Economic Chapter 9: Economic Inflation

Inflation refers to the continuous (persistent) rise in the general price level of goods and services in the economy in a given time. It is measured using price indices by the following formula:

![]()

Where Pt =present year price index, Pt-1 = previous year prices

State of inflation

The state of inflation refers to the speed (rate) at which the general price level of commodities are increasing in the economy at a given time.

Classification of inflation

(1) According to the state of inflation

- Mild (creeping / gradual/moderate) inflation. This is where the persistent increase in the general price level proceeds at a slow rate usually not exceeding 10%. This state of inflation is good since it acts as an incentive to the producers. It increases savings, investments, and output and employment opportunities. .

- Hyper (Run away / Galloping) Inflation. This is where the general price level increases at a very high rate, the increase taking place within hours, days or weeks and the percentage point increase per annum exceeds 20%. In this case, money loses total value and people prefer to hold real goods than money. This state of inflation is bad because it discourages production as consumers are reluctant to buy commodities at very high prices.

(2) According to causes

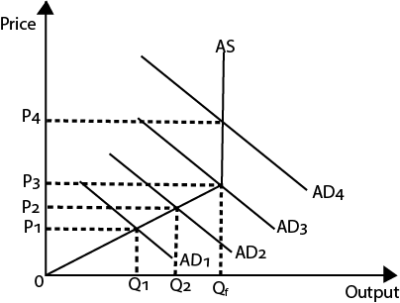

(a) Demand pull inflation

Demand pull inflation is where the persistent increase in the general price level arises out of excess aggregate demand for goods and services over aggregate supply at conditions of full employment. It is described as a situation where there is too much money chasing too few goods.

The figure above shows that increase in aggregate demand from AD1 to AD3 is accompanied by higher output as well as higher prices. Increase in aggregate demand beyond AD3 does not increase output but only prices. At AD3, the economy attains full employment level 0Qf.

Causes of demand pull inflation

- Increase in money supply which leads to increased aggregate demand hence persistent increase in prices.

- Increase in population growth. This increases the consumption of commodities in the economy hence demand pull inflation.

- Increase in disposable incomes of individuals as a result of increased wages and salaries for the workers. This increases the purchasing power of individuals hence increased aggregate demand.

- Increase in exportation of scarce commodities and a decrease in importation of scarce commodities

- Increase in government expenditure in the economy. This increases money supply hence demand pull inflation

Policies (solutions) for demand – pull Inflation

- Using restrictive monetary policies for example increasing bank rate, sale of treasuring bills and bonds to the public, credit squeeze etc. This helps to reduce money supply in the economy.

- Using restrictive fiscal policies in form of reducing government expenditure and increasing direct taxes to reduce on the disposable incomes of individuals.

- Using trade policies. These aim at increasing the importation of scarce commodities in the economy and discouraging the exportation of the scarce commodities from the economy. This increases aggregate supply.

- Using wage freeze policy. This is aimed at keeping down the salaries and wages of workers through maximum wage legislation.

- Using price control policies. This is concerned with controlling prices of major consumer commodities in the economy through use of maximum price legislations.

- Using production policies aimed at increasing the volume of goods and services through liberalization and privatization.

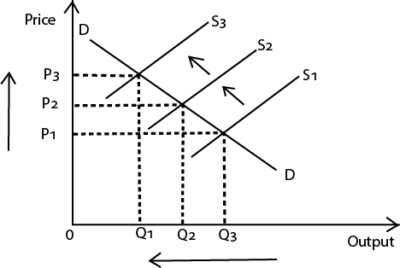

(b) Cost push inflation

Cost push inflation is where the persistent increase in the general price level arises out of increase in the costs of production which increases the prices of commodities for example increase in wages, interest, rent and prices for raw materials. The costs are shifted to consumers in form of high prices of the consumer goods.

From the graph, there is a continuous shift in the supply curve to the left (decrease in supply) due to increase in the, costs of production at constant demand. This increases the prices of commodities in the economy.

Forms (causes) of Cost-push Inflation

- Wage Push Inflation. This occurs when the increase in the wage rate exceeds the increase in productivity of workers. This leads to a reduction in supply of commodities.

- Wage – wage inflation. This occurs as a result of inter-sectoral comparison of wages among workers. The increase in wages in one sector or firm causes an upward revision of wages in similar occupations in the economy. As entrepreneurs increase wages, costs of production and prices also increase.

- Wage price Inflation. This occurs when workers demand for high wages through their trade unions. The increase in wages leads to an increase in the costs of production and prices.

- Price – wage (Spiral) Inflation. This occurs when there is an increase in commodity prices leading to workers demanding for high wages. This increases the costs of production hence continuous rise in prices of all commodities.

- Profit Push inflation (Mark-up Inflation). This occurs when the producers (monopolists) restrict output with the aim of charging high prices to get high profit margins.

Policies (solutions) to cost push inflation

- Providing subsidies to the producers so as to increase in the level of domestic output.

- Encouraging the importation of scarce commodities in the economy by the government

- Discouraging the exportation of scarce commodities.

- Wage control measures to reduce on the high wage demands by workers.

- Use of non-monetary remunerations for workers.

(c) Structural (Bottleneck) Inflation

Structural inflation is where the persistent increase in the general price level arises out of supply rigidities in the economy which keep down the level of production.

Causes of structural inflation

- The poor performance of the agricultural sector due to bad weather, pests and diseases, floods etc.

- Break down of the industrial sector for example due to depreciation of the machines. This results into low production and hence high prices.

- Inadequate managerial and entrepreneurial skills which result in low production leading to increased prices.

- Existence of political instabilities which discourage both domestic and foreign investors. This reduces output and hence high prices.

- Speculation by businessmen who create artificial shortages by hoarding goods.

- Infrastructural break down in form of poor roads.

- Scarcity of raw materials due to limited foreign exchange. Producers fail to import scarce raw materials hence low levels of production.

Solutions to structural Inflation

- Economic diversification. Improving on the export sector through export diversification and production of quality exports. This increases foreign exchange earnings which can be used for buying raw materials necessary for production.

- Encouraging local production of goods and services by offering incentives in form of credit facilities to producers.

- Ensuring political stability aimed at creating a favourable (conducive) investment climate.

- Improvement in technology so as to increase productivity of factors of production.

- Infrastructural development

- Expansion of the industrial sector

- Modernization of the agricultural sector

(d) Imported inflation

Imported inflation is where the persistent increase in the general price level arises out of importing highly priced commodities and other raw materials from countries already experiencing inflation.

Policies (Solutions) to imported inflation

- Use of import restrictions so as to restrict on the volume of imports into the country.

- Use of import substitution strategy so that goods formerly imported are produced domestically.

- Subsidization of importers of essential commodities by the government. This helps the importers to incur fewer costs and hence charge low prices.

- Encouraging the use of domestic raw materials where possible

- Economic integration to get cheaper goods through trade creation.

(e) Suppressed Inflation.

This is where the excessive persistent increase in the general price level of commodities is controlled by the government through the use of price controls.

(f) Open Inflation.

This is where inflation is not controlled by the government through price controls, rationing and other means.

Stagflation, deflation and reflation

Stagflation refers to the economic situation in which high inflation rates co-exist with high levels of unemployment in the economy. It is caused by decline in aggregate supply which leads to decline in output hence unemployment due to laying off of workers.

Costs of stagflation

- Increasing cost of living

- Decline in standards of living

- Decline in investment

- Decline in savings

- Loss of confidence in the country’s currency

- It worsens income inequalities among people

- It raises the cost of borrowing

- It leads to social distress

- Deflation. This refers to the persistent (continuous) fall in the general price level of goods and services in the economy.

- Reflation. This refers to the policy used by the government to lift the economy out of a deflation or depression.

General cause of inflation in developing countries (Uganda)

- Excessive printing of money by the central bank to finance budget deficits. This increases money supply in the economy hence inflation.

- Increase in costs of production. This is due to increase in wages, costs of raw materials, fuel prices, high taxes” etc. Which force producers to increase the prices of commodities in the economy.

- Persistent political Instabilities. These scare away the potential investors leading to low output. This leads to shortage of goods and services hence inflation.

- Importation of commodities and raw materials from countries experiencing inflation. High prices of imports like fuel, capital goods other commodities lead to an increase in the production costs leading to cost push inflation, .

- Supply rigidity such as bad weather, pests and diseases, poor infrastructure etc. Especially in the agricultural sector. This reduces agricultural output hence an increase in the food prices.

- Effects of structural adjustment programs (SAPS) such as privatization, retrenchment etc.

- Desire for excessive profits by businessmen. This forces them to increase the prices of goods and services in the economy.

- Excessive aggregate demand for goods and services as compared to their supply. For example due to increase in population.

- High degree of speculation in business. Traders create artificial shortages with the aim of increasing prices for their goods and services.

- Depreciation of the local currency through forces of demand and supply of foreign currencies.

- Increased printing of counterfeit currency which leads to increase in circulation of money in the economy.

Policies (measures) to control inflation in developing countries

- Selling government securities to the public. This is aimed at reducing money supply and aggregate demand in the economy as a way of controlling inflation.

- Increasing direct taxes. This helps to reduce the disposable incomes of the individuals and to check on aggregate demand.

- Reducing government expenditure for example through retrenchment so as to reduce on money supply and aggregate demand in the economy.

- Maintaining political stability and security by the government through democratic governance and use of amnesty act. This helps to create a favorable investment climate hence increasing the supply of goods and services in the economy.

- Use of import and export policies. Policies aimed at restricting the exportation of scarce commodities and importation of commodities which are scarce in the economy should be promoted. This helps to increase on the availability of commodities in the economy.

- Controlling the importation of goods and raw materials from countries experiencing inflation. This is done by the government adopting import substitution development strategy to produce commodities formerly imported. This helps to check on imported inflation.

- Use of population control measures. This is aimed at reducing population growth rates through the use of appropriate family planning methods. This helps to check on excessive demand. For goods and services.

- Construction of social and economic infrastructure. For example construction of roads, rehabilitation of production units etc. This helps to facilitate the distribution of goods and services from rural to urban areas hence controlling inflation.

- Reducing government borrowing from the central bank for deficit financing. This helps to reduce excessive money supply in the economy.

- Use of price control measures for example use of maximum price legislation, rationing etc. to check on inflation.

- Use of wage freeze policies. These are aimed at controlling wages of workers through the use of wage freeze and restraint. This helps to check on the disposable incomes of individuals hence reducing money supply and aggregate demand.

- Providing investment incentives. There is need for the government to create a conducive investment climate by providing investment incentives to both foreign and local investors in form of subsidization and granting tax holidays. This helps to increase production of goods and services in the economy.

- Use of currency reforms in case the level of inflation is very high. This helps to reduce money supply in the economy.

- Use of privatization policy. This helps the private individuals to get involved in production hence increasing the supply of goods and services in the economy

- Liberalization of the economy. This allows for a number of individuals to get involved in exchange of goods and services with limited unnecessary government intervention

Effects (implications) of inflation

Advantages/merits/Positive effects (Implications) of inflation

Mild Inflation is healthy to the economy in the following ways;

- It stimulates production of goods and services in the economy. This is due to high prices and profit margins received by producers. This leads to economic growth.

- It stimulates people’s effort to work. Individuals work hard in order to maintain their standards of living.

- It encourages forced savings. This is as a result of the high profits realized by those involved in business. This promotes investments in the economy.

- It increases employment opportunities. This is due to increased investments and economic activities taking place in the economy.

- It increases government revenue. The government taxes the high profits got by those involved in economic activities. Such revenue is used to finance recurrent and development expenditures.

- It stimulates entrepreneurial skills in the economy. This is because it encourages innovations and creativity hence increase in investments in the economy

- It encourages food production in the economy. Local farmers take advantage of the high price to produce more food to sell in the domestic market.

- It encourages labour mobility in the economy. Individuals move to other areas in search of better paying jobs so as to make their ends meet.

- It encourages the adoption of import substitution industrial strategy as a result of imported inflation. This accelerates industrialization in the economy.

- Borrowers (debtors) stand to gain as a result of mild inflation. This is as a result of a fall in the real interest rate charged on the borrowed funds by financial institutions which benefits the borrowers

- It increases resource utilization in the economy. This increases the production of goods and services.

Disadvantage/demerit/Negative effects (implications) of inflation

Hyper Inflation is undesirable in the economy in the following ways;

- It leads to low standards of living. This is due to increase in the cost of living resulting from high prices of commodities and production of poor quality commodities.

- It discourages savings in the economy. Individuals spend a lot of money to purchase few goods. This reduces the level of investments in the long run.

- It worsens the balance of payment position of the country. This is because it discourages exports by making them expensive and encourages imports as they become cheaper to the local importers. This reduces foreign exchange earnings and increases foreign exchange expenditure hence balance of payment problems.

- It increases the levels of-unemployment in the economy. This is because inflation discourages investment and production activities in the economy. This leads to low levels of incomes.

- It discourages both foreign and domestic investments. Inflation increases the production costs and this reduces the production of goods and services hence low levels of economic growth and development.

- Inflation accelerates brain drain. Qualified and trained labour is forced to leave the country to go and work in foreign countries where the value of money is high and stable.

- Inflation leads to income inequalities. It makes the rich to earn more incomes at the expense of the poor. This is worse for the low fixed salary earners.

- Inflation leads to rural urban migration. This is because it becomes less profitable to grow crops in rural areas. As a result, people move to urban areas to start businesses where the profit margins are relatively high.

- It leads to misallocation of resources. Resources are diverted from the production of essential commodities to non-essential (luxurious) commodities which are more profitable.

- It encourages illegal activities in the economy. Such activities include corruption and smuggling of goods and services. This is because people struggle to maintain their standard of living as a result of inflation.

- It encourages dumping in the economy. Foreigners sell their commodities in local markets at prices lower than those charged in their countries. This retards the growth of domestic infant industries which charge high prices due to high production costs.

- It makes it difficult for the government to plan and budget. The continuous fall in the value of money due to inflation makes it difficult to meet the planned targets.

- It makes the government in power unpopular. The members of the opposition use inflation as the ground for criticizing the government etc.

- It leads to loss of confidence in the local currency by the public. This is due to continuous fall in the value of the currency.

- It discourages lending by financial institutions. This is because they stand to lose as a result of a fall in the real money value.

- It leads to industrial unrests. This is due to constant demand for high wages by workers through their trade unions.

Why is it difficult to control inflation in developing countries?

- The need to import essential commodities which are lacking in the country for example petroleum products makes it difficult to control imported inflation.

- High rates of rural-urban migration. This increases the costs of living in towns hence inflation.

- Frequent wage increases by the government. This leads to high levels of disposable incomes hence increase in demand for goods and services.

- Low productivity in the agricultural sector. This leads to shortage of food hence increase in food prices.

- High levels of corruption and embezzlement of public funds meant for productive activities. This leads to shortage of goods and services hence inflation.

- The need for high revenue from indirect taxes by the government causes producers to increase prices of their commodities.

- Lack of appropriate measures to control population growth. This leads to excessive demand for goods and services hence inflation.

- Occurrence of unforeseen circumstances for example bad weather, pests and diseases which lead to shortage of goods and services especially in the agricultural sector.

- Political instabilities and insecurity. These demand for increased government expenditure hence increased money supply in the economy.

- Limited capital required to set up industries to increase domestic production of goods and services.

- Existence of poor infrastructure in the economy. Poor infrastructure in form of poor transport and communication facilities makes it difficult to distribute goods from the production areas to market centers.

- Underdeveloped financial sector. This makes it difficult to use the tools of the monetary policy to control money supply in the economy hence inflation.

Revision questions

Section A questions

1 (a) Distinguish between creeping inflation and galloping inflation

(b) Mention any two merits of creeping (mild) inflation.

2 (a) Define the term “Reflation”

(b) State three causes of structural inflation in an economy

3 (a) Distinguish between structural inflation and imported inflation

(b) Outline two solutions to imported inflation in your country

4 (a) Distinguish between state of inflation and reflation

(b) Mention two solutions to structural inflation in Ugnada

5 (a) Distinguish between state of inflation and type of inflation.

(b) Mention two possible remedies to cost push inflation in an economy

- (a) With the help of diagrams, distinguish between Cost push and demand pull inflation.

- State four reasons why an increase in money supply may not necessarily lead to inflation

- State any four policy measures that should be taken to control cost push inflation in an economy.

- Distinguish between the following types of inflation.

(a) Suppressed Inflation and Open Inflation

(b) Speculative inflation and monetary inflation

(c) Underlying inflation and headline inflation

10 (a) Distinguish between demand pun inflation and bottleneck inflation.

(b) Give two causes of demand pull inflation in your country.

11 (a) Define the term disinflation.

(b) State three instruments of a disinflation policy.

12 Explain the relationship between the following

(a) Unemployment and inflation in your country

(b) Inflation and the real value of money.

Section B questions

1 (a) Why may creeping inflation be desirable in your country

(b) Suggest the measures that should be taken to tackle inflation in your country

2 (a) What are the causes of inflation in Uganda? .

(b) Explain the measures being taken to control inflation in your country.

3 (a) Distinguish between deflation and inflation

(b) Assess the impacts (implications) of inflation in an economy

- (a) Explain why the government may induce inflation in an economy?

(b) Account for the persistent increase in the general price level of goods and services in your country.

After going ove a feww oof the blog posts onn your blog, I truly appreciate your techniaue of blogging.

I book-marked itt to my bookmark site list and will be

checking back in the near future. Taake a look at my website as well and let me know what you think. https://Lvivforum.Pp.ua