Types of costs of a firm

Implicit (transfer) costs. There are costs which are not considered when calculating profits of the firm by the accountants e.g. costs in form of noise, pollution, family labour, self-owned inputs, etc. They are normally assumed to be zero when computing profits.

Explicit (nominal/money) costs. These are costs which are considered when calculating profits of the firm by the accountants e.g. costs of raw materials, hired labour, transport costs etc.

Note. Explicit cost can either be fixed costs or variable costs.

Fixed (Supplementary/Overhead) costs. These are the costs incurred by the producer irrespective of the level of output. OR These are costs which remain constant irrespective of the level of output. For example the cost of land, building, vehicles, salaries for top management, rent.

Variable (Prime) Costs. These are costs which change with the changes in the level of output, that is; when the level of output increases, variable costs also increase for example the cost of raw materials, wage payments, transport costs, electricity etc.

Total costs (TC) = Explicit costs + Implicit costs

Total costs (TC) = Total Fixed costs (TFC) + Total Variable costs (TVC) + Implicit costs

Assuming that implicit costs = 0

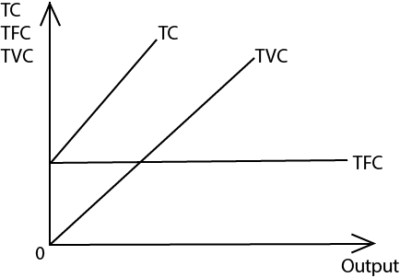

TC =TFC + TVC.

Assuming zero implicit cost, TC = TFC + TVC.

When output is zero as shown from the graph, there are no variable costs (TVC = 0). This implies that the producer has not yet started producing and therefore he cannot incur any variable cost. Therefore Total Cost = 0 + Total Fixed cost (TC = TFC).

When output increases, TVC and TC increase by the same amount. This is because TFC are constant at all levels of output and an increase in TC results from the increase in TVC.