating new demand deposits through lending out excess funds to credit worthy customers by commercial banks by use of cheques.

Credit (Bank deposit/ Money) multiplier

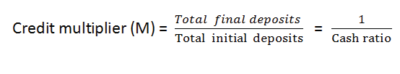

Credit multiplier (M) is the number of times the initial bank deposits multiply to give the final bank deposits

Example 1

Calculate the total credit created when the initial deposits are 5,000/= and the cash ratio is 5%

Solution

Total final deposit = 20 x 5000 = 100,000/=

Example to illustrate the process of credit creation by the commercial bank

- Assume one commercial bank which lends to several individuals A1, A2, A3 ……An.

- Assume the cash ratio be fixed at 20%

- Let the initial deposits (Do) be 1000/=

- Assume that the several individuals A1, A2, A3 ……An are able and willing to borrow money from the bank and the bank is willing to

This process of credit creation is illustrated as below;

| Person | New deposit | Cash reserve (Cr=20%) | New loan (80%) |

| A1

A2 A3 A4 . . . . An |

1000

800 640 512 . . . . 5000/= |

200

160 128 102.4 . . . . 1000/= |

800

640 512 109.6 . . . . 4000/= |

- From the above table, person A, deposited 1000/= in the bank, The bank kept 20% as cash reserve and lent out 80% inform of a cheque to person A2.

- Person A2 deposited the cheque to the same bank which gave him a loan. Then out of 800/=, the bank kept 20% as cash reserve and lent out 640/= to person A3 and the process continues.

Total deposits =1000+800+640+512+…………… .

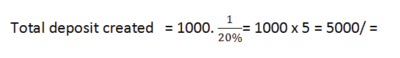

Total deposits created are given by the formula; Total deposits = Do.

Where Do = Initial deposits

Limitations of credit creation by Commercial banks in developing countries

- Use of restrictive monetary policies by the central bank. The central bank limits the powers of commercial banks to create credit by using the restrictive tools of the monetary policy for example increasing bank rate, selling government securities to the public, increasing minimum legal reserve requirement etc.

- Presence of inadequate credit worthy borrowers. In developing countries, there is lack of enough credit worthy borrowers due to lack collateral securities. This leads to excess liquidity in commercial banks due to limited borrowing hence limiting the process.

- The theory assumes that borrowers deposit cheques they get in the same bank. This is not always true. Therefore one bank keeps on losing deposits to other banks hence limiting the process of credit creation by a single bank.

- The process of credit creation keeps on diminishing towards zero. This limits the amount of credit created.

- High levels of liquidity preference. In developing countries, individuals prefer keeping their money with them instead of depositing it in banks. This results into less bank deposits hence limiting the process of credit creation. .

- Low demand for bank deposits. In developing countries, there is low demand for bank loans because of poor investment climate. This is mainly due to the political instabilities, insecurity, poor infrastructure etc. and this results into less money lend out hence limiting the process.

- High interest rates charged by Commercial banks. These discourage the potential borrowers from demanding for loanable funds for investment hence limiting the process of credit creation.

- Limited number of banking institutions in developing countries. The number of banks is few and they are not widely distributed to mobilize enough savings. This limits the amount of credit created.

- High fractions of Cash ratio in commercial banks. A lot of bank deposits are left in commercial banks in cash form instead of lending it out hence limiting the credit creation process.

- Ignorance of the public about the availability of loanable funds in commercial banks. This leads to a small number of individuals accessing bank loans hence limiting the process of credit creation.

Dilemma facing the Commercial banks in their Lending policy

The commercial bank is usually faced with the problem of achieving the objectives of profitability, liquidity and security simultaneously. If it increases lending so as to earn profits, it will not meet the customers’ demands (liquidity). On the other hand, if it maintains liquidity for its customers, it will not get profits as there will be no loanable funds. In order to minimize these conflicts, the commercial bank has to do the following;

Measures of commercial bank for profit maximization

- Giving low interest rates to the depositors and charging high interest rates on the borrowers.

- under taking short term and medium term commercial investments.

- Charging commission for the services rendered to their customers.

- Investment in government securities as a way of earning interest.

- 5. Discounting bills of exchange i.e. the bank can pay less money to the holder of the bill as compared to that stated on it before it’s maturity.

Measures of commercial bank for liquidity

- Lending out money in phases such that all the time, there is some money to meet the needs of the customers.

- Lending out money on short-term basis.

- Purchasing liquid/short term assets that can be turned into cash easily.

- Receiving more deposits from the customers.

- Borrowing from the central bank.

- Keeping some of the deposits with the central bank.

- Regulate withdrawals especially with the savings account holders where one can’t withdraw more than once a week and withdraws are limited to a given amount.

- Ensuring that borrowers deposit collateral / securities which may be liquidated in case of financial problems.

Measures of commercial bank for security,

- The bank has to secure a collateral security from the borrower.

- It should have aimed personnel to safe guard the bank.

- The bank should be made up of strong buildings for security purposes,

Problems facing Commercial banks in Developing countries

- Unfavorable government policies in form of fixing high interest rates. This discourages individuals from borrowing money from commercial banks.

- High levels of economic instabilities. For example inflation, exchange rate fluctuations etc. Inflation discourages savings due to loss of the real value of money hence limiting bank deposits.

- Low levels of technology in developing countries. There is existence poor technology in developing countries and it is expensive to import modern equipments from developed countries. This increases the cost of operation by commercial banks.

- Poor and inadequate infrastructural facilities. This is reflected in form poor transport network like inaccessible roads, insufficient power supply, unreliable telecommunication network etc. This makes it difficult to market financial services especially in rural areas.

- Limited skilled manpower in developing countries. Labour in developing countries lacks the necessary skills required to operate and manage banking activities. This leads to mismanagement of funds. Some banks are forced to import skilled manpower from abroad which is expensive.

- High levels of political instability in developing countries. This makes it difficult to open up more branches especially in rural areas due to fear of losing life and making losses.

- High levels of poverty among the customers. In developing countries, many customers are poor and scattered. Therefore commercial banks face the challenge of mobilizing savings.

- Limited number of credit worthy customers. This limits lending by commercial banks due to lack of collateral securities by most borrowers.

- High levels of illiteracy among customers. Most of the customers are illiterates due to low levels of education. In addition, many customers do not keep books of accounts. Therefore it becomes difficult to assess their credit worthiness.

- High level of competition in the banking sector. Most of the banks are concentrated in urban areas. Therefore, they are faced with the problem of competition for the limited customers.

- High levels of corruption and embezzlement of funds. There is a high degree of corruption and embezzlement of bank funds by bank officials. This limits the expansion of the banking sector.

- The existence of a large subsistence sector. This leads to low savings due to low incomes as a result of low levels of economic activity.

- The general negative attitude by the public about banking in developing countries. Many individuals do not have trust in commercial banks and therefore, they get scared of leaving their savings with banks. Some individuals prefer to keep their money at home.

The role of foreign commercial banks in developing countries

Positive Role (Implications) of foreign commercial banks in developing countries

They create employment opportunities. Foreign commercial banks employment to the local population in form of bank accountants, credit officers, marketing managers, cleaners etc. This increases the incomes of the people hence better standards of living.

- They help to increase efficiency in the banking sector. Foreign banks create a competitive atmosphere in the local banking sector by employing efficient techniques of service delivery. This helps to improve on the quality of the services of the local banks.

- They are a source of government revenue through taxation. Foreign commercial banks help to widen the tax base in form of taxes imposed on their profits, employment incomes and other business activities created hence generating more tax revenue to the government. The revenue realized is used to construct social and economic infrastructure like hospitals, roads, schools etc.

- They increase capital inflow in the country. Foreign commercial banks help to fill the savings-investment gap in developing countries by extending credit in form of loans to the local people. This increases investments in the country hence economic growth and development.

- They help to close the foreign exchange gap. Foreign commercial banks facilitate foreign exchange inflow in developing countries. This increases the country’s foreign exchange reserves and its monetary base. Such foreign exchange is used to import capital and consumer goods which cannot be produced locally.

- They facilitate the development of social and economic infrastructure. Foreign commercial banks promote the development of the social and economic infrastructures in form of roads, schools, hotels, hospitals etc. and this leads to economic development.

- 7. They promote technological development in the banking Foreign commercial banks facilitate technological progress through technology transfer from developed to developing countries. Local banks learn and adopt the modem techniques hence improving on their efficiency in service delivery.

- They promote the exploitation and utilization of the idle local resources. This is because they help to attract foreign investors to invest their capital in the country. This improves on the productive capacities in the economy hence economic growth and development.

- They promote industrial development. Foreign commercial banks help to mobilize financial resources which are used for development of heavy industries like iron and steel industries, electrical engineering etc. Such industries require a lot of capital which is only accessed through borrowing from commercial banks.

- They promote entrepreneurial skills in the economy. The foreign commercial banks help to train the local individuals with the necessary managerial skills required to operate modem banking enterprises. This helps to close the manpower gap in developing countries. In addition, they help to local individuals to get loans and set up business activities.

- They promote good international relationships between their countries of origin and other countries where their business activities are extended. This enhances mutual understandings among countries.

- They help to facilitate and promote international trade. This is because they finance export and import trade by providing foreign exchange and money transfer services to the traders.

Negative role (Implications) of foreign commercial banks in developing countries

- They accelerate regional income inequalities in economy. This is because most of their banking activities are mainly concentrated in urban areas neglecting the rural areas. This creates regional imbalance.

- They lead to profit repatriation. Foreign commercial banks tend to plough back the profits made to their home countries instead of re-investing them in the countries where they operate. This leads to low capital accumulation in the economy.

- They undermine the provision of banking services to the small scale local investors. This discourages the production of cheap goods and services for the local people.

- They lead to unemployment in the economy. This is because they tend to employ mainly foreigners especially at the level of management and they use capital intensive techniques of service delivery hence technological unemployment.

- They encourage rural -urban migration. This is because most of their business activities are concentrated in urban centers due to poor infrastructure in rural areas. Tills leads to congestion in urban areas and minimal contact with the local population,

- They lead to divergence between private and society interests. This is because foreign commercial banks aim at maximizing profits at the expense of the society. Some of their policies are not in line with the national development goals of the country like poverty eradication, rural development etc.

- They discourage the development of local financial institutions. This is because foreign commercial banks have huge capital and they have the capacity to operate on a large scale and provide better quality services to their customers at competitive rates. This undermines the growth of the local banking sector.

- They interfere in the politics of developing countries. Foreign commercial banks use their economic power to influence national policies and politics of the countries in which they operate in their favor. This results into loss of independence in local decision making.

- They limit the successful implementation of the monetary policies. This is because the central bank has little control over their activities.

Revision questions

Section A questions

- (a) Distinguish with the help of examples between Banking and Non-Banking financial intermediaries

(b) Outline two features of banking financial intermediaries in your country

2 (a) Differentiate between cash ratio and liquidity ratio

(b) Give two reasons as to why liquidity is desired in the economy

3 Given that a bank has an initial deposit of shs. 1 million and the required cash ratio of 25%.

Calculate the;

(i) Credit multiplier (ii) Total deposits created.

4 (a) what is meant Bank deposit (credit) multiplier?

(b) State three determinants of bank deposits multiplier in your country

5 (a) What is a Central bank?

(b) Mention three functions of the Central bank.

6 (a) Define the term “credit creation”

(b) Given that the initial deposit amounts to 10,000/= and final deposit amounts to 200,000/=. Calculate the cash ratio of the commercial bank

7 Given cash ratio of 0.2 and initial deposit of USD. 1000. Calculate the total credit in Uganda shillings that is created on the basis of this deposit. (USD 1. = Ug, Shs. 1,500/=).

- Distinguish between the following terms

(i) Cash ratio and liquidity ratio.

(ii) Treasury bills and bonds

(iii) Bank rate and re-discount rate

(iv) Reserve ratio and legal reserve requirement

(v) Credit squeeze and cash reserve

(vi) Nominal money value and real money value

Section B questions

1 (a) Explain the objectives of the monetary policy.

(b) What factors limit the effective implementation of the monetary policy in your country?

2 (a) What is meant by the monetary policy?

(b) Explain the various monetary policy instruments used by the central bank of your country.

(c) Explain the factors that influence the application of the monetary policy in an economy?

5 (a) Given the initial deposit of 250,000/= and cash ratio of 20%, show how a commercial bank would create credit.

(b) What are the limitations of credit creation in your country?

6 (a) Illustrate how commercial batiks create credit in an economy

(b) Explain the factors that influence the process of credit creation in your country?

7 (a) What is the role of foreign commercial banks in the development process of your country?

(b) What problems do commercial banks face in developing countries?

8 (a) What are the assets and liabilities of a commercial bank?

(b) How are commercial banks able to achieve both liquidity and profitability?

(c) Explain the functions of the commercial bank.

Dr. Bbosa Science +256 778 633682