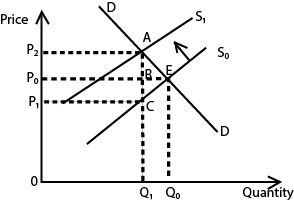

Tax incidence and elasticity of demand

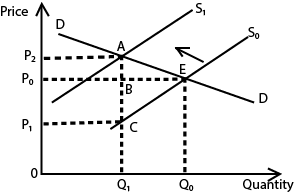

(a) Elastic demand

From the graph, when the tax is imposed on the producer, the supply curve shifts to the left from S0 to S1 (decrease in supply). The total tax is represented by AC. The proportion of the tax paid by the consumer is AB and that of the producer is BC. Since BC is greater than AB, it means that the producer bears a bigger tax burden than the consumer.

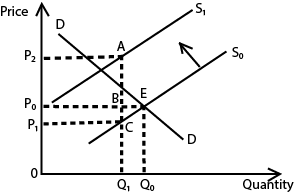

(b) Inelastic demand

From the graph, when the tax is imposed on the producer, the supply curve shits to the left from S0 to S1 (decrease in supply).The total tax is AC. The proportion of the tax paid by the consumer is AB and that of the producer is BC. Since AB is greater than BC, it means that the consumer bears a bigger tax burden than the producer.

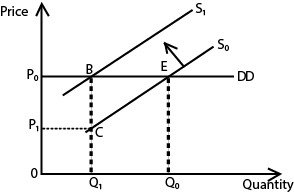

(c) Perfectly elastic demand

From the graph, when the tax is imposed on the producer, the supply curve shits to the left from S0 to S1 (decrease in supply). The total tax is BC. The proportion of the tax paid by the producer is BC; it means that the producer bears the entire tax burden.

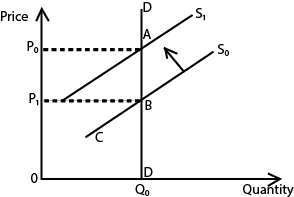

(d) Perfectly inelastic demand

From the graph, when the tax is imposed on the producer, the supply curve shits to the left from S0 to S1 (decrease in supply). The total tax is AB. The proportion of the tax paid by the consumer is AB; it means that the consumer bears the entire tax burden.

(e) Unitary elastic demand

From the graph, when the tax is imposed on the producer, the supply curve shits to the left from S0 to S1 (decrease in supply).The total tax is AC. The proportion of the tax paid by the consumer is AB and that of the producer is BC. Since AB is equal to BC, it means that the consumer and producer bear equal tax burden.