The Keynesian theory of Money Demand

According to Lord John Maynard Keynes, individuals demand for money for three major reasons

(motives). These include;

- Transaction motive. Here, individuals demand for money in order to meet their day to day purchases of commodities (transactions). The level of transactions depends on the individual’s income and the prices of commodities.

- Precautionary motive. Individuals demand for money in order to meet the unforeseen circumstance expenditures for example expenditure on sickness, car break down etc. This also depends on the individual’s income.

- Speculative motive. Individuals demand for money for earning income through buying and selling government securities. This depends on the interest rates on the government securities (treasury bills and bonds). When the interest rate on bonds falls, the speculators prefer holding cash and when interest rates on bonds increases, the speculators prefer holding bonds to cash.

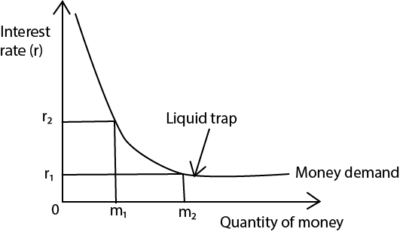

From the graph, when interest rate is expected to fall from 0r2 to 0r1, speculators convert bonds to cash and therefore demand more money m1m2 to avoid losses. When the interest rate is expected to increase from 0r1 to 0r2, speculators buy more bonds and hence demand less money 0m1.

- Liquidity trap. This refers to the point below which the interest rate is too low to encourage speculators to invest in bonds and as a result, they only hold money. OR. It is the point below which the interest rate is too low to break the liquidity preference.

CATEGORIES Economics